InvestorPlace - Stock Market News, Stock Advice & Trading Tips

As wages grow and inflation remains tame, this could give the retail sector the boost investors have been waiting for. Let’s look at a few names as part of our top stock trades group.

Top Stock Trades for Tomorrow #1: Retail ETF

Names like Target (NYSE:TGT), TJX Companies (NYSE:TJX), Home Depot (NYSE:HD) and others have helped to push the SPDR Retail ETF (NYSEARCA:XRT) higher. While the XRT may not be a top trading vehicle for investors, it’s good to know how the sector is performing. Once they know that, investors can pick out the names they’d like to own from the group. Perhaps some of the names listed above seem attractive.

As for the ETF, it’s move above $51 resistance was important, as this level has become a key level of support going into the all-important second half. Now though, $52 to $52.50 has been resistance, as the ETF is rangebound.

Luckily uptrend support is coming into play. These setups — where trend is pushing a security into support or resistance — makes for great risk/reward setups.

In this case, investors can play one of two ways. Because the XRT is up against uptrend support, investors can buy near current levels and use either a close below the uptrend or below range support as their stop-loss. On the other hand, they can wait for a close above resistance before going long.

Either way, the setup for bulls looks good.

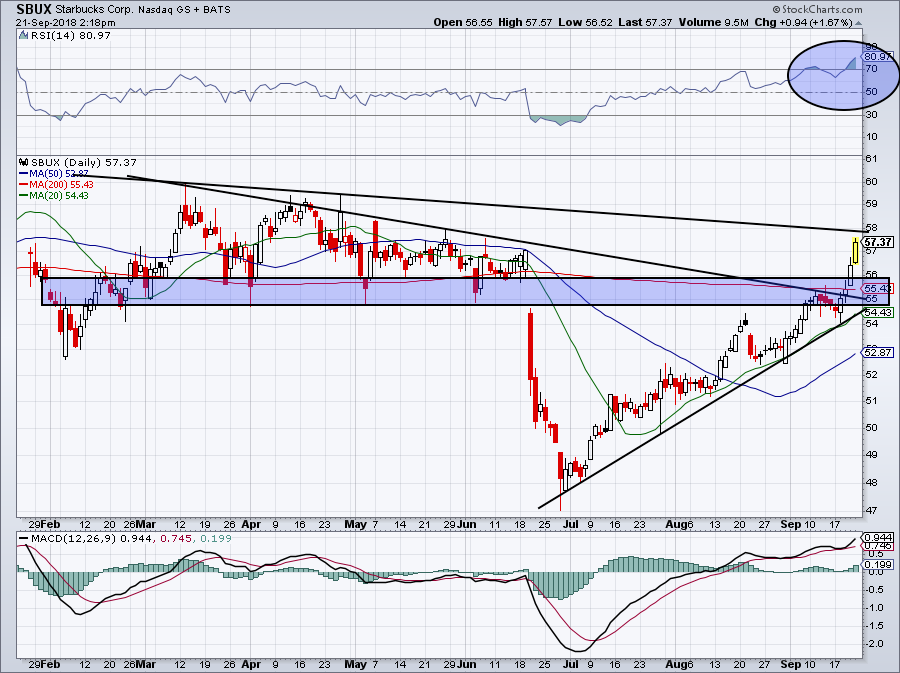

Top Stock Trades for Tomorrow #2: Starbucks

One name in the retail sector that’s been doing well? Starbucks (NASDAQ:SBUX).

After collapsing in June and bottom below $48, Starbucks stock has been on a tear, rising more than 20%. Just in the last few days, the stock has risen about 7%. All of this is on no news at all and comes after a somewhat lackluster quarterly report in July.

I have owned SBUX seemingly forever — it’s my oldest position — so I can’t say I’m disappointed by the action. However, some well-timed profit trimming or covered calls never hurt when the time is right.

Given the powerful move through this $55 to $56 level and the 200-day moving average is impressive. But with an RSI north of 80 and potential downtrend resistance ahead, I bet we get a pullback into that prior range before pushing higher.

Top Stock Trades for Tomorrow #3: Nvidia

The levels in Nvidia (NASDAQ:NVDA) have become nothing short of a mess. Despite having long-term secular drivers, short-term investors still seem worried about weakness in other names — like Intel (NASDAQ:INTC) or Micron (NASDAQ:MU) — and possibly even NVDA’s big run over the past few years.

Either way, long-term investors should be happy with its past performance and its potential in the future.

For short-term investors, it’s a little messier. The 20-day and 50-day moving averages haven’t played much of a role, nor have various price levels over the past six months. At least, consistently anyway.

I would love to see a pullback to the bottom of channel support and a possible test the 200-day moving average. With any luck, the two will be near similar levels and we can get a double-whammy of support. For even shorter-term trades, take note of the downtrend channel (blue lines) Nvidia is currently in.

