From left; U.S. Bancorp Chairman, President, and CEO Andy Cecere; PNC Financial Services Group Chairman, President, and CEO William Demchak; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; Citigroup CEO Jane Fraser; Bank of America Chairman and CEO Brian Moynihan; Truist Financial Corporation Chairman and CEO William Rogers Jr.; and Wells Fargo President and CEO Charles Scharf are sworn in as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

From left; U.S. Bancorp Chairman, President, and CEO Andy Cecere; PNC Financial Services Group Chairman, President, and CEO William Demchak; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; Citigroup CEO Jane Fraser; Bank of America Chairman and CEO Brian Moynihan; Truist Financial Corporation Chairman and CEO William Rogers Jr.; and Wells Fargo President and CEO Charles Scharf are sworn in as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

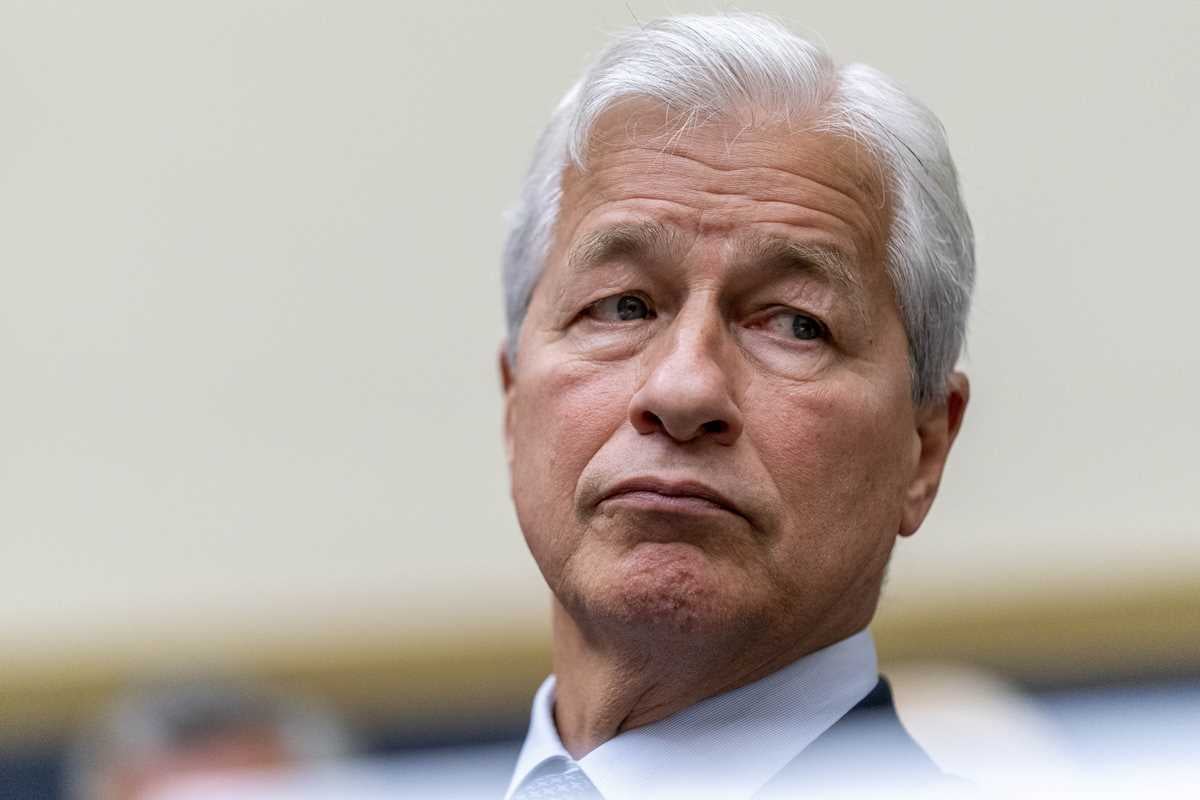

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Citigroup CEO Jane Fraser testifies before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Citigroup CEO Jane Fraser testifies before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon, right, accompanied by U.S. Bancorp Chairman, President, and CEO Andy Cecere, second from left, and PNC Financial Services Group Chairman, President, and CEO William Demchak, fourth from left, appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon, right, accompanied by U.S. Bancorp Chairman, President, and CEO Andy Cecere, second from left, and PNC Financial Services Group Chairman, President, and CEO William Demchak, fourth from left, appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) From left; U.S. Bancorp Chairman, President, and CEO Andy Cecere; PNC Financial Services Group Chairman, President, and CEO William Demchak; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; Citigroup CEO Jane Fraser; Bank of America Chairman and CEO Brian Moynihan; Truist Financial Corporation Chairman and CEO William Rogers Jr.; and Wells Fargo President and CEO Charles Scharf appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

