The stock market has a potential to be a hot mess this summer. Banks are failing. We’re heading towards the most telegraphed recession of all time. I could go on…

But I’ll spare you and say hey, just show us the dividends, baby!

A select group of income heroes are displaying notable “relative strength” right now. This is a fancy way of saying these stocks are going up while the market meanders sideways or lower.

Which, of course, is what we want. Contrarian favorites that will zig while the market zags (or sags!)

A few years back, I saw this quality in A.O. Smith (AOS)—a Milwaukee-based seller of water heaters that many investors misread.

Early on during the COVID pandemic, investors worried that its commercial business would suffer because industrial clients would simply stop putting in orders. I suspected that might be the case for a little while—but just temporarily, with those orders getting kicked into 2021 or 2022.

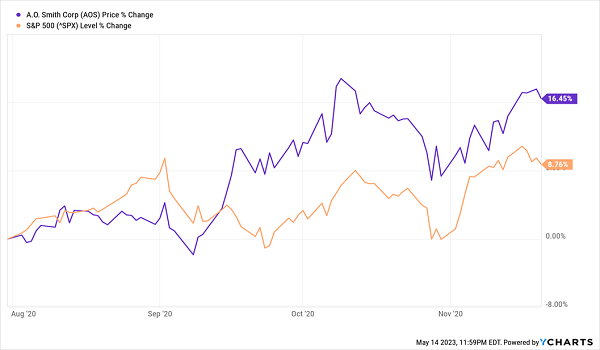

But the chart said something, too. On the left side, you’ll see AOS (purple line) bob along for a few weeks before establishing a base and vaulting past the broader market (orange line).

AOS Warms Up

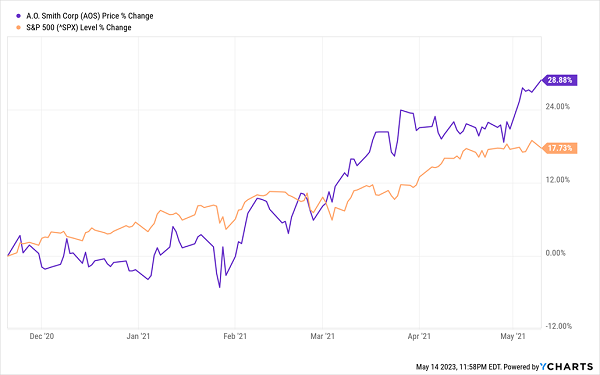

I saw that pattern as an opportunity, so I recommended A.O. Smith to my Hidden Yields members a few weeks later, on Nov. 20, 2020. It went on to pound out 29% gains through May, which was 10 percentage points more than the broader market—all thanks to a “boring” water-heater company!

The Power of Buying Relative Strength

Fast-forward to today, and we’re dealing with a year-plus bear market that has effectively gone dormant. In fact, the S&P 500 hasn’t delivered a weekly close of 1% up or down for the past six weeks!

So if we come across stocks that have set 52-week highs pretty recently—like the four 4.3%-5.8% yielders I’m about to show to you—we want to dig in for a closer examination.

That’s because relative strength is only part of the story. If we want to snap up any of these stocks to reap their dividends in retirement, we also need to make sure their fundamentals, financials and payouts are strong, too.

Wendy’s (WEN)

Dividend Yield: 4.3%

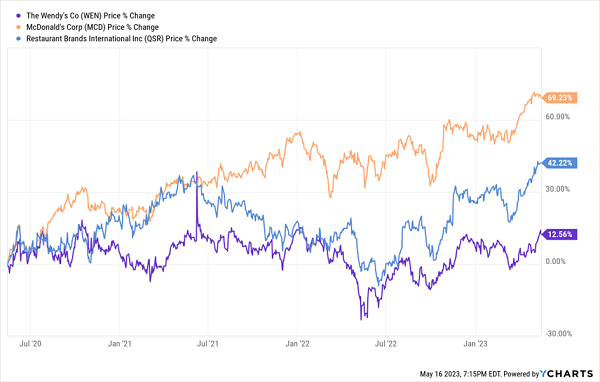

Wendy’s (WEN) is the seventh-largest U.S. fast-food joint by number of locations, and the third-largest burger-slinger, behind McDonald’s (MCD) and Restaurant Brands International’s (QSR) Burger King.

