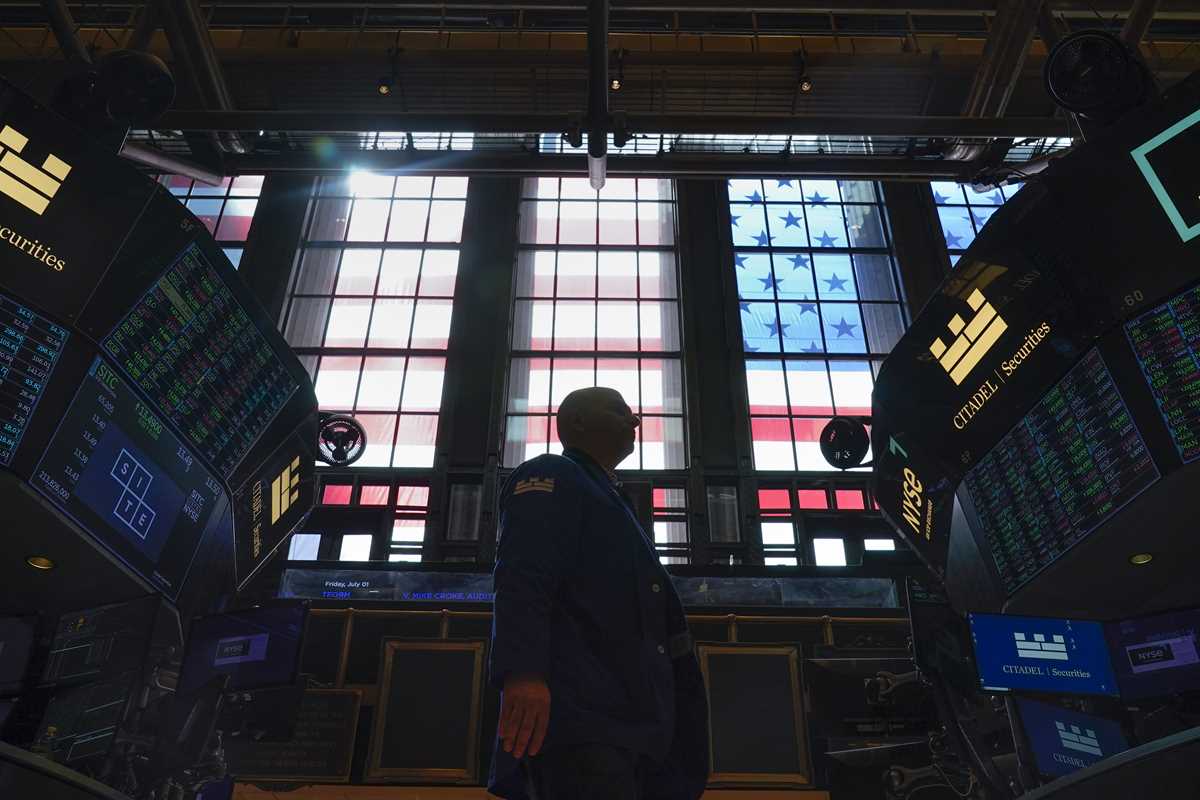

Traders work on the floor at the New York Stock Exchange in New York, July 1, 2022. Stocks are opening lower on Wall Street as markets turn cautious ahead of earnings reports from big U.S. companies starting this week and more reports that will show how badly inflation is hitting American businesses and households. The S&P 500 fell 1.1% in the early going Monday, July 11, 2022 while drops in technology stocks helped send the Nasdaq composite down 2%. (AP Photo/Seth Wenig)

Traders work on the floor at the New York Stock Exchange in New York, July 1, 2022. Stocks are opening lower on Wall Street as markets turn cautious ahead of earnings reports from big U.S. companies starting this week and more reports that will show how badly inflation is hitting American businesses and households. The S&P 500 fell 1.1% in the early going Monday, July 11, 2022 while drops in technology stocks helped send the Nasdaq composite down 2%. (AP Photo/Seth Wenig) A man wearing a face mask walks past a bank's electronic board showing the Hong Kong share index in Hong Kong, Tuesday, July 12, 2022. Asian shares fell Tuesday after a slump on Wall Street erased recent gains. (AP Photo/Kin Cheung)

A man wearing a face mask walks past a bank's electronic board showing the Hong Kong share index in Hong Kong, Tuesday, July 12, 2022. Asian shares fell Tuesday after a slump on Wall Street erased recent gains. (AP Photo/Kin Cheung) A man wearing a face mask walks past a bank's electronic board showing the Hong Kong share index in Hong Kong, Tuesday, July 12, 2022. Asian shares fell Tuesday after a slump on Wall Street erased recent gains. (AP Photo/Kin Cheung)

