Britain's Treasury Chief Jeremy Hunt leaves 11 Downing Street on Nov. 17, 2022. Britain is easing banking rules brought in after the 2008 global financial crisis in a bid to attract investment and secure London’s status as Europe’s leading finance center. Hunt said Friday, Dec. 9, 2022, that the changes, which follow Britain’s departure from the European Union in 2020, will make Britain “one of the most open, dynamic and competitive financial services hubs in the world.” (AP Photo/Kin Cheung)

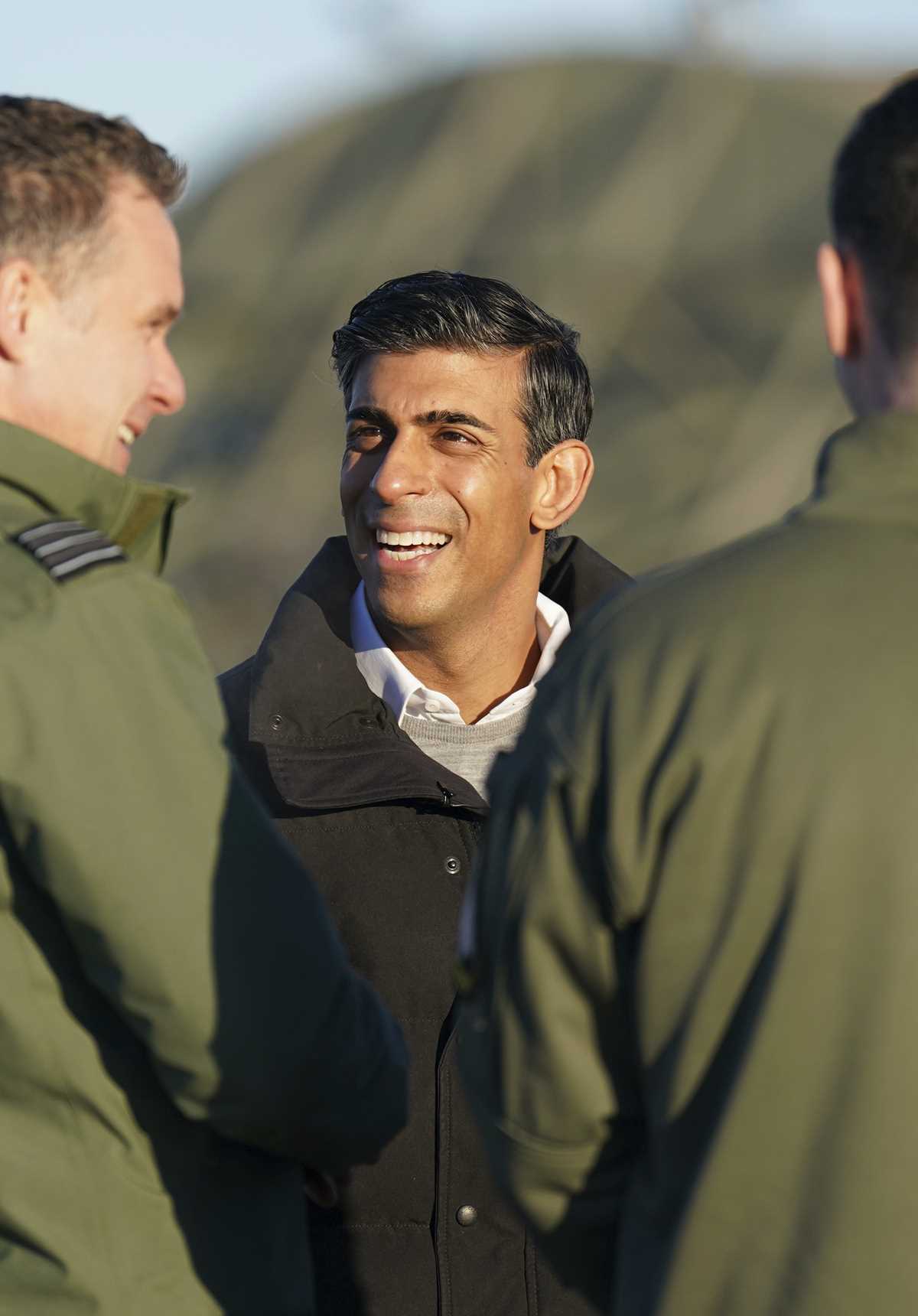

Britain's Treasury Chief Jeremy Hunt leaves 11 Downing Street on Nov. 17, 2022. Britain is easing banking rules brought in after the 2008 global financial crisis in a bid to attract investment and secure London’s status as Europe’s leading finance center. Hunt said Friday, Dec. 9, 2022, that the changes, which follow Britain’s departure from the European Union in 2020, will make Britain “one of the most open, dynamic and competitive financial services hubs in the world.” (AP Photo/Kin Cheung) Britain's Prime Minister Rishi Sunak reacts during his visit to RAF Coningsby in Lincolnshire, England, Friday, Dec. 9, 2022, following the announcement that Britain will work to develop next-generation fighter jets with Italy and Japan. (Joe Giddens/Pool Photo via AP)

Britain's Prime Minister Rishi Sunak reacts during his visit to RAF Coningsby in Lincolnshire, England, Friday, Dec. 9, 2022, following the announcement that Britain will work to develop next-generation fighter jets with Italy and Japan. (Joe Giddens/Pool Photo via AP)LONDON (AP) — Britain announced plans Friday to ease banking rules brought in after the 2008 global financial crisis in a bid to attract investment and secure London’s status as Europe’s leading finance center.

Treasury chief Jeremy Hunt said the changes, which follow Britain’s departure from the European Union in 2020, will make the U.K. “one of the most open, dynamic and competitive financial services hubs in the world.”

The package of more than 30 changes includes lifting a cap on bankers’ bonuses and easing capital requirements for smaller lenders. The government also said it will review regulations that hold bankers accountable for their decisions and will relax “ringfencing” rules intended to separate risky investment banking from retail operations.

