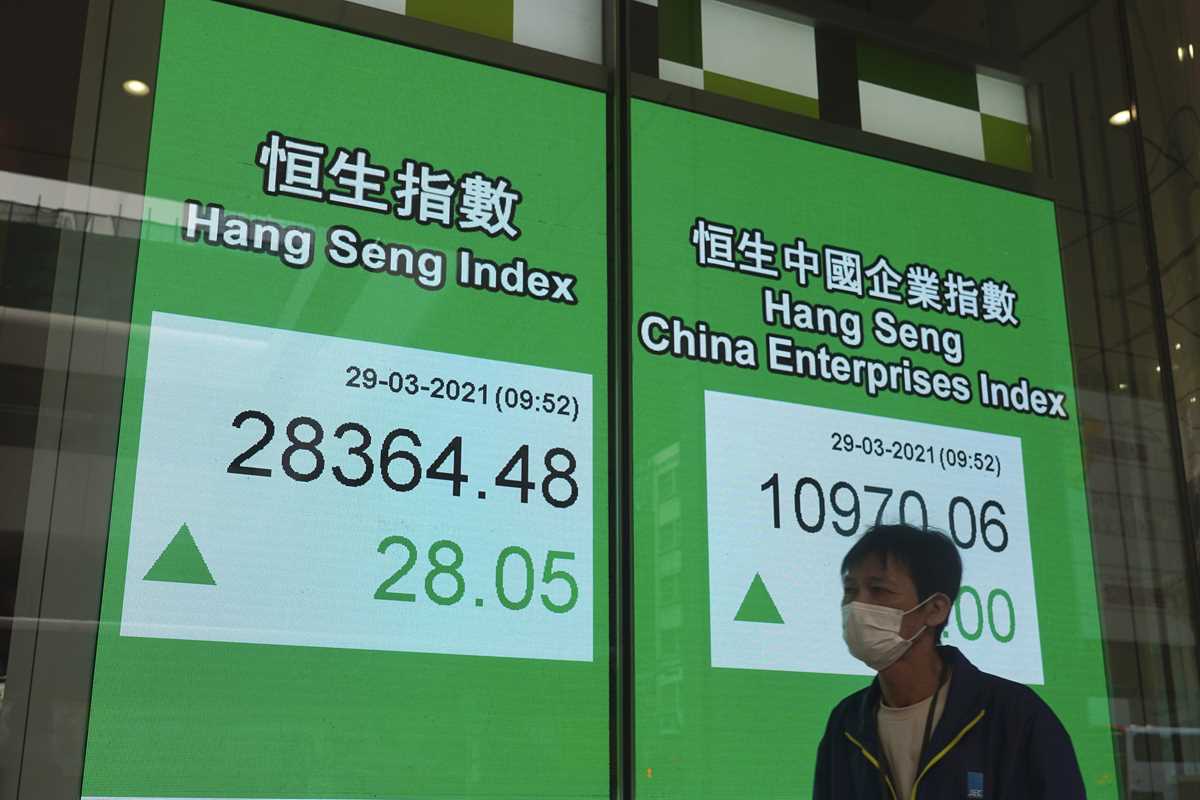

A man walks past a bank's electronic board showing the Hong Kong share index at the stock exchange in Hong Kong Monday, March 29, 2021. Asian stocks rose Monday after Wall Street hit a new high and investors were encouraged by government stimulus and the rollout of coronavirus vaccines. (AP Photo/Vincent Yu)

A man walks past a bank's electronic board showing the Hong Kong share index at the stock exchange in Hong Kong Monday, March 29, 2021. Asian stocks rose Monday after Wall Street hit a new high and investors were encouraged by government stimulus and the rollout of coronavirus vaccines. (AP Photo/Vincent Yu) A man walks past a bank's electronic board showing the Hong Kong share index at the stock exchange in Hong Kong Monday, March 29, 2021. Asian stocks rose Monday after Wall Street hit a new high and investors were encouraged by government stimulus and the rollout of coronavirus vaccines. (AP Photo/Vincent Yu)

