Ethanol is a triple threat as a clean, green and sustainable energy source that can reduce greenhouse gas emissions on many levels. This article will review five publicly traded ethanol stocks that may fit your investment criteria.

What is ethanol?

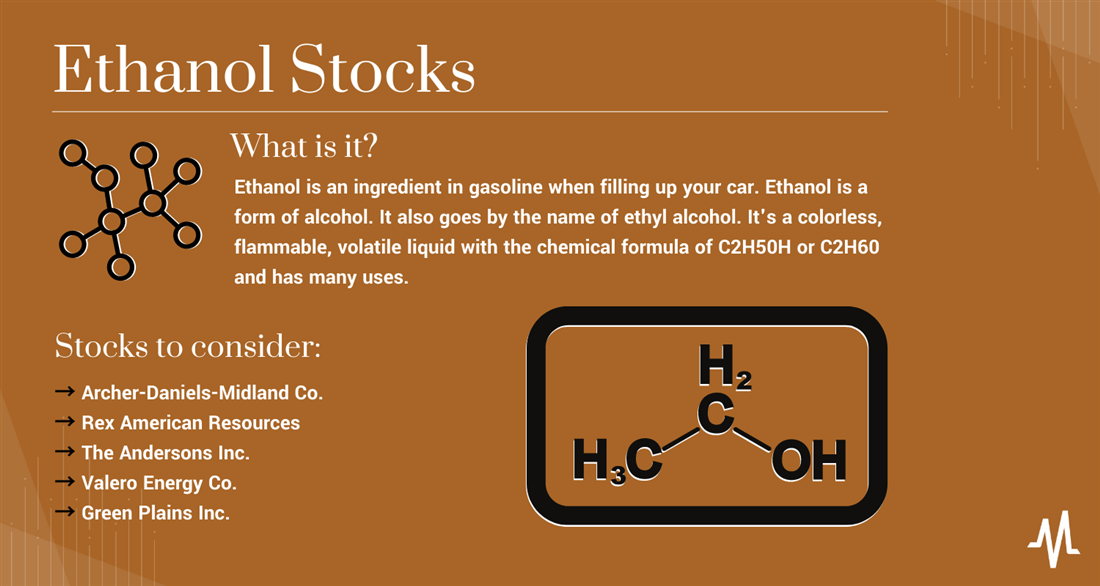

You may have heard of ethanol and even seen it as an ingredient in gasoline when filling up your car. Ethanol is a form of alcohol. It also goes by the name of ethyl alcohol. It's a colorless, flammable, volatile liquid with the chemical formula of C2H5OH and has many uses.

Beer, wine and most liquors contain a mix of ethanol and water. Medical practitioners use ethanol as an antiseptic and disinfectant to clean wounds and swab an area before a needle injection. Ethanol is also commonly used as a biofuel and fuel additive. Ethanol is a required component in producing many consumer staples products, making it an indispensable ingredient in numerous everyday items, from personal care products to cleaning agents and pharmaceuticals.

Ethanol comes from fermenting a range of starch-based crops, also called biomass, which includes corn, wheat, grain, barley or potatoes, sugar cane and sweet sorghum. Due to its abundance and relatively cheap costs, corn makes up most of the ethanol produced in the U.S. Ethanol can also come from landfill gasses and agricultural, animal and food wastes. Most gasoline in the U.S. contains up to 15% ethanol.

Ethanol is a renewable fuel produced from biomass. It burns more entirely and is cleaner than gasoline. It cuts greenhouse gas emissions (GHG) by 44% to 52% compared to gasoline, aiming to reduce reduction to 70%. Many claim it's carbon neutral due to the smaller amount of carbon dioxide (CO2) released in vehicles, offset by the CO2 absorbed by the plants grown to make ethanol.

E85 is the code composition for anhydrous ethanol or flex fuel containing 85% ethanol and 15% gas. In reality, it usually contains 51% to 83%. These fuels are often used in cars designated as flex-fuel vehicles.

Oil companies were required to add ethanol to gasoline in the Energy Act of 2005. Its use as an additive continues to grow, reaching more than 10% blend in U.S. gasoline in 2022.

