We individual investors have many edges on the Wall Street suits. Betting on the next government handout, however, is not one of them.

Megatrends, on the other hand, are our wheelhouse. Professionals excel at “looking ahead” three to six months. Fortunately for us, their eyes glaze over beyond a year! This is where you and I can regain our advantage when it comes to infrastructure income investing.

While Wall Street weighs the trees, we will consider dividends from the broader megatrend forest. Let’s highlight some aspects of the potential American Jobs Plan that also happen to be infrastructure trends already in motion.

An Every Quarter Dividend Hike Play on Broadband

The White House’s American Jobs Plan “Fact Sheet” promises the plan will deliver high-speed broadband to all Americans.

If fast internet speeds become an inalienable American right, then American Tower (AMT) is our payout play. The company is a landlord for mobile phone traffic, collecting rents via its 170,000 towers from carriers such as AT&T and Verizon.

The more videos we watch from our phones, the busier the “roads” that AMT provides become. We can think of the firm as a toll bridge.

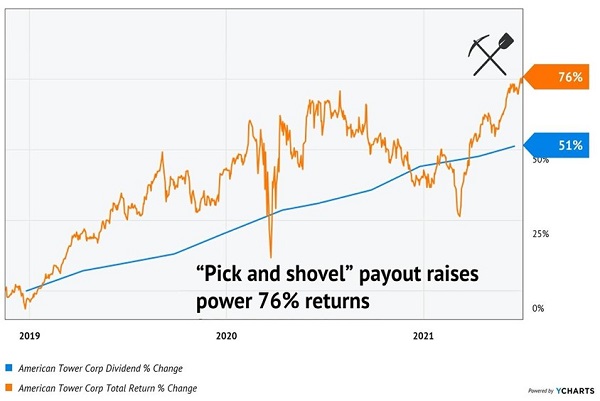

This company is a “pick and shovel” on broadband. The phrase “pick n’ shovel” dates back to the gold rush of the 1840s, when hordes flocked to California to get rich mining for the metal. The guys who made the real money didn’t actually mine anything. They were the entrepreneurs who sold the “picks and shovels” as well as booze, “entertainment” and lodging to the hapless speculators.

We’re not peddling booze. Instead, we’re investing in the cell phone towers that AMT owns. This is a capital-intensive operation that provides the firm with a wide business moat. It also scales quite nicely.

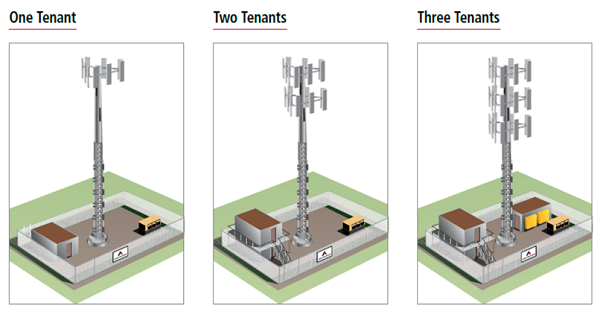

Once AMT builds one tower, it can easily support an additional tenant or two. Check out the illustration below—it’s as simple as bolting some additional equipment on:

Source: American Tower

The return on investment (ROI) AMT generates from a “one tenant tower” is just 3%. However, this jumps with each additional tenant, with ROI increasing to 13% for two tenants and an awesome 24% for three tenants!

AMT is structured as a REIT (real estate investment trust), which means it pays out the majority of its profits to investors directly as dividends. We’ve owned the stock in our Hidden Yields portfolio (my service dedicated to dividend growth) since late 2018 and have enjoyed 76% total returns. Our profits are largely thanks to the fact that AMT raises its dividend every single quarter for the last ten years.

Most recently, the firm raised its dividend by another 2%. The stock’s forward yield is listed at a modest 1.9%, but don’t be lulled to sleep. Any dividend growing this fast will keep pulling the stock price higher.

A similar pick and shovel play on broadband is Crown Castle International (CCI). It is a REIT that owns cell phone towers as well as broadband. CCI “only” raises its dividend annually, but these hikes have added up to a 50% payout gain over the past five years. That increase is good for most stocks, but it’s “dividend dusted” by AMT’s cumulative 131% raise over the same time!

This Related 6.5% Yield is a Hold

When dividend investors need more current yield than AMT provides, we move to Cohen & Steers Infrastructure Fund (UTF). This excellent fund yields 6.5% today and AMT is its fourth largest position (at 3%).

When investors are down on UTF, it is a great way to buy infrastructure growth stocks like AMT at a discount. As a closed-end fund (CEF), UTF often trades for less than the sum of its parts (NAV, net asset value).

Unfortunately, as I write, other investors have caught on to the niftiness of our Contrarian Income Report holding. We were able to add UTF at a discount last November. Since then, we’re up 22% on the position, which is great for current shareholders but not so much for those looking to put new money to work.

Due to this rally, UTF trades at a 5% premium to its NAV today. In other words, investors are paying $1.05 for every dollar of its portfolio of stocks. We say “no thanks” for investing new money.

For my CIR subscribers sitting pretty on our current position, UTF is a Hold. We should wait for a pullback (and discount) to add new money.

Now let’s get back to the picks and shovels with a final play on EVs.

This Dividend Aristocrat Produces What Electric Vehicles (EVs) Need

Back to the White House’s fact sheet, another high-level bullet promises to create good jobs electrifying vehicles.

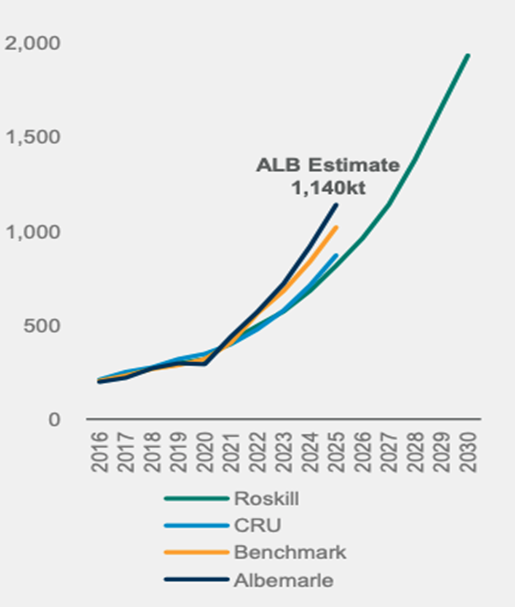

EV batteries require lithium. Demand for lithium is already “hockey sticking” higher thanks to hot EV sales. This trend in motion can only get hotter with government money:

4 Different Lithium Demand Estimates: All Higher

For income fans, Dividend Aristocrat Albemarle (ALB) is the lithium producer to watch. The company recently raised $1.5 billion in equity for the purpose of accelerating “high-return” growth projects. It was a smart move given the demand picture above, but the extra shares are weighing on the stock in the short-term.

These are the types of dividend growth stocks that are benefiting from another megatrend, the “Great American Reset.”

It’s the greatest economic shift in US history. For income investors like us, it could be the most profitable ever.

I have my eye on 7 American Reset stocks set to return 15%+ per year, every year. The American Jobs Plan would add more fuel to these already-strong fires. Please click here and I’ll share the names, tickers and buy-up-to prices for my seven stocks.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report