It’s mid-2021, and stock prices are up, dividend yields are down, and you’re probably wondering what the heck to buy for a decent income stream as we thunder toward 2022.

It’s a head-snapping reversal from where we were a year ago, which makes now the perfect time to step back and plot our next dividend moves.

So let’s piece together our game plan for the rest of the year—and into 2022—by ranking five popular (and not so popular!) investments known for income from worst to first. You’ll find many individual tickers to put on your list here, too—including one yielding a healthy 6.8% today.

“Worst to First” Income Play No. 5: 10-Year Treasuries

The 10-year Treasury offers a “safety feature” investors love: no matter what happens, you’ll get your principal back after 10 years.

That’s a trap, though, because inflation gnaws at your nest egg the whole time, and at the rate consumer prices are soaring—5.4% year over year in June—they’ll devour Treasuries’ pathetic 1.4% yield fast!

Even if you set that depressing fact aside, you’d still need to save north of $2.8 million to get $40,000 in income, which I see as the minimum most folks would need for a decent retirement.

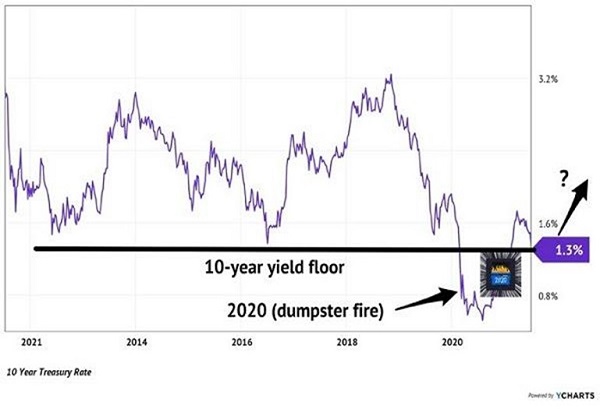

Meantime, Treasuries have taken a beating this year, driving their yields up from 0.9% in late December to their current 1.4% (because bonds’ prices move in opposition to their yields).

Since 1.3% has been a reliable floor for Treasury yields in the last five years (with the exception of the bizzarro year that was 2020), my estimates call for another leg up in Treasury yields from here (and another leg down for prices).

Treasury Yields Test Their Floor (2020 Aside), Get Set to Bounce

Another factor that weighs on bonds’ prices (and pumps up yields) is rising inflation, and we can expect Jay Powell’s “transitory” jumps in consumer prices to last at least a few more months, as we stack this year’s rebounding economy against last year’s COVID-crushed one.

This all raises the obvious question of why you’d buy Treasuries now when you could hold off and wait for lower prices (and higher yields). The answer? There’s no reason to.

“Worst to First” Income Play No. 4: Investment-Grade Corporate Bond Funds

That brings us to corporate bonds, which are worth a look today, but you need to be choosy—and avoid investment-grade issues. Worse still if you buy through an ETF.

For one thing, investment-grade bonds are a crowded trade, with many institutional players limited to only this corner of the market, which is dominated by issues from big firms—think names like Anheuser Busch InBev (BUD), Goldman Sachs Group (GS), AT&T (T) and Wells Fargo (WFC)—and therefore pay lousy coupon rates.

I didn’t just pull those company names out of thin air. Their bonds are among the top holdings of the benchmark ETF for investment-grade corporates, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), which yields 2.4%—better than Treasuries but not nearly as much as the options we’ll look at next.

That middling yield puts LQD and its ilk in a tight spot. If rates rise sooner than expected, they’ll suffer as yields on “safe” Treasuries grow, luring investors away. The payout will likely remain safe, but your dividends could be erased by the resulting price decline.

“Worst to First” Income Play No. 3: High-Yield Bond ETFs

Instead, we’ll hunt for bargains among non-investment grade, or “junk,” bonds, where yields are much higher. The ETF here is the SPDR Bloomberg Barclays High-Yield Bond ETF (JNK), which offers a 30-day SEC yield of around 3.6%.

That’s better than investment-grade corporates or Treasuries, but it’s still at an all-time low. And there are a couple other reasons why JNK isn’t your best route:

- JNK is an “automated” ETF, and in the world of non-investment-grade corporates, personal expertise and deep industry connections are critical, so we need a professional manager working for us.

- JNK only has two ways to pay us: through its dividend and through gains in its bond portfolio. But our next option has three.

“Worst to First” Income Play No. 2: High-Yield Bond CEFs

That option would be a corporate-bond closed-end fund (CEF). Here are the three ways CEFs pay us—in dividend cash and price gains:

- Collapsing discounts: CEFs’ market prices often differ from their per-share net asset value (NAV, or the value of the investments in their portfolios). This never happens with ETFs. It also sets us up to buy when discounts are large, then ride the price up as the discount vanishes.

- Big dividends: CEFs yield about 6.1%, on average, and many high-yield bond CEFs pay more (like the one we’ll discuss below).