The U.S. ethanol industry has over 200 fuel-grade ethanol production facilities that can produce 17 billion gallons annually. The global ethanol fuel market will grow at a 6.3% compound annual growth rate (CAGR) to $96.63 billion in 2023. In fiscal year 2024, the ethanol industry should reach $100.3 billion and grow to as much as $135.5 billion by 2030.

Understanding ethanol as an investment

Once only used in gasoline blends, ethanol has quietly become a key piece of the clean energy puzzle. An alternative fuel produced from crops like corn, this bio-based alcohol is now also an investment opportunity for those concerned about the environment. To fully comprehend ethanol's potential, we must examine its production, environmental impact and the dynamic market forces shaping its future.

From field to factory

Ethanol's (and ethanol producing stocks') journey starts in fertile fields where corn and other feedstocks are grown. These crops undergo a complex fermentation and distillation process similar to making other alcohols like vodka or moonshine. This transformation produces a clean-burning alcohol fuel. You can use it in fuel tanks as a gasoline blend (up to 15% in the U.S.) and power industrial solvents and chemicals. Ethanol has even entered our food supply as a food additive.

Green cred in the spotlight

Ethanol is appealing because of its environmental benefits. When burned, it produces less carbon dioxide than fossil fuels, a potent greenhouse gas. Additionally, the crops used to make it act as natural carbon sinks, absorbing CO2 from the atmosphere. It creates a closed-loop, near-neutral carbon cycle. This green pedigree appeals to investors seeking environmentally responsible options.

Renewable energy champion

In an energy sector where finite fossil fuels are the norm, ethanol stands out as a champion of renewable alternatives. Its production diversifies fuel sources, reducing dependence on dwindling resources and increasing energy security for nations looking to break free from foreign oil dependence.

The market maelstrom

Investing in ethanol requires navigating the currents of a dynamic and sometimes volatile market. Government policies, such as the U.S. Renewable Fuel Standard, are powerful forces that dictate demand and production levels. Commodity prices, particularly corn costs, play a critical role in the economic viability of ethanol.

Technological advancements in biofuel production techniques act as riptides, potentially reshaping market competitiveness and efficiency. Finally, consumer sentiment towards ethanol's environmental benefits and its role in reducing oil dependence shapes its long-term demand trajectory. Understanding these intricate forces is crucial if you are looking to invest in ethanol.

Ethanol isn't just a fuel additive anymore; it's a multi-faceted investment opportunity. Its clean-burning nature, renewable credentials and strategic role in diversifying energy sources make it a compelling proposition for investors seeking exposure to the burgeoning sustainability sector. However, navigating its market dynamics requires understanding the interplay between government policies, commodity prices, technological advancements and consumer preferences. By carefully assessing these factors and adopting a diversified approach, investors can position themselves to capitalize on the potential of ethanol, not just as fuel for our cars but as a catalyst for a greener future.

Six best ethanol stocks to buy now

Here is a list of ethanol company stocks to consider when looking for ethanol stocks to buy. The list is in no particular order or ranking. You can look up stock ratings on MarketBeat. The companies we have chosen are involved in various aspects of the ethanol industry, including production, refinement, improvement, marketing, and distribution. They range from agriculture to energy companies.

Archer-Daniels-Midland Co.

Archer-Daniels-Midland Co. NYSE: ADM is the world's largest processor of grains and seed oils, generating nearly $100 billion in annual revenues. It's an agricultural giant with a significant role in the cultivation and harvesting of the crops commonly used to produce ethanol. It is one of the world's largest ethanol producers, with an annual production capacity of 1.6 billion gallons.

Ethanol production occurs through its vantage corn processors subsidiary, which saw two of its dry mills back online after being temporarily closed during the pandemic. It supplies industrial ethanol to large oil and energy companies.

It expects the demand for ethanol fuel to continue rising. Demand for the E15 ethanol blend will increase when the U.S. Environmental and Protection Agency (EPA) allows year-round sales for biofuel in 2024. You can find more agriculture stocks on MarketBeat. You can find Archer-Daniels-Midland analyst ratings on MarketBeat. The five-year performance for ADM stock is up 22.55% and pays a 2.49% annual dividend yield. Dependable revenue and earnings growth make ADM stock a buy during volatile times.

