Wellington Shields & Co. LLC increased its stake in Alphabet Inc. (NASDAQ:GOOGL - Free Report) by 13.3% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 18,019 shares of the information services provider's stock after purchasing an additional 2,110 shares during the period. Alphabet accounts for 0.9% of Wellington Shields & Co. LLC's portfolio, making the stock its 22nd largest position. Wellington Shields & Co. LLC's holdings in Alphabet were worth $2,786,000 as of its most recent filing with the Securities and Exchange Commission.

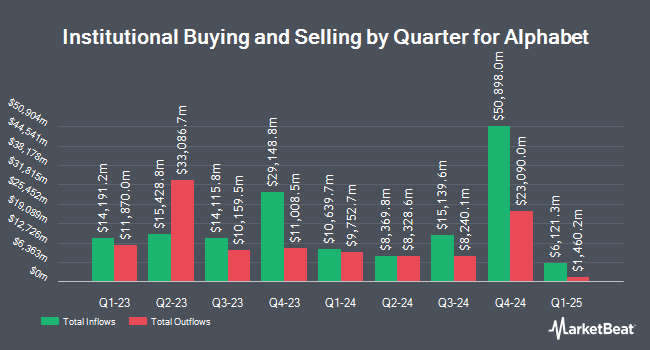

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in GOOGL. FMR LLC grew its holdings in Alphabet by 9.8% in the 4th quarter. FMR LLC now owns 248,416,916 shares of the information services provider's stock worth $47,025,322,000 after buying an additional 22,100,902 shares in the last quarter. GAMMA Investing LLC boosted its position in Alphabet by 16,993.2% during the 1st quarter. GAMMA Investing LLC now owns 16,062,457 shares of the information services provider's stock worth $2,483,898,000 after acquiring an additional 15,968,487 shares during the period. Northern Trust Corp grew its stake in shares of Alphabet by 17.0% in the fourth quarter. Northern Trust Corp now owns 69,616,854 shares of the information services provider's stock worth $13,178,470,000 after purchasing an additional 10,135,430 shares in the last quarter. Capital Research Global Investors grew its stake in shares of Alphabet by 16.2% in the fourth quarter. Capital Research Global Investors now owns 72,033,086 shares of the information services provider's stock worth $13,635,878,000 after purchasing an additional 10,037,685 shares in the last quarter. Finally, Wellington Management Group LLP increased its holdings in shares of Alphabet by 15.9% during the fourth quarter. Wellington Management Group LLP now owns 66,050,135 shares of the information services provider's stock valued at $12,503,291,000 after purchasing an additional 9,042,271 shares during the period. Institutional investors and hedge funds own 40.03% of the company's stock.

Insider Transactions at Alphabet

In related news, Director Kavitark Ram Shriram sold 18,566 shares of the stock in a transaction dated Friday, July 18th. The shares were sold at an average price of $185.76, for a total value of $3,448,820.16. Following the completion of the sale, the director owned 243,400 shares in the company, valued at approximately $45,213,984. This trade represents a 7.09% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Sundar Pichai sold 32,500 shares of Alphabet stock in a transaction dated Wednesday, July 2nd. The stock was sold at an average price of $178.52, for a total value of $5,801,900.00. Following the sale, the chief executive officer directly owned 2,559,892 shares in the company, valued at approximately $456,991,919.84. This trade represents a 1.25% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 273,219 shares of company stock worth $49,474,273. 11.64% of the stock is currently owned by company insiders.

Analyst Ratings Changes

A number of brokerages recently issued reports on GOOGL. Piper Sandler increased their target price on shares of Alphabet from $195.00 to $220.00 and gave the company an "overweight" rating in a research report on Thursday, July 24th. Guggenheim increased their price objective on shares of Alphabet from $190.00 to $210.00 and gave the company a "buy" rating in a report on Wednesday, July 23rd. Westpark Capital increased their price target on Alphabet from $210.00 to $220.00 and gave the company a "buy" rating in a research note on Thursday, July 24th. BNP Paribas downgraded Alphabet from a "strong-buy" rating to a "hold" rating in a research note on Thursday, June 26th. Finally, Barclays upped their price objective on Alphabet from $220.00 to $235.00 and gave the company an "overweight" rating in a report on Thursday, July 24th. Ten equities research analysts have rated the stock with a hold rating, twenty-nine have given a buy rating and four have issued a strong buy rating to the stock. Based on data from MarketBeat, Alphabet currently has a consensus rating of "Moderate Buy" and an average target price of $211.53.

Read Our Latest Stock Analysis on Alphabet

Alphabet Price Performance

Shares of NASDAQ:GOOGL opened at $196.09 on Thursday. The company has a market cap of $2.37 trillion, a price-to-earnings ratio of 20.88, a PEG ratio of 1.32 and a beta of 1.01. The business has a 50 day moving average price of $179.76 and a 200 day moving average price of $173.12. The company has a quick ratio of 1.90, a current ratio of 1.90 and a debt-to-equity ratio of 0.07. Alphabet Inc. has a twelve month low of $140.53 and a twelve month high of $207.05.

Alphabet (NASDAQ:GOOGL - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The information services provider reported $2.31 earnings per share for the quarter, beating the consensus estimate of $2.15 by $0.16. Alphabet had a return on equity of 34.31% and a net margin of 31.12%. The company had revenue of $96,428,000 billion during the quarter, compared to analysts' expectations of $93.60 billion. Research analysts predict that Alphabet Inc. will post 8.9 earnings per share for the current year.

Alphabet Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Monday, September 8th will be issued a dividend of $0.21 per share. The ex-dividend date is Monday, September 8th. This represents a $0.84 annualized dividend and a dividend yield of 0.4%. Alphabet's payout ratio is presently 8.95%.

Alphabet Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Further Reading

Want to see what other hedge funds are holding GOOGL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Alphabet Inc. (NASDAQ:GOOGL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report