Teacher Retirement System of Texas bought a new position in shares of St. Joe Company (The) (NYSE:JOE - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 5,976 shares of the financial services provider's stock, valued at approximately $281,000.

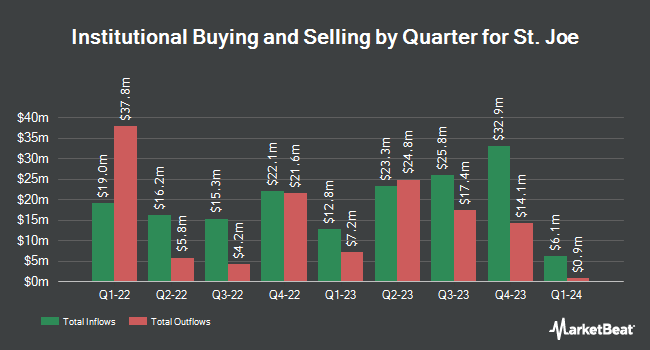

Other institutional investors have also recently made changes to their positions in the company. Lazard Asset Management LLC bought a new stake in shares of St. Joe during the fourth quarter valued at approximately $38,000. XTX Topco Ltd purchased a new stake in St. Joe in the 4th quarter worth $210,000. Polymer Capital Management US LLC purchased a new stake in shares of St. Joe during the 4th quarter valued at about $223,000. Bridgefront Capital LLC purchased a new stake in shares of St. Joe during the 4th quarter valued at about $225,000. Finally, Arete Wealth Advisors LLC raised its position in shares of St. Joe by 5.1% during the 4th quarter. Arete Wealth Advisors LLC now owns 5,047 shares of the financial services provider's stock valued at $226,000 after buying an additional 243 shares in the last quarter. Hedge funds and other institutional investors own 86.67% of the company's stock.

St. Joe Trading Down 1.0%

JOE opened at $49.44 on Friday. The firm has a market capitalization of $2.88 billion, a P/E ratio of 37.17 and a beta of 1.36. The firm's 50 day moving average is $47.05 and its 200-day moving average is $46.09. St. Joe Company has a 52-week low of $40.19 and a 52-week high of $64.69. The company has a quick ratio of 1.52, a current ratio of 1.52 and a debt-to-equity ratio of 0.83.

St. Joe (NYSE:JOE - Get Free Report) last released its quarterly earnings data on Wednesday, April 23rd. The financial services provider reported $0.30 EPS for the quarter. St. Joe had a return on equity of 10.62% and a net margin of 18.99%. The firm had revenue of $94.20 million for the quarter.

St. Joe Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Thursday, June 26th. Investors of record on Tuesday, June 10th were given a $0.14 dividend. This represents a $0.56 dividend on an annualized basis and a yield of 1.13%. The ex-dividend date was Tuesday, June 10th. St. Joe's dividend payout ratio is presently 42.11%.

Analyst Ratings Changes

Separately, Wall Street Zen lowered shares of St. Joe from a "buy" rating to a "hold" rating in a research note on Sunday, June 8th.

Read Our Latest Stock Analysis on JOE

St. Joe Profile

(

Free Report)

The St. Joe Company, together with its subsidiaries, operates as a real estate development, asset management, and operating company in Northwest Florida. It operates through three segments: Residential, Hospitality, and Commercial. The Residential segment engages in the development of communities into homesites for sale to homebuilders and on a limited basis to retail customers.

Featured Stories

Want to see what other hedge funds are holding JOE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for St. Joe Company (The) (NYSE:JOE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider St. Joe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and St. Joe wasn't on the list.

While St. Joe currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.