Rex American Resources

REX American Resources Corp. NYSE: REX is a holding company with varying ownership levels in six ethanol production facilities in corn-belt areas in the Midwest with access to major railroads. The company produces over 700 million gallons of ethanol annually and reported net sales and revenue for Q3 2023 at around $221.1 million.

Its facilities produce ethanol through refining and distilling corn. They also offer non-food grade corn oil, distiller grains for animal feed and natural gas. The Russian-Ukraine war has elevated oil and corn prices, benefiting the company as its margin expands. The company carries no debt and doesn't pay an annual dividend. You can find Rex American Resources' financials on MarketBeat. The five-year performance for REX stock is 17%.

The Andersons Inc.

The Andersons Inc. NASDAQ: ANDE is a diversified agriculturally rooted company operating in three segments: trade, renewables and plant nutrients. Its renewables segment engages in the production of ethanol co-products and biofuels, including biodiesel. It co-owns four ethanol plants throughout the Midwest located close to corn production areas with an annual production capacity of 545 million gallons. The company partners with the country's largest ethanol blender, Marathon Petroleum.

The Andersons are a significant supply chain player in the U.S. Its trade segment manages the logistics of shipping whole grains, feed ingredients, fuel products and physical commodities across the U.S. and Canada. The Andersons generate north of $17.33 billion in annual revenues. The company is all about sustainability, as its ethanol plants are powered through cogeneration facilities, considerably reducing power grid usage.

Find The Anderson's earnings estimates and conference call transcripts on MarketBeat. The one-year performance for ANDE stock is up 59% and pays a 1.26% annual dividend yield.

Valero Energy Co.

Valero Energy Co. NYSE: VLO is one of the country's largest oil refineries (and publicly traded ethanol companies). Combustion engine cars can't run on straight crude oil. The crude oil has to be refined into gasoline or diesel fuel.

While oil pipeline problems can cause minor disruptions in the oil supply, refinery shutdowns cause significant problems. It takes at least two weeks to convert crude oil into gasoline, but delays or problems can prolong the process for months.

Valero is a vertically integrated operation controlling its supply chain from crude oil production to refining and selling to energy companies and retail customers through its gas stations. The company has 14 oil refineries and over 6,800 retail and wholesale outlets. Valero operates 12 ethanol plants to produce renewable fuel from corn plants. It has as much annual ethanol production capacity as Archer-Daniels-Midland at 1.6 billion gallons. Valero generated over $151 billion in 2023. Look at Valero Energy analyst ratings and price targets on MarketBeat. The one-year performance for VLO stock is up 5.34% and pays a 3.09% annual dividend yield.

Green Plains Inc.

Green Plains Inc. NASDAQ: GPRE is another vertically integrated organization that produces, markets, sells and distributes ethanol. With 10 ethanol plants in six states, GPRE produces up to one billion gallons of biofuels annually, making it the third largest ethanol producer in the country. Producing ethanol from corn requires 56 pounds of corn to produce around three pounds of ethanol, and GPRE uses approximately 300 million bushels of corn per year.

The escalated price of corn has made input costs expensive since Great Plains must buy the corn before processing it into ethanol. The company acquired a majority interest in Fluid Quip in 2021, enabling it to integrate MSC protein technology to yield higher corn oil and protein quality for wider margins. The new premium products sell for $200 over conventional distillers' low-protein products.

The company has deployed this new technology at its biorefinery in York, Nebraska, and plans to add it to its facilities. The company announced a sustainable jet fuel partnership with United Airlines NASDAQ: UAL, PNNL and Tallgrass. Revenues for Green Plains Inc. were $832.9 million for the first quarter of 2023, $857.6 million for the second quarter of 2023, and $892.8 million for the third quarter of 2023. The five-year performance for VLO stock is up 10.4%. Learn more about Green Plains analyst ratings and price targets on MarketBeat.

Alto Ingredients

Alto Ingredients NASDAQ: ALTO (formerly Pacific Ethanol) has undergone a fascinating metamorphosis. They haven't abandoned their ethanol roots but have become a specialty ingredient manufacturer. The company has leveraged its bio-based alcohol expertise to create high-value products. These specialty alcohols are used in everything from pharmaceuticals to paints. This diverse approach offers investors unique exposure to the clean energy and sustainable materials sector.

