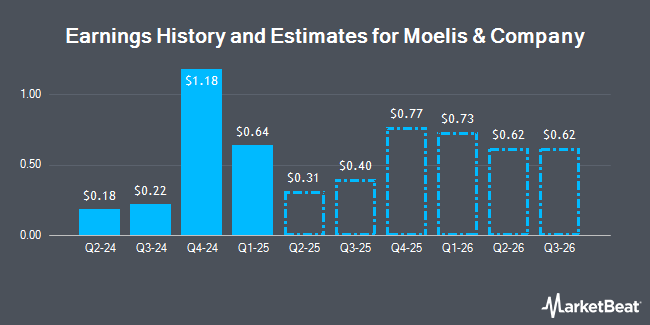

Moelis & Company (NYSE:MC - Free Report) - Investment analysts at Seaport Res Ptn lifted their Q2 2025 earnings per share estimates for Moelis & Company in a research report issued on Monday, July 14th. Seaport Res Ptn analyst J. Mitchell now expects that the asset manager will post earnings per share of $0.28 for the quarter, up from their prior estimate of $0.22. The consensus estimate for Moelis & Company's current full-year earnings is $2.97 per share. Seaport Res Ptn also issued estimates for Moelis & Company's Q4 2025 earnings at $0.77 EPS and FY2025 earnings at $1.95 EPS.

Moelis & Company (NYSE:MC - Get Free Report) last released its earnings results on Wednesday, April 23rd. The asset manager reported $0.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.57 by $0.07. The firm had revenue of $306.59 million for the quarter, compared to analyst estimates of $309.67 million. Moelis & Company had a return on equity of 40.89% and a net margin of 13.22%. Moelis & Company's revenue was up 41.0% compared to the same quarter last year. During the same period in the previous year, the company earned $0.22 earnings per share.

A number of other equities analysts have also recently weighed in on MC. Keefe, Bruyette & Woods lifted their price target on Moelis & Company from $69.00 to $89.00 and gave the stock an "outperform" rating in a research note on Monday. JMP Securities reissued a "market perform" rating on shares of Moelis & Company in a research note on Thursday, April 24th. JPMorgan Chase & Co. dropped their price target on Moelis & Company from $55.00 to $52.00 and set a "neutral" rating on the stock in a research note on Thursday, April 24th. Wells Fargo & Company lifted their price target on Moelis & Company from $50.00 to $64.00 and gave the stock an "equal weight" rating in a research note on Friday, July 11th. Finally, The Goldman Sachs Group lifted their price target on Moelis & Company from $56.00 to $63.00 and gave the stock a "neutral" rating in a research note on Thursday, May 15th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and two have given a buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $66.00.

View Our Latest Stock Report on Moelis & Company

Moelis & Company Trading Down 2.1%

NYSE:MC traded down $1.48 during mid-day trading on Wednesday, reaching $70.35. 831,586 shares of the stock were exchanged, compared to its average volume of 812,817. The business has a fifty day moving average price of $61.37 and a 200 day moving average price of $63.68. The firm has a market capitalization of $5.52 billion, a PE ratio of 32.27 and a beta of 1.64. Moelis & Company has a 1-year low of $47.00 and a 1-year high of $82.89.

Moelis & Company Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, June 20th. Shareholders of record on Monday, May 5th were given a dividend of $0.65 per share. The ex-dividend date was Monday, May 5th. This represents a $2.60 dividend on an annualized basis and a yield of 3.70%. Moelis & Company's payout ratio is presently 119.27%.

Institutional Investors Weigh In On Moelis & Company

A number of institutional investors have recently bought and sold shares of the business. Vanguard Group Inc. lifted its holdings in shares of Moelis & Company by 1.9% during the 1st quarter. Vanguard Group Inc. now owns 8,305,688 shares of the asset manager's stock valued at $484,720,000 after buying an additional 158,373 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in shares of Moelis & Company by 214.5% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 2,942,299 shares of the asset manager's stock valued at $171,713,000 after buying an additional 2,006,747 shares during the last quarter. Goldman Sachs Group Inc. lifted its holdings in shares of Moelis & Company by 32.6% during the 1st quarter. Goldman Sachs Group Inc. now owns 2,356,893 shares of the asset manager's stock valued at $137,548,000 after buying an additional 579,529 shares during the last quarter. Ameriprise Financial Inc. lifted its holdings in shares of Moelis & Company by 4.4% during the 1st quarter. Ameriprise Financial Inc. now owns 2,260,345 shares of the asset manager's stock valued at $131,914,000 after buying an additional 95,114 shares during the last quarter. Finally, Madison Asset Management LLC lifted its holdings in shares of Moelis & Company by 8.5% during the 1st quarter. Madison Asset Management LLC now owns 1,264,200 shares of the asset manager's stock valued at $73,779,000 after buying an additional 99,313 shares during the last quarter. 91.53% of the stock is currently owned by institutional investors and hedge funds.

About Moelis & Company

(

Get Free Report)

Moelis & Co operates as a holding company. It engages in the provision of financial advisory, capital raising and asset management services to a client base including corporations, governments, sovereign wealth funds and financial sponsors. The firm focuses on clients including large public multinational corporations, middle market private companies, financial sponsors, entrepreneurs and governments.

Recommended Stories

Before you consider Moelis & Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moelis & Company wasn't on the list.

While Moelis & Company currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.