From left; U.S. Bancorp Chairman, President, and CEO Andy Cecere; PNC Financial Services Group Chairman, President, and CEO William Demchak; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; Citigroup CEO Jane Fraser; Bank of America Chairman and CEO Brian Moynihan; Truist Financial Corporation Chairman and CEO William Rogers Jr.; and Wells Fargo President and CEO Charles Scharf appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Citigroup CEO Jane Fraser, center, and Bank of America Chairman and CEO Brian Moynihan, center right, greet members of congress as she appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Citigroup CEO Jane Fraser, center, and Bank of America Chairman and CEO Brian Moynihan, center right, greet members of congress as she appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon, right, accompanied by U.S. Bancorp Chairman, President, and CEO Andy Cecere, left, and PNC Financial Services Group Chairman, President, and CEO William Demchak, second from left, appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon, right, accompanied by U.S. Bancorp Chairman, President, and CEO Andy Cecere, left, and PNC Financial Services Group Chairman, President, and CEO William Demchak, second from left, appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon, center, accompanied by PNC Financial Services Group Chairman, President, and CEO William Demchak, left, greets members of congress as he appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon, center, accompanied by PNC Financial Services Group Chairman, President, and CEO William Demchak, left, greets members of congress as he appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) From left; Wells Fargo President and CEO Charles Scharf; Truist Financial Corporation Chairman and CEO William Rogers Jr.; Bank of America Chairman and CEO Brian Moynihan; Citigroup CEO Jane Fraser; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; PNC Financial Services Group Chairman, President, and CEO William Demchak; and U.S. Bancorp Chairman, President, and CEO Andy Cecere, are sworn in as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

From left; Wells Fargo President and CEO Charles Scharf; Truist Financial Corporation Chairman and CEO William Rogers Jr.; Bank of America Chairman and CEO Brian Moynihan; Citigroup CEO Jane Fraser; JPMorgan Chase & Co. Chairman and CEO Jamie Dimon; PNC Financial Services Group Chairman, President, and CEO William Demchak; and U.S. Bancorp Chairman, President, and CEO Andy Cecere, are sworn in as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) U.S. Bancorp Chairman, President, and CEO Andy Cecere, left, and PNC Financial Services Group Chairman, President, and CEO William Demchak, right, appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

U.S. Bancorp Chairman, President, and CEO Andy Cecere, left, and PNC Financial Services Group Chairman, President, and CEO William Demchak, right, appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Truist Financial Corporation Chairman and CEO William Rogers Jr. appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Truist Financial Corporation Chairman and CEO William Rogers Jr. appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Wells Fargo President and CEO Charles Scharf testifies before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Wells Fargo President and CEO Charles Scharf testifies before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

JPMorgan Chase & Co. Chairman and CEO Jamie Dimon appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Chairwoman Maxine Waters, D-Calif., right, accompanied by Ranking Member Patrick McHenry, R-N.C., left, questions banking leaders as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Chairwoman Maxine Waters, D-Calif., right, accompanied by Ranking Member Patrick McHenry, R-N.C., left, questions banking leaders as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Bank of America Chairman and CEO Brian Moynihan appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Bank of America Chairman and CEO Brian Moynihan appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Citigroup CEO Jane Fraser testifies before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Citigroup CEO Jane Fraser testifies before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Truist Financial Corporation Chairman and CEO William Rogers Jr. appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Truist Financial Corporation Chairman and CEO William Rogers Jr. appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Bank of America Chairman and CEO Brian Moynihan rubs his eyes as he appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Bank of America Chairman and CEO Brian Moynihan rubs his eyes as he appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Chairwoman Maxine Waters, D-Calif., right, and Ranking Member Patrick McHenry, R-N.C., left, listen to testimony from banking leaders as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