Alto's core strength lies beyond the ethanol barrel. They produce high-purity, bio-based alcohols like n-propanol and isobutyl alcohol, finding applications across various industries while extracting valuable ingredients like protein-rich corn gluten meal for animal feed. This diversification shields them from fluctuations in fuel demand, providing stability and potential growth opportunities.

But Alto isn't content with just replicating existing products. They're actively innovating, exploring new applications for their bio-based ingredients and venturing into emerging markets like renewable fuels and bioplastics. This focus on the future aligns perfectly with the rising global demand for green and eco-conscious products, positioning Alto to ride the tailwinds of these market trends.

Of course, no investment comes without its considerations. Alto's smaller size and niche markets can lead to higher stock price volatility than established players. Their transition towards a diversified model also means their profitability may not match some larger ethanol producers. However, if you seek exposure to the clean energy and sustainable materials revolution, Alto's compelling growth story, focus on innovation and commitment to sustainability offer a potentially rewarding opportunity.

Market trends and forecasts

The ethanol market is a complex, dynamic and volatile market for investors. This sector offers promising growth forecasts, geopolitical influences and regulatory shifts. Understanding these interrelated factors is crucial for making informed investment decisions.

Promising growth trajectory

The ethanol market is poised for steady growth in the coming decade, fueled by favorable factors. Government mandates, like the US Renewable Fuel Standard (RFS), act as catalysts, demanding higher ethanol blends in gasoline, leading to a direct increase in demand.

Additionally, mounting environmental concerns surrounding fossil fuel emissions spotlight ethanol's cleaner combustion profile give it a significant edge over its traditional counterpart. The rapid economic expansion in regions like Asia and Latin America should contribute substantially to the future consumption of ethanol, not just for fuel but also for various industrial applications.

North America currently reigns supreme in the global ethanol market, boasting a well-established infrastructure and robust production capacity. However, the landscape is evolving. Regions like Asia and Latin America are expected to experience significant growth in their ethanol production capabilities, diversifying the global market and creating new investment opportunities. This shift could offer exciting avenues for geographically diversified portfolios seeking exposure to the promising future of ethanol.

Global factors shaping ethanol stock prices

Although the ethanol market has growth potential, investors must contend with a complex web of international forces that can significantly affect stock prices. Geopolitical turmoil, such as trade wars, political instability and regional conflicts, can disrupt supply chains and influence commodity prices, especially corn, a key ethanol input. These fluctuations directly impact production costs and profitability for ethanol companies, which can lead to volatile stock performance.

Government policies, especially those related to biofuel mandates and environmental regulations, play a crucial role in shaping ethanol demand. Changes in these policies, such as adjustments to blending mandates or the introduction of new carbon emission regulations, can significantly impact the demand for ethanol, consequently affecting stock prices. Investors must remain vigilant and adaptable in the face of evolving policy landscapes.

Furthermore, economic trends influence the ethanol market. Fluctuations in global oil prices can affect the economic viability of ethanol as a fuel alternative, impacting demand and market sentiment. Additionally, the overall health of the energy sector, encompassing factors like global economic growth and energy consumption patterns, can indirectly influence ethanol demand and investor confidence.

Understanding these global headwinds and their potential impact is crucial for informed investment decisions in the ethanol market. Investors should adopt a holistic approach, considering:

- Diversification: Spreading investments across different ethanol-related companies and geographic regions can mitigate risks associated with specific geopolitical events or policy changes.

- Long-term perspective: Recognizing the market's inherent volatility, investors should focus on long-term trends and growth potentials rather than short-term market swings.

- Strategic analysis: Conducting thorough due diligence on individual companies, including their operational efficiency, risk management strategies and financial resilience, can help investors identify companies best equipped to navigate these global headwinds.

The ethanol market offers promising growth potential, but navigating its complexities requires a strategic and informed approach. By understanding growth drivers, global headwinds and adopting sound investment practices, you can position yourself to benefit from the potential of ethanol stocks.