A man walks past a bank's electronic board showing the Hong Kong share index at the stock exchange in Hong Kong Monday, March 29, 2021. Asian stocks rose Monday after Wall Street hit a new high and investors were encouraged by government stimulus and the rollout of coronavirus vaccines. (AP Photo/Vincent Yu) A woman walks past a bank's electronic board showing the Hong Kong share index at the stock exchange in Hong Kong Monday, March 29, 2021. Asian stocks rose Monday after Wall Street hit a new high and investors were encouraged by government stimulus and the rollout of coronavirus vaccines. (AP Photo/Vincent Yu)

A woman walks past a bank's electronic board showing the Hong Kong share index at the stock exchange in Hong Kong Monday, March 29, 2021. Asian stocks rose Monday after Wall Street hit a new high and investors were encouraged by government stimulus and the rollout of coronavirus vaccines. (AP Photo/Vincent Yu)BEIJING (AP) — Asian stock markets were mixed Monday after Wall Street hit a new high amid optimism about government stimulus and the rollout of coronavirus vaccines.

Shanghai, Tokyo, Hong Kong and Seoul advanced.

Wall Street’s advance Friday was led by stocks that would benefit if vaccinations and government spending boost the U.S. economy as much as expected.

Vaccines and stimulus have “helped to create an aura of high optimism,” John Bilton of JP Morgan Asset Management said in a report. He said “above-trend global growth” should last into 2022 and regions such as Europe that are at “peak pessimism” due to vaccine delays should accelerate later this year.

U.S. futures were lower following sales Friday of large blocks of stock that news reports said were carried out by Archegos Capital Management, run by financier Bill Hwang.

Shares of media giants ViacomCBS Inc. and Discovery Inc., Chinese search engine operator Baidu Inc. and Tencent Music Entertainment Group fell. Baidu's shares fell 4.1% Monday in Hong Kong and Tencent's were 1.9% lower.

In Tokyo, brokerage Nomura Holdings' shares fell 16.3% after it warned of an event on March 26 that could cause a “significant loss" due to transactions with an unnamed “US client."

“Nomura is currently evaluating the extent of the possible loss and the impact it could have on its consolidated financial results," the company said in a statement. “The estimated claim against the client is approximately $2 billion based on market prices as of March 26."

But the company said the situation would have no impact on its financial soundness.

The Shanghai Composite Index rose 0.4% 3,431.36 and the Nikkei 225 in Tokyo advanced 0.6% 29,358.49. The Hang Seng in Hong Kong shed 0.3% to 28,240.59.

The Kospi in Seoul lost 0.2% to 3,035.56 while Sydney’s S&P-ASX 200 shed 0.4% to 6,799.50.

New Zealand and Southeast Asian markets advanced. Indian markets were closed for a holiday.

Markets have been swinging between optimism that vaccines might allow business and travel to return to normal and anxiety over distribution delays and concern about possible inflation after massive government stimulus.

Investors were jolted last week by news Egypt’s Suez Canal, one of the busiest trade routes, was blocked by a cargo ship that became wedged into the waterway.

On Wall Street, the S&P rose 1.7% on Friday to 3,974.54. A quarter of that gain came in the last five minutes of trading. That produced a weekly gain of 1.7% after a 0.8% decline the previous week.

The Dow Jones Industrial Average rose 1.4%, to 33,072.88. The Nasdaq composite climbed 1.2%, to 13,138.72, though it is is 6.8% below last month’s record high.

U.S. stocks have benefited from President Joe Biden’s proposal for higher spending on infrastructure. Steelmaker Nucor climbed 8.9% and miner Freeport-McMoRan rose 5.9%.

In energy markets, benchmark U.S. crude lost $1.37 to $59.60 per barrel in electronic trading on the New York Mercantile Exchange. The contract rose $2.41 to $60.97 on Friday. Brent crude, the basis for international oil prices, retreated $1.30 to $63.13 per barrel in London. It advanced $2.62 the previous session to $64.57.

The dollar declined to 109.50 yen from Friday’s 109.69 yen. The euro edged down to $1.1781 from the previous session’s $1.1790.

Before you consider Tencent Music Entertainment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent Music Entertainment Group wasn't on the list.

While Tencent Music Entertainment Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report