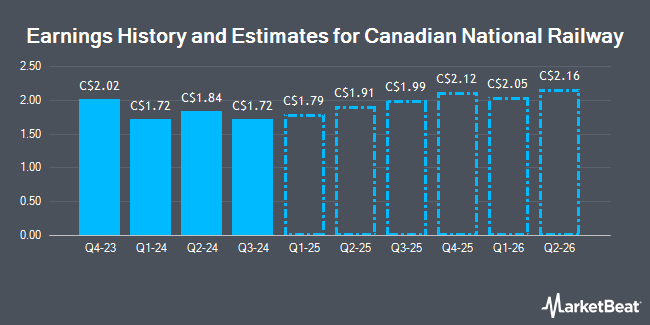

Canadian National Railway (TSE:CNR - Free Report) NYSE: CNI - Stock analysts at Raymond James Financial increased their Q4 2025 earnings estimates for Canadian National Railway in a research note issued to investors on Thursday, July 17th. Raymond James Financial analyst S. Hansen now forecasts that the company will post earnings of $2.15 per share for the quarter, up from their prior forecast of $2.13. Raymond James Financial currently has a "Moderate Buy" rating and a $162.00 target price on the stock. The consensus estimate for Canadian National Railway's current full-year earnings is $8.26 per share. Raymond James Financial also issued estimates for Canadian National Railway's FY2026 earnings at $8.75 EPS.

CNR has been the subject of several other research reports. UBS Group increased their price target on shares of Canadian National Railway from C$172.00 to C$174.00 and gave the company a "buy" rating in a research report on Friday, May 2nd. Desjardins reduced their price target on shares of Canadian National Railway from C$169.00 to C$160.00 and set a "buy" rating for the company in a research report on Friday, May 2nd. ATB Capital dropped their price objective on shares of Canadian National Railway from C$156.00 to C$155.00 and set a "sector perform" rating on the stock in a report on Monday, July 7th. Barclays dropped their price objective on shares of Canadian National Railway from C$150.00 to C$145.00 and set an "equal weight" rating on the stock in a report on Friday, May 2nd. Finally, CIBC upped their price objective on shares of Canadian National Railway from C$146.00 to C$155.00 in a report on Thursday, May 22nd. One research analyst has rated the stock with a sell rating, five have assigned a hold rating, nine have assigned a buy rating and four have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of C$160.57.

View Our Latest Research Report on Canadian National Railway

Canadian National Railway Trading Down 2.4%

Shares of CNR stock traded down C$3.39 during trading hours on Friday, hitting C$136.61. 1,951,168 shares of the company were exchanged, compared to its average volume of 1,349,387. The firm has a market cap of C$85.59 billion, a P/E ratio of 14.77, a P/E/G ratio of 3.38 and a beta of 0.65. Canadian National Railway has a fifty-two week low of C$130.02 and a fifty-two week high of C$168.03. The company has a debt-to-equity ratio of 107.59, a quick ratio of 0.58 and a current ratio of 0.64. The company has a 50 day simple moving average of C$143.70 and a two-hundred day simple moving average of C$142.83.

Canadian National Railway Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Monday, June 9th were paid a $0.8875 dividend. This represents a $3.55 annualized dividend and a dividend yield of 2.60%. This is a boost from Canadian National Railway's previous quarterly dividend of $0.85. Canadian National Railway's dividend payout ratio (DPR) is presently 36.54%.

Insider Activity at Canadian National Railway

In related news, Director Susan C. Jones acquired 1,461 shares of Canadian National Railway stock in a transaction that occurred on Tuesday, May 6th. The shares were purchased at an average price of C$136.62 per share, for a total transaction of C$199,600.80. Also, Director Shauneen Elizabeth Bruder bought 627 shares of Canadian National Railway stock in a transaction on Wednesday, June 25th. The stock was acquired at an average price of C$139.47 per share, for a total transaction of C$87,448.44. 2.64% of the stock is currently owned by company insiders.

About Canadian National Railway

(

Get Free Report)

Canadian National's railway spans Canada from coast to coast and extends through Chicago to the Gulf of Mexico. In 2019, CN delivered almost 6 million carloads over its 19,600 miles of track. CN generated roughly CAD 14 billion in total revenue by hauling intermodal containers (25% of consolidated revenue), petroleum and chemicals (21%), grain and fertilizers (16%), forest products (12%), metals and mining (11%), automotive shipments (6%), and coal (4%).

Read More

Before you consider Canadian National Railway, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian National Railway wasn't on the list.

While Canadian National Railway currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.