As much as a fast-food joint can be “premium,” Wendy’s is premium—at least compared to its primary competitors. And that lack of value proposition has largely held it back compared to MCD and QSR

Wendy’s Isn’t Just No. 3 in Size

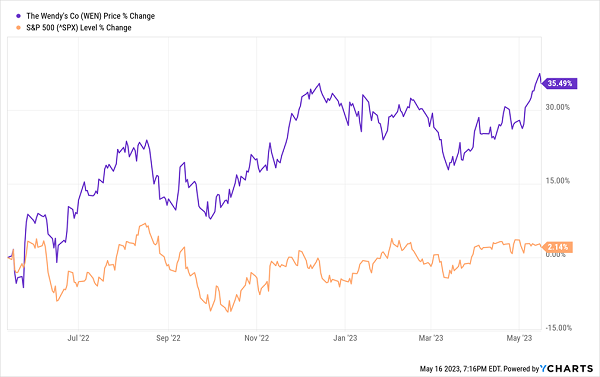

But Wendy’s is still crushing the market of late in part because of fast food’s overall relative value. In a more difficult economy, where you’re concerned about inflation, you might frequent sit-down restaurants less, but still get yourself a decent burger (or spicy chicken sandwich) at Wendy’s.

So, Relative to the Market, Wendy’s Is Killing It

As it stands, Wendy’s is projected to enjoy mid-teens profit and mid-single-digit revenue growth over the next couple of years. The big question mark is whether those expectations can hold up if we do get a true recessionary slump and people downgrade from Baconators to Whoppers and QPCs.

MDC Holdings (MDC)

Dividend Yield: 4.8%

MDC Holdings (MDC) won’t be familiar to most people, but it’s possible that you’ve heard of Richmond American Homes—its primary subsidiary that constructs homes across the East Coast, Southeast, Midwest and West Coast. MDC’s other subsidiaries provide lending, homeowner’s insurance and title insurance.

Like the rest of the housing industry, MDC Holdings went bananas in the wake of the COVID crash. Homebuilders couldn’t keep up with the massive ramp-up in demand as city dwellers rushed for the suburbs and exurbs.

Also like the rest of the homebuilding industry, MDC was yanked back down to earth in 2022. The Federal Reserve’s signaling of rapid interest-rate hikes sent mortgage rates booming, and the housing industry showed signs of cooling, as intended.

But I said back in June that “this very well could be a baby-and-bathwater situation,” and that has proven truer and truer ever since.

MDC Bottomed Out, Is Back to Building

The argument then: MDC still had ample pricing power, as well as a historic valuation discount.

Today, though, the lay of the land is a little different. Executive Chairman Larry Mizel said earlier this month that MDC focused more on generating sales than maintaining prices in Q1. That led to margins contracting to 16.8% after MDC projected 18% to 19% gross margins; the company now sees 17% margins in the current quarter. Valuation isn’t quite as compelling, either, at 14 times this year’s earnings estimates.

As for the dividend? MDC still has a rock-solid dividend with a respectable yield and that represents just 30% of earnings. But that payout has remained stagnant for more than a year now, with no signs of coming back to life.

Edison International (EIX)

Dividend Yield: 4.0%

California-based Edison International (EIX) is a name you wouldn’t expect to generate much growth. It’s the name behind regulated utility Southern California Edison, which serves 15 million customers and generates a considerable portion of its electricity from renewable sources such as solar, wind, and hydro. It also has another subsidiary, Edison Energy, which is a global energy advisory firm that serves commercial, institutional, and industrial users.