Hunt said the government was using “Brexit freedoms” to make Britain more competitive. But many economists point out that the U.K.’s departure from the EU has erected barriers to trade and led some firms to shift offices and jobs to other European cities.

Last year, Amsterdam overtook London as Europe’s largest share-trading hub, though London remains the biggest financial services center overall.

The Conservative government says the rule changes will create a “smarter regulatory framework,” and analysts said the financial sector would appreciate them.

“The direction of travel will definitely be welcome,” said Jonathan Herbst, global head of financial services regulation at law firm Norton Rose Fulbright.

He added, however that “it is important for people not to overplay this; there is no sense of any move back to a pre-financial crisis world. Most of the U.K. regulatory regime reflects either international commitments or policy developed over many years to reflect the lessons of experience.”

But critics said the changes could reintroduce the kind of risk that led to the 2008 crisis. The British government at the time was forced to spend billions in taxpayers’ money to save some banks from collapse.

Opposition Liberal Democrat Treasury spokeswoman Sarah Olney said “our financial services need good and smart regulation, not more promises of slashing red tape, or a race to the bottom.”

Prime Minister Rishi Sunak insisted regulation of U.K. financial services would remain “robust.”

“Today’s reforms will ensure the industry remains competitive, we can create more jobs. But of course, this will always be a safe place where consumers will be protected,” he said.

Separately, the U.K. financial regulator fined Santander bank 108 million pounds ($132 million) Friday for lax controls against money-laundering. It said the bank was slow to close suspicious business accounts between 2012 and 2017.

The Financial Conduct Authority said “Santander’s poor management of their anti-money laundering systems and their inadequate attempts to address the problems created a prolonged and severe risk of money laundering and financial crime.”

Santander Chief Executive Officer Mike Regnier said the bank accepted that its procedures at the time “should have been stronger.”

“We have since made significant changes to address this by overhauling our financial crime technology, systems and processes,” he said.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report