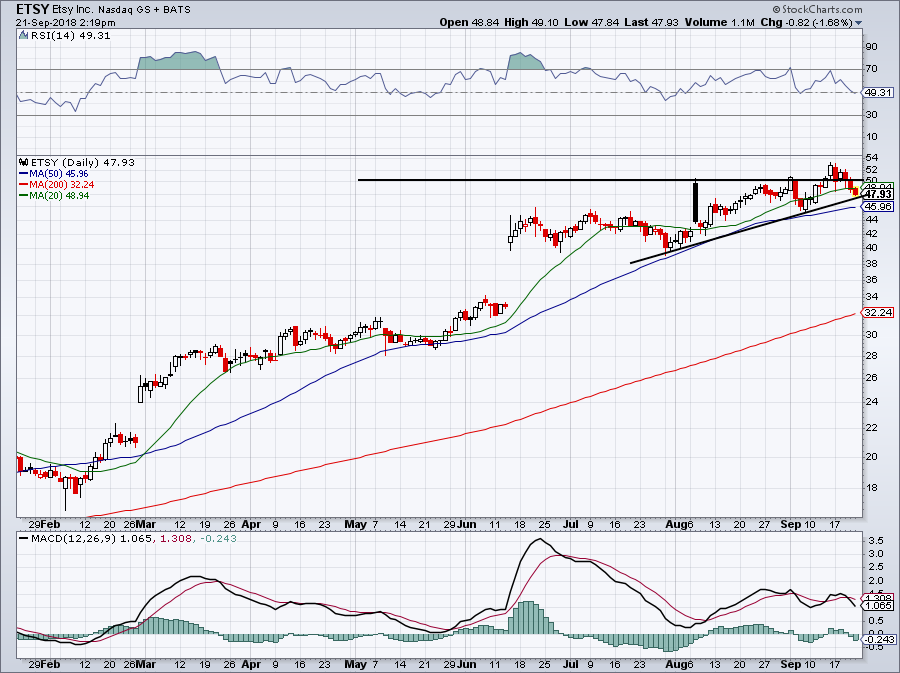

Top Stock Trades for Tomorrow #4: Etsy

Will Etsy (NASDAQ:ETSY) be able to recover? A breakout over $50 has officially failed, but uptrend support is nearby.

If this trend and the 50-day moving average hold up, it’s likely that Etsy will give this breakout another try. Given the stock’s strong performance so far this year and the direction of the trend, it’s hard to bet against it for too long.

Below the 50-day and that rhetoric changes, though.

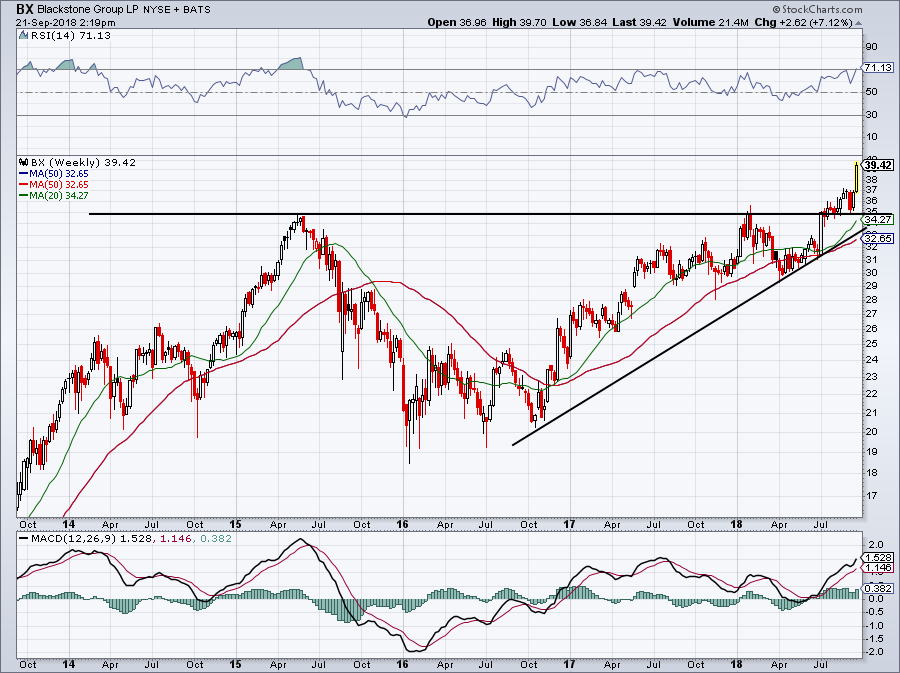

Top Stock Trades for Tomorrow #5: Blackstone

Blackstone (NYSE:BX) has a similar chart to Etsy, with the exception that it has taken years and not months and that it has already pushed through its breakout level. Above is a five-year weekly chart, showing BX’s powerful move above $35.

I wish I had noticed last week’s epic bounce (the second to most recent candle on the chart) off this strong support level.

Now just under $40 though, we may have missed our chance. But if we do get a decline in BX — which happens to be entering an overbought state, by the way — then this is the level to watch.

If we get a decline in BX within a buck of the $35 level, it’s probably worth a short. Conservative bulls may wait for a decline closer to that level. If the pullback takes time, maybe uptrend support becomes more relevant first. Keep this one on your watchlist.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long NVDA and SBUX.

More From InvestorPlace

Compare Brokers

The post 5 Top Stock Trades for Monday — Time to Finally Buy Starbucks? appeared first on InvestorPlace.

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report