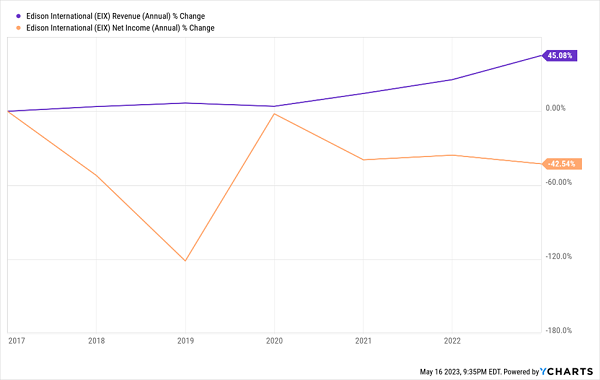

EIX has spent the past few years doing what utilities do, slowly growing its revenues thanks to slow expansion and small rate hikes.

The bottom line hasn’t followed suit, however, as Edison International has spent the past few years battling in court over wildfire damage—a fight that has resulted in multiple billion-dollar-plus settlements.

Edison’s Profits Go Up in Smoke

That said, there’s reason for optimism connected to Edison’s wildfire woes. Specifically, the upcoming general rate case (GRC) for 2025-28 could result in additional regulatory rate recovery, which could jolt earnings for at least the next couple of years—a rare and significant updraft within a typically stodgy industry.

EIX shares aren’t terribly cheap in a bubble, at more than 15 times this year’s earnings estimates and a price/earnings-to-growth (PEG) ratio of 2.6. But both of those sit lower than peer averages, making the stock at least a relative value right now.

Cogent Communications (CCOI)

Dividend Yield: 5.8%

Cogent Communications (CCOI) helps provide the backbone of the internet. It’s one of the world’s largest internet service providers (ISPs), with roots in the United States, but with branches sprawled out across the world. The company uses more than 79,000 route miles of optical fiber to serve nearly 220 major markets in 51 countries.

Until recently, CCOI was just a yield play—the company’s legacy business, while critical to internet infrastructure, is struggling to deliver any meaningful growth. I say “until recently” because CCOI is expected to get a jolt from its recent acquisition of T-Mobile’s wireline business (formerly Sprint GMG).

Funnily, Cogent is getting a $700 million payment to take the business off T-Mobile’s hands, but it’s largely expected to take this money-loser and turn it profitable. That’s showing up in go-go profit expectations—estimates are for a 345% jump this year to 49 cents per share, and another 260% next year to $1.76 per share. Also, the potential boost to free cash flow (FCF) should go a long way in improving the health of CCOI’s dividend, which is still growing on a quarterly basis, but at a much slower pace than in years past.

The problem, of course, with CCOI’s relative success is that it’s priced for virtual perfection. It’s trading at a ludicrous 120 times this year’s earnings expectations, Its forward price-to-earnings (P/E) is above 100, and 36 times 2024’s projected profits. That’s a massive hurdle to success for new buyers.

How to Retire on Just $500K

The problem with stretching that far on valuation to buy CCOI isn’t just how difficult it is to secure generous price upside—you’re also overpaying for a stock that falls short of the benchmark you need to secure a worry-free retirement.

The number you need to focus on, especially if you’re working with a smaller-than-average nest egg, is 8%.

That number will allow you to retire on dividends alone, even with a mere $500,000 to work with. Just do the math—at 8%, you’re generating $40,000 in cash from your retirement account alone, which, when combined with Social Security, gives most folks plenty to work with once you’ve moved on from your career.

And if you have an even bigger pile of cash to plug into our 8% “No Withdrawal” Retirement Portfolio, you could be looking at a downright comfortable retirement—one where you never have to touch your original nest egg!

These relative-strength stocks, of course, aren’t quite there. But I have plenty of stealth payout plays that do yield the 8% or more that we need to coast forever on dividends alone. Please click here and I’ll share the details on these secure funds with very generous dividends.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report