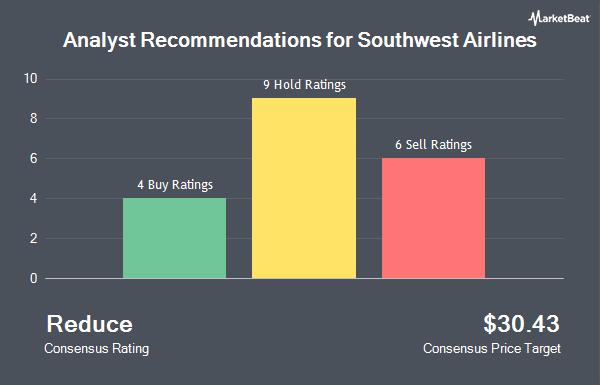

Shares of Southwest Airlines Co. (NYSE:LUV - Get Free Report) have received a consensus rating of "Reduce" from the eighteen brokerages that are covering the firm, MarketBeat reports. Five investment analysts have rated the stock with a sell rating, nine have assigned a hold rating and four have given a buy rating to the company. The average 1 year price objective among analysts that have issued a report on the stock in the last year is $33.13.

A number of research firms have recently commented on LUV. UBS Group upped their target price on Southwest Airlines from $27.00 to $34.00 and gave the company a "neutral" rating in a research note on Monday, July 7th. Susquehanna dropped their price objective on Southwest Airlines from $34.00 to $25.00 and set a "neutral" rating on the stock in a research note on Monday, April 7th. Deutsche Bank Aktiengesellschaft upgraded Southwest Airlines from a "hold" rating to a "buy" rating and set a $40.00 target price for the company in a report on Thursday, May 29th. Citigroup decreased their price objective on Southwest Airlines from $30.00 to $23.00 and set a "sell" rating for the company in a report on Monday, April 14th. Finally, Raymond James Financial reiterated an "outperform" rating and set a $40.00 price objective (down previously from $42.00) on shares of Southwest Airlines in a report on Tuesday, April 29th.

Get Our Latest Analysis on Southwest Airlines

Insider Transactions at Southwest Airlines

In other Southwest Airlines news, Director Gregg A. Saretsky bought 3,670 shares of the business's stock in a transaction dated Wednesday, April 30th. The shares were acquired at an average price of $27.29 per share, with a total value of $100,154.30. Following the purchase, the director owned 14,881 shares in the company, valued at approximately $406,102.49. The trade was a 32.74% increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director David P. Hess purchased 7,500 shares of the company's stock in a transaction that occurred on Monday, April 28th. The shares were purchased at an average cost of $26.52 per share, for a total transaction of $198,900.00. Following the purchase, the director directly owned 23,156 shares in the company, valued at $614,097.12. This trade represents a 47.90% increase in their ownership of the stock. The disclosure for this purchase can be found here. Company insiders own 0.79% of the company's stock.

Institutional Investors Weigh In On Southwest Airlines

Hedge funds have recently made changes to their positions in the company. Institute for Wealth Management LLC. increased its stake in shares of Southwest Airlines by 50.0% during the 2nd quarter. Institute for Wealth Management LLC. now owns 16,491 shares of the airline's stock worth $535,000 after purchasing an additional 5,496 shares during the last quarter. Janney Montgomery Scott LLC grew its stake in Southwest Airlines by 11.0% in the 2nd quarter. Janney Montgomery Scott LLC now owns 11,498 shares of the airline's stock valued at $373,000 after buying an additional 1,136 shares during the last quarter. Fort Washington Investment Advisors Inc. OH grew its stake in Southwest Airlines by 1.5% in the 2nd quarter. Fort Washington Investment Advisors Inc. OH now owns 1,258,993 shares of the airline's stock valued at $40,842,000 after buying an additional 18,270 shares during the last quarter. Patton Fund Management Inc. acquired a new position in Southwest Airlines in the 2nd quarter valued at $270,000. Finally, CX Institutional grew its stake in Southwest Airlines by 8.7% in the 2nd quarter. CX Institutional now owns 11,938 shares of the airline's stock valued at $387,000 after buying an additional 957 shares during the last quarter. Hedge funds and other institutional investors own 80.82% of the company's stock.

Southwest Airlines Stock Up 0.1%

LUV stock opened at $36.52 on Friday. The stock has a market cap of $20.81 billion, a P/E ratio of 42.97, a P/E/G ratio of 5.54 and a beta of 1.21. The stock's fifty day simple moving average is $33.13 and its two-hundred day simple moving average is $31.25. The company has a current ratio of 0.77, a quick ratio of 0.72 and a debt-to-equity ratio of 0.44. Southwest Airlines has a 1-year low of $23.58 and a 1-year high of $37.96.

Southwest Airlines (NYSE:LUV - Get Free Report) last posted its earnings results on Wednesday, April 23rd. The airline reported ($0.13) EPS for the quarter, topping analysts' consensus estimates of ($0.18) by $0.05. The business had revenue of $6.43 billion during the quarter, compared to analyst estimates of $6.47 billion. Southwest Airlines had a return on equity of 7.27% and a net margin of 1.98%. The company's quarterly revenue was up 1.6% compared to the same quarter last year. During the same quarter last year, the company earned ($0.36) EPS. Analysts expect that Southwest Airlines will post 1.55 EPS for the current year.

Southwest Airlines Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, July 9th. Investors of record on Wednesday, June 18th were issued a dividend of $0.18 per share. The ex-dividend date was Wednesday, June 18th. This represents a $0.72 annualized dividend and a yield of 1.97%. Southwest Airlines's dividend payout ratio is currently 84.71%.

Southwest Airlines Company Profile

(

Get Free ReportSouthwest Airlines Co operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets. As of December 31, 2023, the company operated a total fleet of 817 Boeing 737 aircraft; and served 121 destinations in 42 states, the District of Columbia, and the Commonwealth of Puerto Rico, as well as ten near-international countries, including Mexico, Jamaica, the Bahamas, Aruba, the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Southwest Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southwest Airlines wasn't on the list.

While Southwest Airlines currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.