Envestnet Asset Management Inc. increased its position in shares of Charter Communications, Inc. (NASDAQ:CHTR - Free Report) by 20.3% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 33,471 shares of the company's stock after purchasing an additional 5,642 shares during the period. Envestnet Asset Management Inc.'s holdings in Charter Communications were worth $12,335,000 as of its most recent SEC filing.

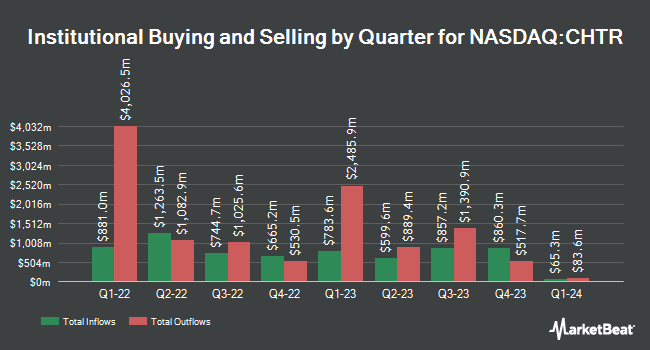

Other large investors have also recently added to or reduced their stakes in the company. Norges Bank acquired a new stake in Charter Communications during the fourth quarter worth approximately $1,032,236,000. Price T Rowe Associates Inc. MD boosted its position in Charter Communications by 822.8% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 1,263,721 shares of the company's stock worth $433,167,000 after acquiring an additional 1,126,783 shares during the last quarter. GAMMA Investing LLC boosted its position in Charter Communications by 43,296.0% during the first quarter. GAMMA Investing LLC now owns 857,938 shares of the company's stock worth $316,176,000 after acquiring an additional 855,961 shares during the last quarter. Arrowstreet Capital Limited Partnership boosted its position in Charter Communications by 130.1% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 1,078,175 shares of the company's stock worth $369,566,000 after acquiring an additional 609,554 shares during the last quarter. Finally, LSV Asset Management raised its stake in Charter Communications by 8,343.1% during the fourth quarter. LSV Asset Management now owns 177,305 shares of the company's stock worth $60,775,000 after purchasing an additional 175,205 shares during the period. 81.76% of the stock is owned by hedge funds and other institutional investors.

Charter Communications Trading Down 0.4%

Shares of CHTR opened at $382.08 on Friday. The stock has a market capitalization of $53.63 billion, a P/E ratio of 10.66, a PEG ratio of 0.42 and a beta of 1.08. The company has a quick ratio of 0.36, a current ratio of 0.36 and a debt-to-equity ratio of 4.54. The firm has a fifty day simple moving average of $400.15 and a two-hundred day simple moving average of $372.58. Charter Communications, Inc. has a twelve month low of $304.76 and a twelve month high of $437.06.

Charter Communications (NASDAQ:CHTR - Get Free Report) last posted its quarterly earnings results on Friday, April 25th. The company reported $8.42 earnings per share (EPS) for the quarter, missing the consensus estimate of $8.70 by ($0.28). Charter Communications had a return on equity of 27.70% and a net margin of 9.42%. The company had revenue of $13.74 billion during the quarter, compared to analysts' expectations of $13.67 billion. During the same period in the prior year, the firm earned $7.55 EPS. Charter Communications's revenue for the quarter was up .4% compared to the same quarter last year. On average, research analysts anticipate that Charter Communications, Inc. will post 38.16 EPS for the current year.

Analyst Upgrades and Downgrades

CHTR has been the topic of several analyst reports. Wall Street Zen raised shares of Charter Communications from a "hold" rating to a "buy" rating in a research note on Thursday, May 1st. UBS Group upped their price objective on Charter Communications from $400.00 to $425.00 and gave the company a "neutral" rating in a research note on Wednesday, June 18th. Loop Capital upgraded Charter Communications from a "hold" rating to a "buy" rating and upped their price objective for the company from $430.00 to $510.00 in a research note on Monday, May 19th. BNP Paribas restated an "underperform" rating and set a $290.00 price objective on shares of Charter Communications in a research note on Thursday, April 10th. Finally, Royal Bank Of Canada upped their price objective on Charter Communications from $385.00 to $395.00 and gave the company a "sector perform" rating in a research note on Monday, April 28th. Three equities research analysts have rated the stock with a sell rating, ten have issued a hold rating and nine have assigned a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $422.37.

View Our Latest Stock Report on Charter Communications

About Charter Communications

(

Free Report)

Charter Communications, Inc operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based internet, video, and mobile and voice services; a suite of broadband connectivity services, including fixed internet, WiFi, and mobile; Advanced WiFi services; Spectrum Security Shield; in-home WiFi, which provides customers with high performance wireless routers and managed WiFi services to enhance their fixed wireless internet experience; out-of-home WiFi; and Spectrum WiFi services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Charter Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charter Communications wasn't on the list.

While Charter Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.