There is another.

–Yoda

The Jedi Master had last week’s 8.4% dividend in mind, no doubt. David Friar’s Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) is an elite 8%+ payer worthy of a discussion.

But yes, Yoda, there is another. A rival ETF, also based on “the Qs”—the Nasdaq 100. The Force must be strong with this one—it yields 12.7%.

Is this for real? Or a Hollywood fairy-tale?

Well, let’s go back to David, QQQX’s manager. His elite 8%+ yield is no joke either. He’s doing something that many of us have dabbled with. He buys tech stocks and sells (“writes”) covered calls on his positions.

It’s a tedious strategy. As sellers of options, we want them to decline in price. Which happens fastest as we approach their expiration dates.

Problem is, selling covered calls for income tends to be a monthly effort. That can be a pain with a single stock—and it becomes progressively more annoying as we diversify the portfolio. So, we outsource the task to someone like David and collect our 8.4% per year as we tip our caps to him.

Why does he focus on tech stocks? They are volatile and command higher option premiums. As a seller of these premiums, David signs up for the nausea.

But volatility is a knife that cuts both ways and, conservative strategy or not, covered calls won’t prevent price declines. I mean, the Nasdaq-100 lost 33% last year.

QQQX wasn’t much better. It “outperformed” its index, losing “only” 27%.

Not exactly what we look for in a retirement investment.

Readers often ask me if a dividend is safe. But payouts are really only half the battle, because price matters. QQQX actually raised its dividend in 2022 (yay, higher volatility) but still dropped 27%. Including those payouts.

No thanks. There’s a reason we don’t currently hold QQQX in our Contrarian Income Report portfolio (since selling it near a previous tech top). Better to stuff cash under a mattress and wait for the Qs to bottom out before we start jousting with QQQX again.

When the Qs finally wash out, rival fund Global X Nasdaq-100 Covered Call ETF (QYLD) will be worth our consideration too. Its headline 12.7% yield can be a Jedi mind trick. It depends on our timing.

With QYLD’s monthly payout, we contrarians are up to the challenge. I mean, what’s not to like about 1% in cash coming our way every 30 days?

Now QYLD, unlike QQQX with Dave, is automatic. QYLD sells (“writes”) one big NASDAQ call option. It doesn’t pick and choose.

It’s easier than selling the individual calls, but it doesn’t pay as much. The option premium is lower on the index than it is on the individual stock positions (even when we add them up).

That said, sometimes we don’t care. QYLD’s “days to expiry” on that option is just eight days as I write. Which is good. It’s going down fast in value, which is good for QYLD shareholders who own a short position on the call.

However, the underlying value of the index—and funds like QQQX and QYLD—is determined by the long-term trend in interest rates.

Rates? Not profits?

You Must Unlearn What You Have Learned

Yeah, rates. We roughly know how much money Microsoft (MSFT) and Apple (AAPL) (the NASDAQ’s top two stocks) will make over the next five years. But, due to inflation, we don’t know how much those profits are worth today.

The 10-year Treasury began 2022 with a yield of just 1.5%. With a basement “discount” rate like this, future profits are nearly as good as cash-in-hand right now.

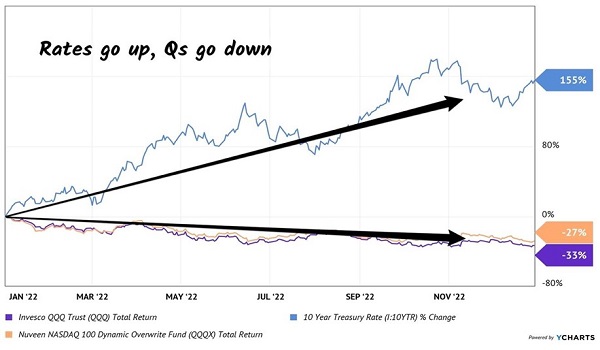

Then inflation struck, and long rates soared. The 10-year ended 2022 at 3.9%, a 155% increase! The trend acted as a death star on valuations.

As the 10-year climbed, the price-to-earnings (P/E) ratio of MSFT contracted by 26% and AAPL by 25%. This was no coincidence. Higher rates hurt valuations. Which, in turn, hurt the net asset values (NAVs) of Invesco QQQ Trust (QQQ), QQQX and QYLD (not pictured). Which crushed these funds’ prices.

Rates Up, QQQ and QQQX Down

Covered calls, again, can only do so much damage control! Until we think the Qs have bottomed, we need to be careful of all Nasdaq-related funds. Even those paying 8.4% and 12.7%!

And tech stocks won’t bottom until rates top. I’m not sure they have just yet.

Be ready. We’ll get an opportunity to buy one, or both, of these funds at a better value later this year. When rates top, P/Es crater and nobody wants to own these things other than calculated income investors like us.

Smaller in number are we contrarians, but larger in mind.

And fear not, because we do have monthly dividends with lower risk. They pay 7%+ per year and these rock-steady dividends are in the bargain bin. Let’s grab them now.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report