The role of government policies

Government policies play a pivotal role in shaping the ethanol market's trajectory, acting as both tailwinds and headwinds for different stakeholders. Staying informed about the current policy landscape and its potential future is crucial if you seek exposure to the renewable fuels sector.

Current policy landscape

Government policies form the intricate scaffolding upon which the ethanol market rests, acting as catalysts and roadblocks for stakeholders. Understanding the current regulatory landscape and its potential for change is crucial for investors navigating this evolving sector.

Demand-driving mandates

At the heart of this framework lies the Renewable Fuel Standard (RFS) seen in the US and similar mandates implemented in other countries. These policies dictate minimum volumes of ethanol blending in gasoline, directly boosting demand and providing production stability. This international regulatory push creates a supportive environment for ethanol utilization, shaping market dynamics on a global scale.

Sweetening the deal

Governments often add sweeteners to the ethanol market through tax breaks and subsidies. These financial incentives, offered to producers and consumers, further encourage the production and adoption of ethanol. By lowering the cost barrier compared to fossil fuels, these policies significantly impact the economic viability of ethanol, making it a more attractive option for various stakeholders.

The clean combustion advantage

As environmental concerns climb the global agenda, stringent carbon emissions and air quality regulations play an indirect but crucial role in bolstering ethanol's position. Compared to traditional fossil fuels, its cleaner combustion profile becomes increasingly attractive under stricter regulations. This trend could further fuel demand for ethanol in both transportation and industrial applications, opening up new market avenues for the future.

While the current policy landscape provides tailwinds for the ethanol market, the potential for change casts a shadow of uncertainty. Future adjustments to RFS mandates, revisions to tax incentives and the broader shift towards a low-carbon economy all hold significant implications for investors. Careful analysis of potential policy changes, their impact on specific companies and the risk management strategies employed by individual players will be key to navigating this complex landscape and capitalizing on the promising opportunities that policy evolution may unlock.

By understanding the intricate interplay between government policies, market dynamics and the evolving environmental landscape, investors can position themselves to thrive in the dynamic world of ethanol.

Potential policy changes

While the current policy landscape supports the ethanol market, investors must remain vigilant, as the seas of policy can shift, bringing both headwinds and tailwinds.

The mandate maze

Future adjustments to RFS blending mandates, a cornerstone of ethanol demand, could significantly impact the market. Increases in mandated blending volumes would raise demand, potentially boosting market prices and company valuations. Conversely, reductions could dampen demand, creating a ripple effect on market performance. Investors should stay abreast of potential policy changes and their impact on specific companies within the sector.

Beyond the pump

As nations ramp up efforts towards a low-carbon future, a shift beyond RFS mandates could unlock new opportunities for ethanol. Government strategies focused on advanced biofuel technologies and carbon capture, utilization, and storage (CCUS) could open doors for ethanol beyond transportation fuel. Investments in these emerging areas could present compelling options for investors seeking exposure to the broader clean energy landscape.

Trade tides

The ethanol market isn't immune to the ebb and flow of international trade. Policies affecting corn and other biofuel feedstock prices can significantly impact production costs and ethanol's competitiveness. Trade wars or disruptions in supply chains could pose challenges, potentially increasing costs and dampening demand. Understanding the trade landscape and its potential impact on specific companies is crucial for navigating these uncertain waters.

While potential policy changes introduce risk, they also present exciting avenues for long-term growth within the ethanol market. By staying informed about policy developments, identifying companies best positioned to navigate potential headwinds and embracing the shift towards a greener future, investors can leverage the opportunities in the dynamic world of ethanol.

Implications for investors

The intricate interplay between government policies and the ethanol market presents challenges and lucrative avenues for investors. Understanding the implications of this dynamic relationship is crucial for navigating the potential volatility and unlocking long-term opportunities within this evolving sector.

Volatility in the wake of policy shifts

Investors must be prepared for potential market turbulence triggered by adjustments to RFS mandates, environmental regulations, or trade policies. These uncertainties can cause fluctuations in demand, production costs and stock prices. Diversifying across different regions and companies with diverse revenue streams beyond fuel blending is a prudent strategy to mitigate these risks.