A man wearing a face mask walks past a bank's electronic board showing the Hong Kong share index in Hong Kong, Tuesday, July 12, 2022. Asian shares fell Tuesday after a slump on Wall Street erased recent gains. (AP Photo/Kin Cheung) A woman wearing a face mask walks past a bank's electronic board showing the Hong Kong share index in Hong Kong, Tuesday, July 12, 2022. Asian shares fell Tuesday after a slump on Wall Street erased recent gains. (AP Photo/Kin Cheung)

A woman wearing a face mask walks past a bank's electronic board showing the Hong Kong share index in Hong Kong, Tuesday, July 12, 2022. Asian shares fell Tuesday after a slump on Wall Street erased recent gains. (AP Photo/Kin Cheung) Sunlight shines on the facade of the New York Stock Exchange, Friday, July 8, 2022, in New York. U.S. futures and most global benchmarks fell Tuesday, Jly 12, 2022, with new data dropping this week on inflation, as well as the start of the earnings season. (AP Photo/John Minchillo, File)

Sunlight shines on the facade of the New York Stock Exchange, Friday, July 8, 2022, in New York. U.S. futures and most global benchmarks fell Tuesday, Jly 12, 2022, with new data dropping this week on inflation, as well as the start of the earnings season. (AP Photo/John Minchillo, File)U.S. futures and most global benchmarks fell Tuesday with new data dropping this week on inflation, as well as the start of the earnings season.

Futures for the Dow Jones industrial slid 0.7% and futures for the S&P 500 declined 0.5%. Oil prices fell almost 5% and are down about 18% from a month ago.

Shares in Europe declined in midday trading. Benchmarks finished lower in Tokyo, Seoul, Hong Kong and Shanghai but rose slightly in Sydney.

The euro cost $1.0040, down slightly from $1.0042, having dipped as low as $1.0004. The U.S. dollar inched down to 136.73 Japanese yen from 137.47 yen.

Both currencies have been trading at 20-year lows as the dollar has surged along with U.S. interest rates, which promise higher returns for investors.

The European common currency is close to dropping below parity, or one-to-one with the dollar. The last time the euro was below $1 was on July 15, 2002.

At midday in Europe, 18Germany's DAX fell 0.8% and Britain's FTSE 100 edged down 0.5%, while France’s CAC 40 slipped 0.4%.

In Asian trading, Japan’s benchmark Nikkei dropped 1.8% to 26,336.66. Australia’s S&P/ASX 200 gained nearly 0.1% to 6,606.30. South Korea’s Kospi slipped 1.0% to 2,317.76. Hong Kong’s Hang Seng sank 1.3% to 20,844.74, while the Shanghai Composite index shed 1% to 3,281.47 on growing concerns over COVID-19.

Adding to the pessimism, Hong Kong authorities announced they are considering implementing an electronic health code system to restrict movements of people infected with COVID-19, as well as overseas arrivals, a system similar to what's already in place in mainland China.

The highest inflation in four decades is pushing the Federal Reserve and other central banks to hike interest rates, which puts the clamps on the economy and hurts various types of investments.

Companies this week are set to begin reporting how their profits fared during the spring. Big banks and other financial companies dominate the early part of the schedule, with JPMorgan Chase and Morgan Stanley set for Thursday. BlackRock, Citigroup and Wells Fargo are among those reporting on Friday.

Expectations for second-quarter results appear subdued. Analysts are forecasting 4.3% growth for companies across the S&P 500, which would be the weakest since the end of 2020, according to FactSet.

Industry analysts will likely focus on what CEOs say about what they expect going forward, rather than the just-completed quarter.

Beyond earnings updates, reports this week on inflation will likely dominate trading. On Wednesday, economists expect the U.S. to report that inflation at the consumer level accelerated again last month, up to 8.8% from 8.6% in May. Data on prices at the producer level is due Thursday.

The housing sector has not been spared from rising costs, with median home prices up nearly 15% from a year ago. However, mortgage rates have soared, forcing sellers to lower asking prices and increasingly placing the reins back in the hands of buyers.

Redfin says nearly 15% of home purchase agreement — roughly 60,000 — fell through in June. That's the highest rate on record, excluding March and April of 2020, when the real estate market came to a standstill at the onset of the coronavirus pandemic. Sales of existing homes have declined for four months straight.

And on Tuesday, the online mortgage company loanDepot said it was cutting 2,000 jobs.

In energy trading, benchmark U.S. crude fell $4.86 to $99.23 a barrel. It lost 70 cents to $104.09 a barrel on Monday. Brent crude, the international standard for pricing, lost $4.67 to $102.43 a barrel.

___

Before you consider Morgan Stanley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morgan Stanley wasn't on the list.

While Morgan Stanley currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report