Chairwoman Maxine Waters, D-Calif., right, and Ranking Member Patrick McHenry, R-N.C., left, listen to testimony from banking leaders as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) Chairwoman Maxine Waters, D-Calif., questions banking leaders as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

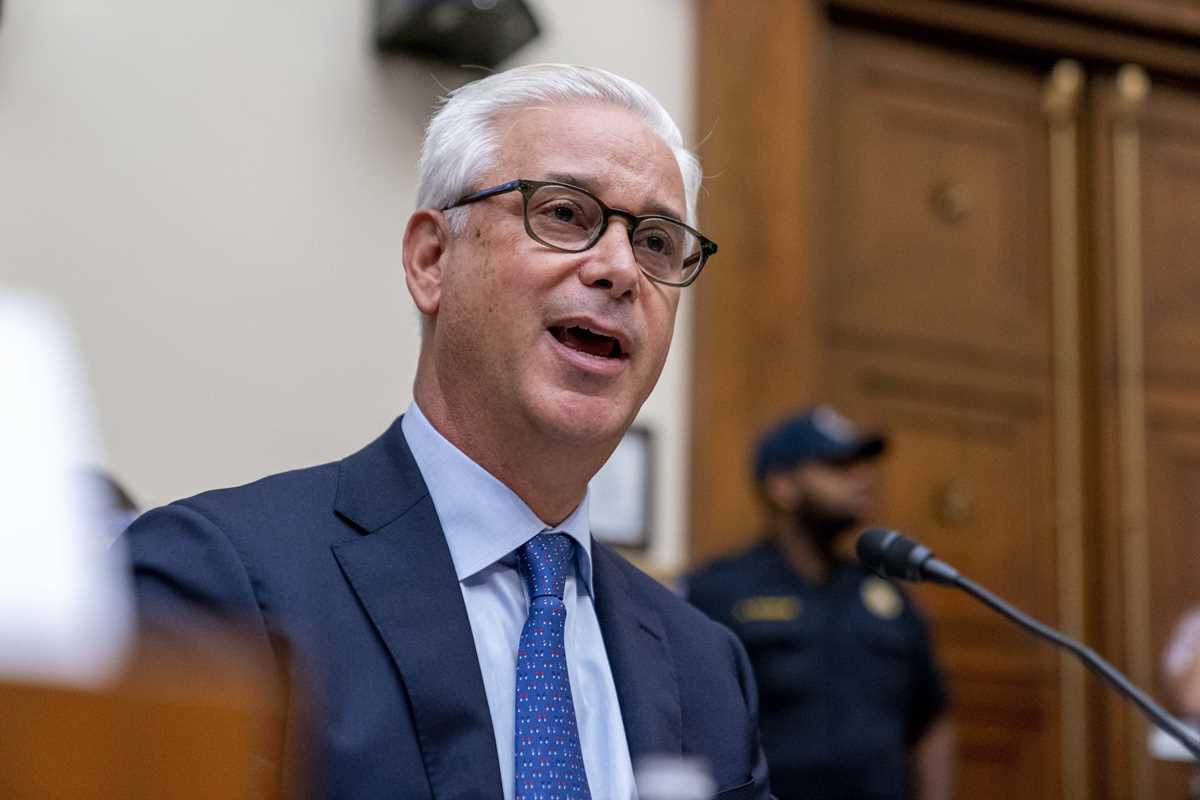

Chairwoman Maxine Waters, D-Calif., questions banking leaders as they appear before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) PNC Financial Services Group Chairman, President, and CEO William Demchak appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

PNC Financial Services Group Chairman, President, and CEO William Demchak appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik) U.S. Bancorp Chairman, President, and CEO Andy Cecere appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)

U.S. Bancorp Chairman, President, and CEO Andy Cecere appears before a House Committee on Financial Services Committee hearing on "Holding Megabanks Accountable: Oversight of America's Largest Consumer Facing Banks" on Capitol Hill in Washington, Wednesday, Sept. 21, 2022. (AP Photo/Andrew Harnik)WASHINGTON (AP) — The CEOs of the nation's biggest banks appeared in front of Congress Wednesday and gave a dim view of the U.S. economy, reflecting the financial and economic distress many Americans are facing.