Embracing the long-term green tide

Focusing on the long-term trends shaping the market, particularly the global push towards cleaner energy and environmental sustainability, can help investors identify potentially lucrative opportunities. Investments in advanced biofuel technologies, such as cellulosic ethanol or next-generation biofuels and innovative solutions like carbon capture, utilization and storage (CCUS) could offer significant growth potential within the broader ethanol ecosystem.

Navigating the policy labyrinth

Staying informed about evolving policies and conducting thorough due diligence on individual companies is key to making informed investment decisions. Understanding a company's sensitivity to specific policy changes, analyzing its risk management strategies and assessing its financial resilience will equip investors to navigate the complex policy landscape and capitalize on favorable opportunities while minimizing potential risks.

While navigating the ethanol market requires awareness of the potential headwinds caused by policy uncertainties, embracing the long-term green horizon and conducting thorough due diligence can unlock promising opportunities for investors. By embracing diversification, focusing on clean technology advancements and staying informed about the evolving policy landscape, investors can position themselves to ride the waves of change and thrive in the dynamic world of ethanol.

While government policies present uncertainties, they also offer powerful levers for shaping the future of the ethanol market. By understanding the current policy landscape, anticipating potential changes and adopting a strategic approach, investors can position themselves to capitalize on the promising opportunities that government policies can unlock within the ethanol sector.

Environmental and social impact of ethanol investments

Ethanol stocks are gaining prominence not only for their financial potential but also for their alignment with ethical and environmental values. This sector presents a unique opportunity for socially conscious investors to achieve profitability while contributing positively to the environment and society.

The environmental impact of ethanol

When blended with gasoline, ethanol has a significantly cleaner combustion profile than traditional fossil fuels. This characteristic of ethanol contributes to reducing greenhouse gas emissions, a critical factor in combating climate change and achieving sustainability objectives.

Moreover, ethanol is derived from renewable resources such as corn and sugarcane, underscoring its sustainability compared to finite fossil fuels. The ethanol industry's investment in sustainable agricultural practices can further diminish its environmental footprint. Additionally, using ethanol can improve air quality in urban areas by decreasing the emissions of harmful pollutants. This improvement in air quality has the potential to enhance public health outcomes.

Socioeconomic contributions of ethanol

The production and distribution of ethanol have significant social benefits. It fosters economic growth in rural areas by generating employment opportunities in agriculture, production and related sectors. This growth can play a pivotal role in reducing poverty and enhancing the livelihoods of rural populations. Ethanol also contributes to a nation's energy security by reducing dependence on imported fossil fuels, which can lead to increased geopolitical stability. Furthermore, the ethanol sector encourages technological innovation in energy production, paving the way for advancements that benefit both environmental sustainability and economic growth.

Ethical investment in ethanol

For investors focusing on social responsibility, there are several avenues to consider. Socially Responsible Funds (SRFs) that emphasize renewable energy and sustainability offer exposure to ethanol stocks in line with ethical investment principles. Impact investing, which involves selecting companies committed to sustainable practices in the biofuel industry, aligns financial objectives with positive environmental and social impacts. Additionally, engaging with ethanol companies on environmental and social issues can foster responsible practices and drive positive changes within the industry.

Financial considerations and ethical commitments

Investing in ethanol aligns with environmental and social impacts without compromising financial objectives. Ethanol stocks can provide competitive returns while contributing to a more sustainable and equitable future. Investors must conduct thorough research, diversify their portfolios and maintain a long-term investment perspective for optimal results.

Pros and cons of investing in ethanol stocks

Here are some pros and cons that come with investing in ethanol stocks.

Pros

Here are some of the benefits:

- Clean energy demand: The global decarbonization movement should accelerate and gain more momentum. This demand for clean, green and renewable energy will continue to grow. This demand should continue to benefit ethanol companies.

- Diversification: Ethanol stocks can provide diversification for your portfolio. Since they are more anchored to commodity prices, falling inflation lowers corn prices, thereby improving margin as input costs fall. Ethanol stocks tend to move with the oil and energy sector.