- Rising NAV, as the value of your CEF’s holdings increases.

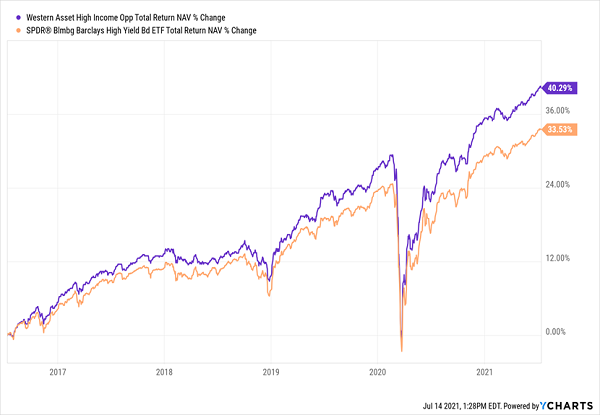

A nice corner of the high-yield bond market to shop in right now is international bonds, where you’ll find the Western Asset High Income Opportunity Fund (HIO). This fund trades at a 4.4% discount and has easily bested JNK, going by its total NAV return (the best measure of management’s skill):

HIO’s Managers Beat Their Benchmark

The concern around HIO is that rising rates in the US will lure investors away from international issues.

Will that hamper HIO? Nope. Because the fund’s dividend yields 6.8% as I write this. How can a 1.4%-paying Treasury compete with that? It can’t.

Even so, HIO’s 4.4% discount is near eight-year highs, and discounts on other high-yield corporate-bond CEFs have narrowed, as well, and could face more pressure as rates rise. That makes them good picks—but not the best ones for that sweet combo of dividends and upside we crave.

“Worst to First” Income Play No. 1: Oil and Gas Stocks

Everyone says energy prices are unpredictable, and in the short term, that’s true. But following a crisis, they have a very predictable “crash ’n’ rally” pattern we can exploit. The last one unfolded from 2008 to 2012 and is underway again.

Here’s how it typically plays out:

- First, demand for oil evaporates due to a recession. Oil prices crash.

- Next, energy producers slash costs and production.

- The economy recovers. Energy demand picks up.

- But there’s not enough supply! So oil prices climb.

- Energy producers bring supply back online, but it takes time. Supply lags demand for years, and the price of oil climbs and climbs.

We’re still early in this latest crash ’n’ rally pattern. We should assume oil prices will keep climbing for the next two or three years at least. And oil’s recent consolidation, which saw it pull back from around $75 a barrel to $72, has given us a buy window. What’s more, as inflation runs hot, oil and gas stocks are primed to rip higher.

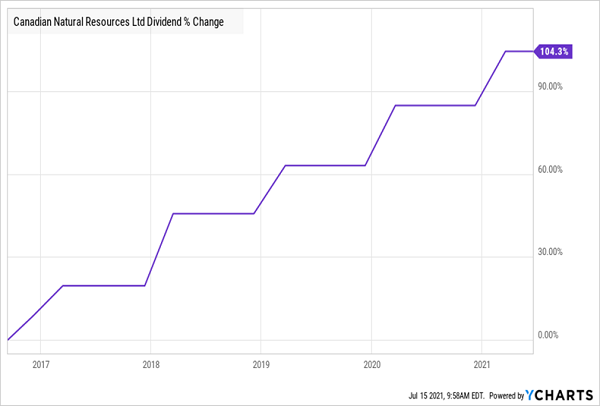

One dividend stock that’s benefiting from this setup is Canadian Natural Resources (CNQ), Canada’s largest producer of heavy crude.

CNQ’s shares have bounced with oil, but still have room to run, thanks in part to their bargain valuation: CNQ trades at 10.3-times forward earnings as I write this.

You’re also getting a solid dividend here. Shares yield 4.1%, and this payout has staying power: management doubled the payout (in Canadian dollars) in just the last five years, including through the March 2020 disaster, when oil prices briefly went negative. Few other energy firms can make such a claim.

CNQ’s Dividend Powers Through the Crash

The firm’s rising dividend and attractive valuation should attract more investors in the months ahead. And we also get a nice boost thanks to the strong Canadian dollar, which is likely to gain against the greenback. That would inflate our payout further.

Do This NOW to Retire on 7%+ Dividends (Paid Monthly!)

Your best play now is to buy the stocks and funds in the “7% Monthly Dividend Portfolio” I’m urging my readers to buy today. As the name says, the stocks and funds inside pay out a 7% average dividend today, and your payouts come to you every 30 (or 31) days, like clockwork!

That matches up perfectly with your bills. And if you invest, say, a $500K nest egg, you’ll pull in a tidy $2,916 a month. That’s an incredible payout in today’s world, and it could easily be enough to let you retire on dividends alone!

Don’t miss this unique income opportunity. Get the full story on this breakthrough portfolio—including the names, tickers and my complete research on every stock and fund inside—right here.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report