JPMorgan Chase's Jamie Dimon, Citigroup's Jane Fraser and other chief executives said the U.S. consumer is in good shape but faces threats from high inflation and rising interest rates.

The hearing was held on the same day the Federal Reserve announced it was raising its benchmark interest rate by three-quarters of a point in a bid to contain inflation. When asked by lawmakers, the bank CEOs seemed increasingly skeptical that the Fed can achieve its goal of a “soft landing,” where inflation is brought back down without causing widespread damage to the economy.

“I'm keeping my fingers crossed,” Dimon said.

Fraser said in remarks prepared for the hearing that while “COVID is behind us, the economic challenges we are now facing are no less daunting.”

Despite the dimmer view, the CEOs generally said the U.S. consumer is currently in good financial health due to the savings they accumulated during the pandemic. Bank of America's Brian Moynihan said the amount of money in customers' accounts has been stable. Dimon said wages are up while debt loads have dropped, and Fraser said consumers are spending at elevated levels.

All that could change as the Fed increases rates at an aggressive pace. With inflation rising as high as 9% this year, the Fed has aggressively raised rates from near zero to a range of 3% to 3.25% in a few months. Fed Chair Jerome Powell acknowledged that households will feel an impact.

“We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t,” Powell said at a news conference following the announcement of the rate increase.

While less confident about a “soft landing," the seven bank executives did give a unanimous vote of confidence in Powell's ability to rein in inflation when asked by Rep. Jake Auchincloss, D-Massachusetts.

While billed as a hearing on everyday finances, the CEOs were also peppered with election-year political questions. Democrats pushed the CEOs on issues like racial equity, the unionization efforts at banks, as well as evergreen financial topics like overdraft fees and fraud.

“In this environment, the role that banks play to protect consumers and provide access to affordable credit is absolutely critical,” said Rep. Maxine Waters, D-California and chairwoman of the House Financial Services Committee.

Republicans took the opportunity to both push back on the need for the hearing — this is the third time Democrats have brought Wall Street executives in front of this committee since taking control of the House in 2019 — as well as high inflation. One hot-button issue was gun store sales. Earlier this month the major payment networks — Visa, Mastercard and American Express — said they would start categorizing gun store sales as a separate merchant code. It’s a decision gun control advocates have pushed for, potentially to help catch surges of gun sales ahead of a mass shooting.

Rep. Roger Williams, R-Texas, pushed the bank CEOs on whether they would follow the payment networks’ decision. In response, all six CEOs said they would not stop legal gun sales and would protect consumers’ privacy.

“We don’t want to tell Americans what to do with their money,” Dimon said.

Goldman Sachs and Morgan Stanley, which focus on investment banking, did not testify at Wednesday's hearing. Instead, the CEOs of three new banks were brought in: Andy Cecere of U.S. Bank, William Demchak of PNC Financial, and Bill Rogers Jr. of Truist.

Each of them runs “super regionals” — banks that are huge in their own right, with thousands of branches and hundreds of billions in assets, but dwarfed in size by JPMorgan, BofA, Citi and Wells.

Many Americans still remember bailing out the banking industry nearly 15 years ago, so the CEOs also used the platform to sell themselves as a force for good.

Eager to avoid the political headache that comes with being labeled as part of “Wall Street,” the super regionals used the hearing to sell themselves as a competitive “Main Street” alternative to the Wall Street mega banks.

“We are one-sixth the size of some banks on this panel,” PNC's Demchak said.

After the committee hearing ended, Waters said that it is important to bring the regional banks before her committee, saying the recent wave of mergers of midsize banks could negatively impact competition.

“These mergers need to be looked at much more carefully,” Waters said.

The head of Wells Fargo typically faces tough questions from lawmakers because of the various scandals that cost the bank billions of dollars in fines and forced it to operate under the supervision of the Federal Reserve.

Wells CEO Charles Scharf said the bank has taken a number of steps to revamp its culture. But Waters was doubtful, noting recent reports about the bank holding fake job interviews for women and having additional fines imposed upon it by financial regulators.

The CEOs will testify before the Senate Banking Committee on Thursday.

Before you consider Morgan Stanley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morgan Stanley wasn't on the list.

While Morgan Stanley currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report