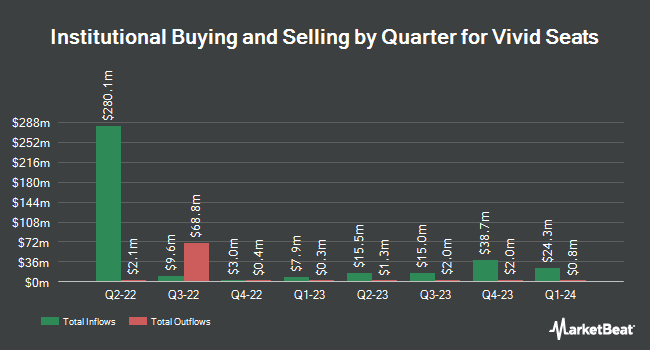

M&T Bank Corp lessened its holdings in shares of Vivid Seats Inc. (NASDAQ:SEAT - Free Report) by 90.8% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 18,484 shares of the company's stock after selling 181,444 shares during the period. M&T Bank Corp's holdings in Vivid Seats were worth $55,000 at the end of the most recent quarter.

Several other institutional investors have also modified their holdings of SEAT. Price T Rowe Associates Inc. MD raised its position in Vivid Seats by 17.2% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 29,251 shares of the company's stock valued at $136,000 after buying an additional 4,288 shares during the last quarter. Charles Schwab Investment Management Inc. increased its position in shares of Vivid Seats by 0.8% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 741,722 shares of the company's stock worth $3,434,000 after purchasing an additional 5,828 shares during the last quarter. American Century Companies Inc. increased its position in shares of Vivid Seats by 9.6% during the 4th quarter. American Century Companies Inc. now owns 96,396 shares of the company's stock worth $446,000 after purchasing an additional 8,450 shares during the last quarter. Quinn Opportunity Partners LLC acquired a new position in shares of Vivid Seats during the 4th quarter worth approximately $46,000. Finally, Barclays PLC increased its position in shares of Vivid Seats by 8.8% during the 4th quarter. Barclays PLC now owns 136,181 shares of the company's stock worth $630,000 after purchasing an additional 11,018 shares during the last quarter. Institutional investors own 39.92% of the company's stock.

Wall Street Analysts Forecast Growth

SEAT has been the topic of a number of recent analyst reports. Canaccord Genuity Group decreased their target price on Vivid Seats from $5.00 to $4.00 and set a "buy" rating on the stock in a report on Wednesday, May 7th. Benchmark decreased their target price on Vivid Seats from $6.00 to $3.00 and set a "buy" rating on the stock in a report on Wednesday, May 7th. William Blair lowered Vivid Seats from an "outperform" rating to a "market perform" rating in a report on Tuesday, May 6th. Royal Bank Of Canada decreased their target price on Vivid Seats from $4.00 to $2.00 and set a "sector perform" rating on the stock in a report on Wednesday, May 7th. Finally, Maxim Group decreased their target price on Vivid Seats from $5.00 to $3.00 and set a "buy" rating on the stock in a report on Wednesday, May 7th. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $4.49.

Check Out Our Latest Report on Vivid Seats

Insider Transactions at Vivid Seats

In other Vivid Seats news, General Counsel Emily T. Epstein sold 14,476 shares of the stock in a transaction that occurred on Monday, May 12th. The stock was sold at an average price of $1.99, for a total value of $28,807.24. Following the transaction, the general counsel owned 151,194 shares in the company, valued at approximately $300,876.06. This represents a 8.74% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 88.46% of the company's stock.

Vivid Seats Stock Performance

Shares of SEAT opened at $1.63 on Friday. Vivid Seats Inc. has a 12-month low of $1.44 and a 12-month high of $5.40. The business has a 50-day simple moving average of $1.80 and a two-hundred day simple moving average of $2.95. The company has a quick ratio of 0.70, a current ratio of 0.77 and a debt-to-equity ratio of 1.01.

Vivid Seats (NASDAQ:SEAT - Get Free Report) last issued its quarterly earnings results on Tuesday, May 6th. The company reported ($0.05) earnings per share for the quarter, missing the consensus estimate of ($0.02) by ($0.03). Vivid Seats had a negative net margin of 0.35% and a negative return on equity of 2.17%. The company had revenue of $164.02 million during the quarter, compared to analyst estimates of $169.99 million. As a group, analysts predict that Vivid Seats Inc. will post 0.12 EPS for the current year.

Vivid Seats Profile

(

Free Report)

Vivid Seats Inc operates an online ticket marketplace in the United States, Canada, and Japan. The company operates in two segments, Marketplace and Resale. The Marketplace segment acts as an intermediary between event ticket buyers and sellers; processes ticket sales on its website and mobile applications through its distribution partners; and sells tickets for sports, concerts, theater events, and other live events.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vivid Seats, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vivid Seats wasn't on the list.

While Vivid Seats currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.