Jennison Associates LLC cut its stake in Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM by 14.7% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 521,829 shares of the mining company's stock after selling 89,701 shares during the quarter. Jennison Associates LLC owned 0.10% of Agnico Eagle Mines worth $56,571,000 as of its most recent filing with the Securities & Exchange Commission.

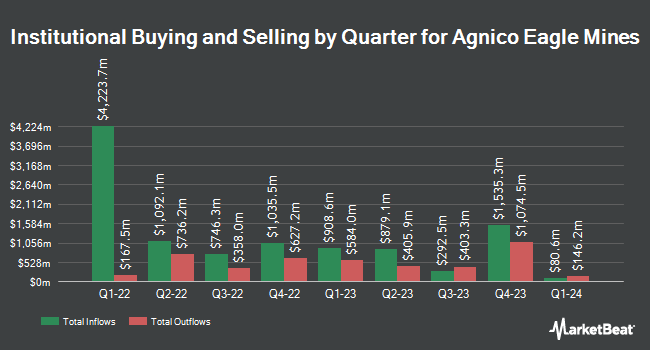

A number of other large investors have also recently made changes to their positions in the stock. Sumitomo Mitsui DS Asset Management Company Ltd boosted its holdings in shares of Agnico Eagle Mines by 1.5% in the first quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 5,702 shares of the mining company's stock worth $618,000 after buying an additional 85 shares during the last quarter. Hexagon Capital Partners LLC boosted its holdings in shares of Agnico Eagle Mines by 31.1% in the first quarter. Hexagon Capital Partners LLC now owns 367 shares of the mining company's stock worth $40,000 after buying an additional 87 shares during the last quarter. Benjamin Edwards Inc. boosted its holdings in shares of Agnico Eagle Mines by 2.0% in the fourth quarter. Benjamin Edwards Inc. now owns 5,472 shares of the mining company's stock worth $428,000 after buying an additional 106 shares during the last quarter. Laird Norton Wetherby Wealth Management LLC boosted its holdings in shares of Agnico Eagle Mines by 1.8% in the fourth quarter. Laird Norton Wetherby Wealth Management LLC now owns 6,944 shares of the mining company's stock worth $543,000 after buying an additional 120 shares during the last quarter. Finally, MassMutual Private Wealth & Trust FSB boosted its holdings in shares of Agnico Eagle Mines by 19.3% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 774 shares of the mining company's stock worth $84,000 after buying an additional 125 shares during the last quarter. 68.34% of the stock is currently owned by institutional investors.

Agnico Eagle Mines Trading Down 0.8%

Shares of AEM traded down $0.89 during trading hours on Friday, reaching $117.72. 1,872,910 shares of the company traded hands, compared to its average volume of 2,618,928. The firm has a market cap of $59.19 billion, a price-to-earnings ratio of 25.05, a PEG ratio of 0.86 and a beta of 0.50. Agnico Eagle Mines Limited has a 12-month low of $69.72 and a 12-month high of $126.76. The company has a current ratio of 2.37, a quick ratio of 1.20 and a debt-to-equity ratio of 0.05. The stock's fifty day moving average price is $117.99 and its 200 day moving average price is $107.15.

Agnico Eagle Mines (NYSE:AEM - Get Free Report) TSE: AEM last released its quarterly earnings results on Thursday, April 24th. The mining company reported $1.53 EPS for the quarter, beating the consensus estimate of $1.39 by $0.14. The business had revenue of $2.38 billion during the quarter, compared to analyst estimates of $2.27 billion. Agnico Eagle Mines had a net margin of 26.48% and a return on equity of 12.09%. The company's quarterly revenue was up 34.9% on a year-over-year basis. During the same period in the prior year, the firm posted $0.76 earnings per share. Sell-side analysts forecast that Agnico Eagle Mines Limited will post 4.63 earnings per share for the current year.

Agnico Eagle Mines Dividend Announcement

The business also recently disclosed a dividend, which was paid on Monday, June 16th. Stockholders of record on Monday, June 2nd were issued a dividend of $0.40 per share. The ex-dividend date was Friday, May 30th. This represents a dividend yield of 1.36%. Agnico Eagle Mines's dividend payout ratio (DPR) is currently 34.04%.

Analysts Set New Price Targets

Several brokerages have weighed in on AEM. Bank of America lifted their price target on shares of Agnico Eagle Mines from $170.00 to $173.00 and gave the company a "buy" rating in a report on Monday, June 23rd. Citigroup lifted their price target on shares of Agnico Eagle Mines from $100.00 to $140.00 and gave the company a "buy" rating in a report on Monday, March 31st. Royal Bank Of Canada lifted their price target on shares of Agnico Eagle Mines from $115.00 to $145.00 and gave the company an "outperform" rating in a report on Wednesday, June 4th. Lake Street Capital reaffirmed a "buy" rating on shares of Agnico Eagle Mines in a report on Monday, June 23rd. Finally, TD Securities raised shares of Agnico Eagle Mines to a "strong-buy" rating in a report on Thursday. Two analysts have rated the stock with a hold rating, eight have given a buy rating and five have given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Buy" and an average price target of $136.90.

Read Our Latest Analysis on AEM

About Agnico Eagle Mines

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

See Also

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.