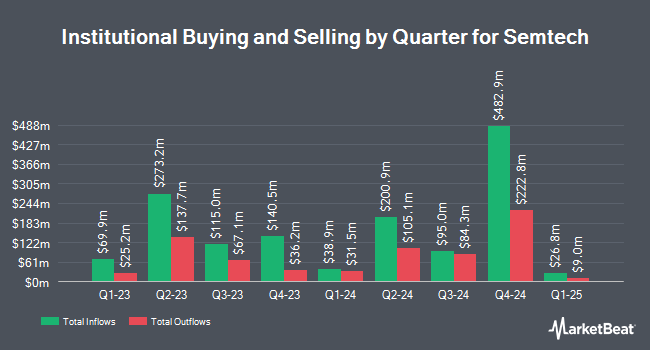

BNP Paribas Financial Markets lifted its stake in Semtech Co. (NASDAQ:SMTC - Free Report) by 471.3% in the fourth quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 204,159 shares of the semiconductor company's stock after purchasing an additional 168,426 shares during the quarter. BNP Paribas Financial Markets owned about 0.27% of Semtech worth $12,627,000 at the end of the most recent reporting period.

Other large investors have also recently modified their holdings of the company. Algert Global LLC bought a new stake in Semtech in the fourth quarter worth about $3,904,000. Alyeska Investment Group L.P. purchased a new stake in shares of Semtech in the fourth quarter worth approximately $51,315,000. Freestone Grove Partners LP bought a new stake in shares of Semtech during the 4th quarter worth approximately $14,660,000. Soros Fund Management LLC purchased a new position in Semtech during the 4th quarter valued at $6,185,000. Finally, Northern Trust Corp grew its position in Semtech by 26.3% in the 4th quarter. Northern Trust Corp now owns 865,472 shares of the semiconductor company's stock valued at $53,529,000 after acquiring an additional 180,098 shares during the last quarter.

Analyst Ratings Changes

A number of research firms have recently commented on SMTC. Needham & Company LLC restated a "buy" rating and issued a $54.00 price target on shares of Semtech in a report on Friday, March 14th. Robert W. Baird dropped their target price on shares of Semtech from $80.00 to $60.00 and set an "outperform" rating on the stock in a research note on Friday, February 7th. Craig Hallum decreased their price target on shares of Semtech from $70.00 to $55.00 and set a "buy" rating for the company in a research note on Friday, March 14th. Piper Sandler reissued an "overweight" rating and issued a $55.00 price objective (down previously from $75.00) on shares of Semtech in a research note on Monday, February 10th. Finally, UBS Group decreased their target price on Semtech from $60.00 to $55.00 and set a "buy" rating for the company in a research report on Monday, May 5th. Three analysts have rated the stock with a hold rating and eleven have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $56.92.

Read Our Latest Stock Report on SMTC

Semtech Stock Performance

NASDAQ:SMTC opened at $35.07 on Friday. The company's 50-day simple moving average is $32.41 and its 200-day simple moving average is $47.90. Semtech Co. has a fifty-two week low of $24.05 and a fifty-two week high of $79.52. The stock has a market capitalization of $3.04 billion, a P/E ratio of -2.69, a P/E/G ratio of 2.12 and a beta of 1.88.

Semtech (NASDAQ:SMTC - Get Free Report) last released its quarterly earnings results on Thursday, March 13th. The semiconductor company reported $0.40 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.32 by $0.08. The firm had revenue of $251.00 million during the quarter, compared to analysts' expectations of $249.40 million. During the same period in the prior year, the firm posted ($0.06) earnings per share. Semtech's revenue for the quarter was up 30.1% compared to the same quarter last year. On average, research analysts forecast that Semtech Co. will post -0.02 EPS for the current year.

Insider Buying and Selling at Semtech

In other news, CFO Mark Lin sold 2,907 shares of Semtech stock in a transaction on Thursday, March 27th. The shares were sold at an average price of $37.71, for a total transaction of $109,622.97. Following the completion of the sale, the chief financial officer now directly owns 13,481 shares in the company, valued at approximately $508,368.51. The trade was a 17.74 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. 0.60% of the stock is currently owned by company insiders.

Semtech Profile

(

Free Report)

Semtech Corporation designs, develops, manufactures, and markets analog and mixed-signal semiconductor and advanced algorithms. It provides signal integrity products, including a portfolio of optical data communications and video transport products used in various infrastructure, and industrial applications; a portfolio of integrated circuits for data centers, enterprise networks, passive optical networks, wireless base station optical transceivers, and high-speed interface applications; and video products for broadcast applications, as well as video-over-IP technology for professional audio video applications.

Read More

Want to see what other hedge funds are holding SMTC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Semtech Co. (NASDAQ:SMTC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Semtech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Semtech wasn't on the list.

While Semtech currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.