Migdal Insurance & Financial Holdings Ltd. grew its position in Innoviz Technologies Ltd. (NASDAQ:INVZ - Free Report) by 7.3% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The firm owned 7,305,731 shares of the company's stock after purchasing an additional 500,000 shares during the period. Migdal Insurance & Financial Holdings Ltd. owned about 3.67% of Innoviz Technologies worth $4,763,000 at the end of the most recent reporting period.

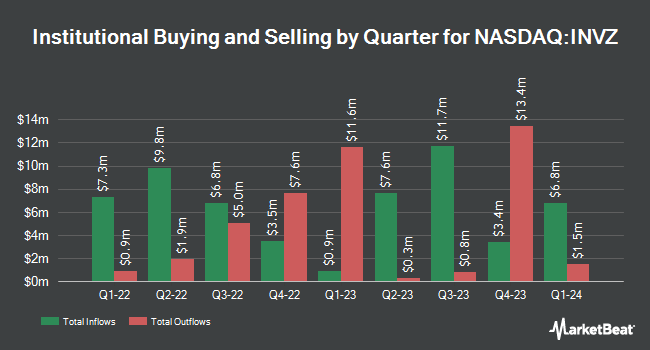

Several other hedge funds also recently bought and sold shares of INVZ. Raymond James Financial Inc. acquired a new stake in shares of Innoviz Technologies during the fourth quarter worth $87,000. New Age Alpha Advisors LLC acquired a new stake in Innoviz Technologies in the 4th quarter valued at $168,000. XTX Topco Ltd acquired a new stake in Innoviz Technologies in the 4th quarter valued at $80,000. PEAK6 LLC acquired a new stake in Innoviz Technologies in the 4th quarter valued at $97,000. Finally, HITE Hedge Asset Management LLC acquired a new stake in Innoviz Technologies in the 4th quarter valued at $1,972,000. 63.26% of the stock is currently owned by institutional investors and hedge funds.

Innoviz Technologies Stock Performance

Shares of Innoviz Technologies stock traded up $0.19 on Friday, reaching $1.89. 12,395,537 shares of the stock were exchanged, compared to its average volume of 5,621,220. The firm's 50 day moving average is $1.20 and its 200-day moving average is $1.07. Innoviz Technologies Ltd. has a one year low of $0.45 and a one year high of $3.14. The firm has a market cap of $376.04 million, a PE ratio of -4.11 and a beta of 1.26.

Analyst Ratings Changes

A number of equities analysts recently commented on INVZ shares. Rosenblatt Securities reiterated a "buy" rating and set a $4.00 price target on shares of Innoviz Technologies in a report on Thursday, May 15th. The Goldman Sachs Group lifted their price target on Innoviz Technologies from $0.75 to $1.00 and gave the stock a "neutral" rating in a report on Friday, May 16th. Wall Street Zen raised shares of Innoviz Technologies from a "sell" rating to a "hold" rating in a report on Thursday, May 22nd. Finally, Westpark Capital lifted their target price on shares of Innoviz Technologies from $2.22 to $2.53 and gave the stock a "buy" rating in a report on Wednesday, June 18th. Three research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, Innoviz Technologies has a consensus rating of "Hold" and an average price target of $2.38.

Read Our Latest Report on INVZ

About Innoviz Technologies

(

Free Report)

Innoviz Technologies Ltd. manufactures and sells automotive grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale. The company offers InnovizOne, a solid-state LiDAR sensor designed for automakers and robotaxis, shuttles, trucks, and delivery companies requiring an automotive-grade and mass-producible solution to achieve autonomy.

Read More

Before you consider Innoviz Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innoviz Technologies wasn't on the list.

While Innoviz Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.