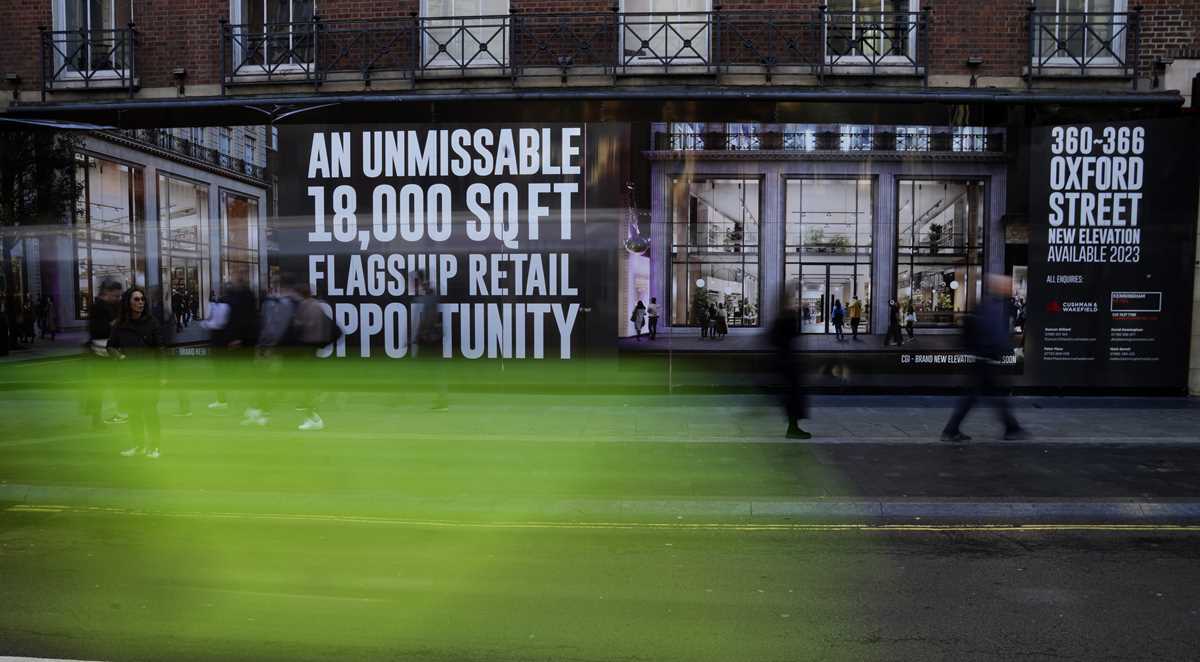

A cyclist in yellow jacket passes an empty retail space on Oxford Street in London, Wednesday, Nov. 16, 2022. Britain's inflation rate rose to a 41-year high in October, fueling demands for the government to do more to ease the nation's cost-of-living crisis when it releases new tax and spending plans on Thursday. The Office for National Statistics says consumer prices rose 11.1% in the 12 months through October, compared with 10.1% in September. The October figure exceeded economists expectations of 10.7%. (AP Photo/Alastair Grant)

A cyclist in yellow jacket passes an empty retail space on Oxford Street in London, Wednesday, Nov. 16, 2022. Britain's inflation rate rose to a 41-year high in October, fueling demands for the government to do more to ease the nation's cost-of-living crisis when it releases new tax and spending plans on Thursday. The Office for National Statistics says consumer prices rose 11.1% in the 12 months through October, compared with 10.1% in September. The October figure exceeded economists expectations of 10.7%. (AP Photo/Alastair Grant) Residents wearing masks carry bags as they visit the Wangfujing shopping street in Beijing, Monday, Nov. 14, 2022. Chinese consumer spending contracted in October and factory activity weakened as anti-virus controls following a rise in infections weighed on the economy. (AP Photo/Ng Han Guan)

Residents wearing masks carry bags as they visit the Wangfujing shopping street in Beijing, Monday, Nov. 14, 2022. Chinese consumer spending contracted in October and factory activity weakened as anti-virus controls following a rise in infections weighed on the economy. (AP Photo/Ng Han Guan) Shoppers walk into a store at a shopping center in Tokyo on Aug. 17, 2020. The Japanese economy has contracted at an annual rate of 1.2% in the July-September quarter, as consumption declined amid rising prices. (AP Photo/Hiro Komae, File)

Shoppers walk into a store at a shopping center in Tokyo on Aug. 17, 2020. The Japanese economy has contracted at an annual rate of 1.2% in the July-September quarter, as consumption declined amid rising prices. (AP Photo/Hiro Komae, File)Hobbled by high interest rates, punishing inflation and Russia’s war against Ukraine, the world economy is expected to eke out only modest growth this year and to expand even more tepidly in 2023.

That was the sobering forecast issued Tuesday by the Paris-based Organization for Economic Cooperation and Development. In the OECD's estimation, the world economy will grow just 3.1% this year, down sharply from a robust 5.9% in 2021.

Next year, the OECD predicts, will be even worse: The international economy will expand only 2.2% in 2023, it estimates.

The OECD, made up of 38 member countries, works to promote international trade and prosperity and issues periodic reports and analyses. In its latest forecast, the organization predicts that the Federal Reserve’s aggressive drive to tame inflation with higher interest rates — it’s raised its benchmark rate six times this year, in substantial increments — will grind the U.S. economy to a near-halt. It expects the United States, the world's largest economy, to grow just 1.8% this year (down drastically from 5.9% in 2021), 0.5% in 2023 and 1% in 2024.

That grim outlook is widely shared. Most economists expect the United States to enter at least a mild recession next year, though the OECD did not specifically predict one.

The report foresees U.S. inflation, though decelerating, to remain well above the Fed’s 2% annual target next year and into 2024.

The OECD's forecast for the 19 European countries that share the euro currency, which are enduring crippling energy shortages from Russia's war, is hardly brighter. The organization expects the eurozone to collectively manage just 0.5% growth next year before accelerating slightly to 1.4% in 2024.

And it expects inflation to continue squeezing the continent: The OECD predicts that consumer prices, which rose just 2.6% in 2021, will jump 8.3% for all of 2022 and 6.8% in 2023.

Whatever growth the international economy produces next year, the OECD says, will come largely from the emerging market countries of Asia: Together, it estimates, they will account for three-quarters of world growth next year while the U.S. and European economies falter. India’s economy, for instance, is expected to grow 6.6% this year and 5.7% next year.

China's economy, which not long ago boasted double-digit annual growth, will expand just 3.3% this year and 4.6% in 2023. The world’s second-biggest economy has been hobbled by weakness in its real estate markets, high debts and draconian zero-COVID policies that have disrupted commerce.

Fueled by vast government spending and record-low borrowing rates, the world economy soared out of the pandemic recession of early 2020. The recovery was so strong that it overwhelmed factories, ports and freight yards, causing shortages and higher prices. Moscow's invasion of Ukraine in February disrupted trade in energy and food and further accelerated prices.

After decades of low prices and ultra-low interest rates, the consequences of chronically high inflation and interest rates are unpredictable.

“Financial strategies put in place during the long period of hyper-low interest rates may be exposed by rapidly rising rates and exert stress in unexpected ways,’’ the OECD said in Tuesday's report.

The higher rates being engineered by the Fed and other central banks will make it difficult for heavily indebted governments, businesses and consumers to pay their bills. In particular, a stronger U.S. dollar, arising in part from higher U.S. rates, will imperil foreign companies that borrowed in the U.S. currency and may lack the means to repay their now-costlier debt.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report