Cloud-based payroll and human resources management specialist

Paylocity NASDAQ: PCTY has lost ground in recent sessions, although it’s still far from closing the gap from a price jump following its earnings report.

Paylocity offers a suite of products to simplify payroll, automate processes and manage compliance requirements. It also offers products to address expense management, on-demand payment, and garnishment solutions. On the human resources side, offerings include employee self-service solutions, document library, compliance dashboard and software to track time and attendance data.

The company earned $0.80 per share on revenue of $229 million. Those were year-over-year increases of 74% and 37%, respectively.

A quick check of MarketBeat earnings data shows that those were significant beats on both the top- and bottom lines.

The stock gapped 12.72% higher following the report.

In the earnings conference call, co-CEO Toby Williams cited several reasons for the company’s success in the quarter.

“The ability to attract and retain talent remains top of mind for our clients as the combination of a tight labor market and the challenges that come with managing remote, on-site and hybrid teams are driving increased demand for HR technology. These dynamics are reflected in increasing attach rates across our entire platform,” he said.

When Williams says “attach rate,” he is referring to the rate of clients purchasing add-ons to the basic subscription. In the case of Paylocity, that may include learning management, premium video and surveys.

Williams went on to say, “The demand environment remains strong, and our sales teams executed very well in fiscal '22. We saw strong sales execution across our entire market, driving healthy sales activity and setting us up for a strong fiscal '23. Building off this strong momentum, we've expanded our sales force for fiscal '23 by adding new sales reps.”

Analysts were encouraged by Paylocity’s strong growth and upbeat outlook for fiscal 2023. Since the earnings report, nine analysts boosted their price target on Paylocity, as you can see by using MarketBeat’s analyst data.

The analyst consensus rating on the stock is “moderate buy” with a price target of $267.19, representing an upside of 8.18%.

A monthly chart of Paylocity gives you an excellent glimpse of the stock’s steady upward trajectory since its 2014 IPO.

Compared to other payroll processors such as Automatic Data Processing NASDAQ: ADP and Paychex NASDAQ: PAYX, which have been public for decades, Paylocity is a relative newcomer.

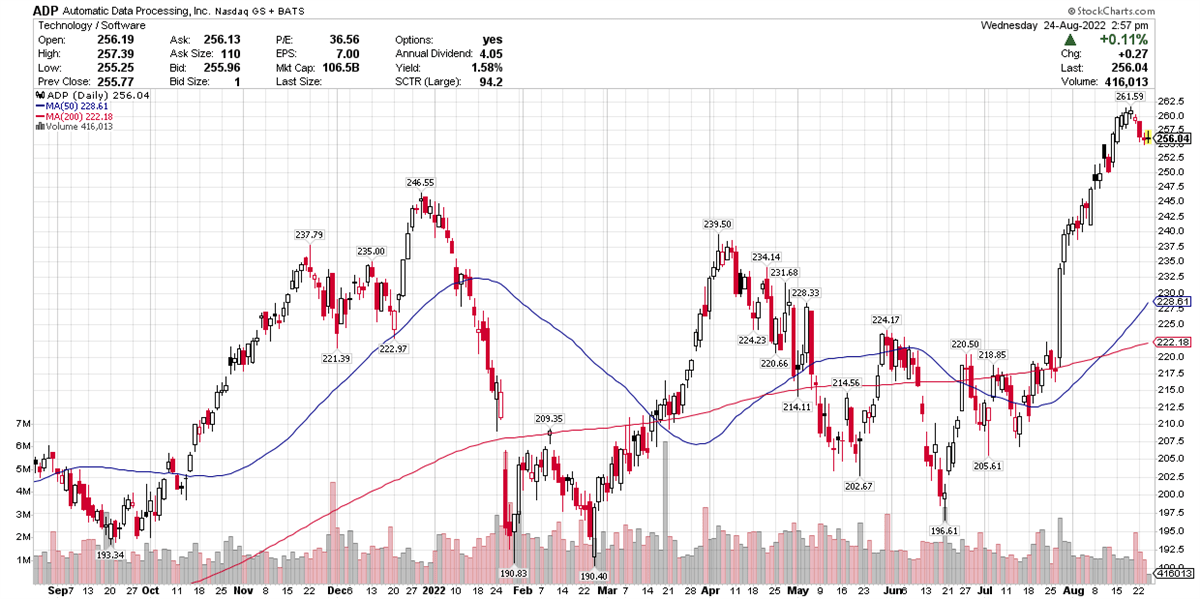

ADP is up 6.10% this month. Shares also climbed 14.80% in July on the heels of the company’s fiscal fourth-quarter earnings report. ADP earned $1.50 per share, topping views by $0.03, according to MarketBeat data. Revenue of $4.13 billion was also ahead of expectations.

ADP’s earnings accelerated in the past two quarters. In the company’s earnings call, CFO Don McGuire said the company’s “consolidated revenue outlook is the 7% to 9% growth in fiscal '23 …”

He added, “we expect adjusted EPS growth of 13% to 16% supported by buybacks …”

Those expectations helped propel the stock higher in July and August.

Paychex is another well-established payroll company whose stock has also been strong lately.

Analyst Emma Williams of Morningstar summed up several pros and cons regarding Paychex.

“We expect increased regulatory complexity, tight labor markets, and a growing adoption of hybrid work will underpin strong demand for Paychex's suite of offerings supporting greater share of wallet and market share gains,” she wrote. “This includes greater penetration of the outsourced payroll and human resources model in the small-business market. While we factor in market share gains, we expect increasing competition to limit Paychex's pricing power and force the company to sustain elevated expenditure on software development and innovation to remain competitive.”

The stock is up 10.90% in the past month and 14.87% in the past three months. Since December, it’s repeatedly hit resistance just below $140. If you see a breakout above that level, that may be an indication that a fresh rally may be in the cards.

Before you consider Paylocity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paylocity wasn't on the list.

While Paylocity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report