- Favorable government incentives: The U.S. Energy Act of 2005 required all gasoline in the U.S. to contain at least a 10% blend of ethanol to gasoline. More regulation aimed toward clean and renewable energy can further bolster the demand and application of ethanol. The U.S. government provides incentives for the production and use of ethanol. Qualified ethanol producers get a $1 income tax credit per gallon of corn or cellulose-based ethanol.

Cons

Here are some cons that come with investing in ethanol stocks:

- Commodity market volatility: Rising commodity prices result in higher input costs for ethanol producers who need to buy corn or grain first. Rising inflation can impact net margins for ethanol producers, who may charge more for the product, causing demand to taper.

- Technology risks: Advancements in technology can also impact ethanol users negatively. For example, migrating to electric vehicles (EVs) should reduce the demand and usage of fossil fuels. EVs don't use ethanol; more EVs theoretically mean less need for ethanol.

- Regulatory risks: Government regulation can be cut both ways. Mandating its inclusion into U.S. gasoline is an obvious benefit. However, depending on the day's politics, the government could reduce its support for ethanol. The U.S. and other nations are moving towards electrification and ultimately cutting down the use of fossil fuels.

Tips for successful ethanol stock investing

The ethanol industry presents enticing opportunities for investors, yet it demands a nuanced and strategic approach to navigate its complexities effectively. Understanding and implementing key investment strategies is crucial to maximize returns and mitigate risks in this volatile market.

The importance of diversification

Diversification is essential when investing in ethanol stocks. It is advisable to spread investments across a variety of companies within the industry. This approach should encompass different geographic regions, stages of production, and technology focuses. Such diversification reduces the risk associated with specific company or market volatilities. Investors are encouraged to consider companies engaged in different segments of the ethanol value chain, including production, distribution and technology. This strategy enables investors to capture growth opportunities from various facets of the industry.

Adopting a long-term perspective

The ethanol market is subject to short-term fluctuations driven by policy changes, commodity price shifts and global events. Investors should resist short-term speculative strategies and focus on the industry's long-term prospects, anchored in the global shift towards cleaner energy production and environmental sustainability. A minimum investment horizon of five to ten years is recommended, allowing the market to stabilize from temporary disturbances and realize its full growth potential.

Staying abreast of the latest developments in the ethanol market is crucial. This includes keeping up-to-date with government policies, environmental regulations, technological advancements and global trade dynamics. Regularly monitoring company performance, financial reports and analyst insights is important to remain competitive. Investors should remain flexible, adapting their investment strategies as the market evolves and be ready to seize emerging opportunities while managing potential risks.

Conducting comprehensive due diligence

Before investing, a thorough analysis of the target companies is necessary. This includes evaluating their financial stability, operational efficiency and risk management strategies. Consider factors such as dependence on specific feedstocks, sensitivity to government policies and vulnerability to technological disruptions. Companies with strong growth trajectories, diversified revenue sources and a commitment to sustainable practices are typically more likely to offer long-term return potential.

The future of corn

Investing in the ethanol market requires patience, strategic diversification and a commitment to staying well-informed. By understanding the market's underlying dynamics, conducting thorough research and maintaining a long-term perspective, investors can position themselves to capitalize on the promising prospects of this evolving sector. These practices are integral to achieving successful investment outcomes in the ethanol industry.

FAQs

Here are some answers to some of the most frequently asked questions.

Who is the largest producer of ethanol?

Archer-Daniels-Midland and Valero can each produce 1.6 billion gallons of ethanol annually. Archer-Daniels-Midland is one of the world's most prominent grain and oilseed processors. Valero is one of the country's largest oil refineries, which exposes you to the oil industry if you invest in the company.

Which is the best ethanol stock?

The best ethanol stock depends on your investment criteria. If looking for growth, consider some pure ethanol stock plays. If looking for income, consider companies participating in other industries like agriculture, food production or oil and gas that also pay dividends. Use the MarketBeat dividend calculator to gauge if the APR fits your investment income goals. You can also look at stock ratings on MarketBeat to compare ethanol stocks.

Can you invest in ethanol?

You can invest in the stocks of companies involved in the ethanol industry. Review the five companies in this article if you're considering investing in ethanol stocks.

Before you consider Archer-Daniels-Midland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Archer-Daniels-Midland wasn't on the list.

While Archer-Daniels-Midland currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.