ING Groep NV trimmed its holdings in shares of Iron Mountain Incorporated (NYSE:IRM - Free Report) by 22.3% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 29,108 shares of the financial services provider's stock after selling 8,373 shares during the quarter. ING Groep NV's holdings in Iron Mountain were worth $2,504,000 at the end of the most recent quarter.

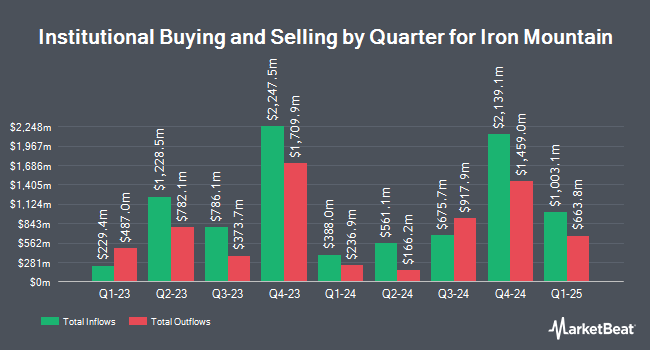

Other institutional investors and hedge funds also recently modified their holdings of the company. Northern Trust Corp increased its position in Iron Mountain by 56.1% in the fourth quarter. Northern Trust Corp now owns 4,326,476 shares of the financial services provider's stock worth $454,756,000 after buying an additional 1,554,746 shares during the last quarter. Dimensional Fund Advisors LP increased its position in Iron Mountain by 0.4% in the fourth quarter. Dimensional Fund Advisors LP now owns 4,219,263 shares of the financial services provider's stock worth $443,476,000 after buying an additional 15,097 shares during the last quarter. Nuveen Asset Management LLC increased its position in Iron Mountain by 39.0% in the fourth quarter. Nuveen Asset Management LLC now owns 2,548,970 shares of the financial services provider's stock worth $267,922,000 after buying an additional 715,024 shares during the last quarter. Invesco Ltd. increased its position in Iron Mountain by 17.2% in the fourth quarter. Invesco Ltd. now owns 2,482,820 shares of the financial services provider's stock worth $260,969,000 after buying an additional 363,783 shares during the last quarter. Finally, Point72 Asset Management L.P. increased its position in Iron Mountain by 439.8% in the fourth quarter. Point72 Asset Management L.P. now owns 1,200,660 shares of the financial services provider's stock worth $126,201,000 after buying an additional 978,251 shares during the last quarter. 80.13% of the stock is owned by hedge funds and other institutional investors.

Iron Mountain Stock Performance

NYSE:IRM opened at $95.65 on Wednesday. The firm has a market capitalization of $28.22 billion, a price-to-earnings ratio of 233.29 and a beta of 1.07. Iron Mountain Incorporated has a 52-week low of $72.33 and a 52-week high of $130.24. The stock has a fifty day moving average of $99.92 and a 200 day moving average of $95.05.

Insiders Place Their Bets

In related news, CEO William L. Meaney sold 69,125 shares of Iron Mountain stock in a transaction on Friday, August 1st. The stock was sold at an average price of $94.55, for a total transaction of $6,535,768.75. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Walter C. Rakowich sold 900 shares of Iron Mountain stock in a transaction on Wednesday, June 4th. The shares were sold at an average price of $99.97, for a total value of $89,973.00. Following the sale, the director directly owned 36,515 shares of the company's stock, valued at $3,650,404.55. This represents a 2.41% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 240,007 shares of company stock worth $23,543,507 over the last three months. Corporate insiders own 1.90% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have issued reports on IRM shares. Wall Street Zen raised Iron Mountain from a "sell" rating to a "hold" rating in a research report on Friday, April 18th. Barclays lifted their price target on Iron Mountain from $118.00 to $121.00 and gave the company an "overweight" rating in a research report on Tuesday, May 27th. Finally, Truist Financial initiated coverage on Iron Mountain in a research report on Tuesday, April 8th. They issued a "buy" rating and a $95.00 price target for the company. One equities research analyst has rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Buy" and an average target price of $122.00.

View Our Latest Analysis on Iron Mountain

Iron Mountain Profile

(

Free Report)

Iron Mountain Incorporated NYSE: IRM is a global leader in information management services. Founded in 1951 and trusted by more than 240,000 customers worldwide, Iron Mountain serves to protect and elevate the power of our customers' work. Through a range of offerings including digital transformation, data centers, secure records storage, information management, asset lifecycle management, secure destruction and art storage and logistics, Iron Mountain helps businesses bring light to their dark data, enabling customers to unlock value and intelligence from their stored digital and physical assets at speed and with security, while helping them meet their environmental goals.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Iron Mountain, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iron Mountain wasn't on the list.

While Iron Mountain currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.