Colgate-Palmolive NYSE: CL

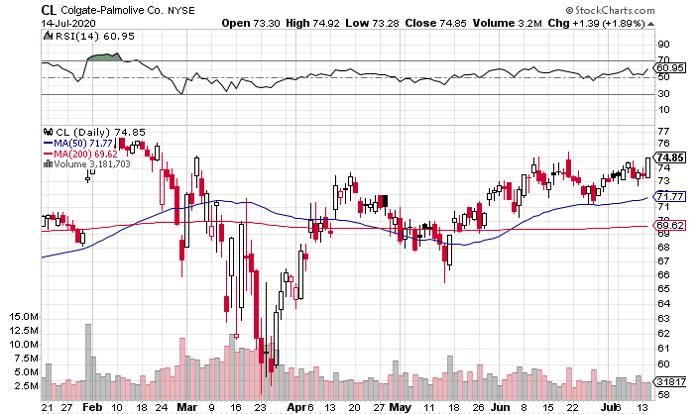

Colgate-Palmolive NYSE: CL has been basing between around $60 and $75 a share for roughly the past seven years. Over that period, the stock has edged out of that base a few times, but the move always stalled out around $76-$78. Most recently, shares hit $76.94 in February, before markets tanked, sending Colgate down to $58.14 in a little over a month.

Colgate quickly recovered to over $70 a share in less than a month, completing a V-shaped recovery. It was a shallow V by March 2020 standards, but a deep V for a low beta stock like Colgate.

Share have since consolidated in the low $70s range. Yesterday, CL increased by nearly 2%, closing near the highs of the day at $74.85. If Colgate has a strong high-volume breakout above $77, shares could have a lot of room to run.

Let’s take a look at the fundamentals and see if they can support a leg-up.

Fundamentals

Colgate, as you probably know, manufactures/sells toothpaste and dish soap among other oral, personal care, and home care products. This focus makes the company somewhat recession-proof as people will always need toothpaste and dish soap.

Colgate beat expectations in Q1 as sales increased by 5.5% yoy and profits were up 28% yoy. The onset of the pandemic actually boosted sales as many shopped for essentials as if the world were going to end. That said, it’s a good sign that Colgate is one of the brands that people purchase in times of distress.

On its Q1 earnings call, Colgate indicated that while “pantry loading” provided a benefit, the company’s sales and profit trends were strong through February. But the company acknowledged the unprecedented nature of the current economic environment and withdrew its guidance for the remainder of the year.

Investors should take heed of Colgate’s strong Q1 performance when projecting its numbers for the remainder of the year:

- Gross profit margin increased in every division in the quarter

- On a GAAP basis, operating margin was up 8% yoy

- Supply chain hasn’t been compromised at any stage

On that last point, CEO Noel Wallace had this to say on the Q1 earnings call:

“As the crisis hit, we mobilized our supply chain teams to offset lost production in China to increase manufacturing elsewhere. We established strict safety procedures in China, which allow us to reopen our factories in a safe and efficient manner. Now, we are operating in over 100% of our expected capacity in many of our Chinese plants, which is helping to alleviate pressuring countries where COVID is still a developing problem. By taking these procedures around the globe, we helped our Anzio, Italy plant to stay open throughout the crisis, delivering 40% more volume in March than initially anticipated.”

Valuation

Colgate is trading at around 26x projected 2020 earnings and around 24.5x projected 2021 earnings.

At first glance, that seems a bit steep for a company with low recent growth numbers.

But Colgate’s global business – the company gets around 75% of its revenue from emerging markets – gives it growth potential in the years ahead. In these countries, Colgate can see increased revenue from:

- Rising disposable income levels

- Improving hygiene habits

- Higher population growth compared to developed countries

Of course, there is risk that not all of the above factors will come to fruition. And there is also the possibility that local brands prevent Colgate from attaining a high market share in the long run. But an incredible brand (Colgate was founded over 200 years ago) and stable operations give Colgate a level of safety combined with this upside.

And Colgate’s track record is excellent for investors in another way.

Dividend

Colgate’s dividend history is matched by few companies. The company has paid a dividend for 125 consecutive years. Furthermore, CL has increased the payout every year starting in 1963 – almost 60 years.

The dividend is modest at a little under 2.5%, but that’s nothing to sneeze at in our current low-yield environment. And Colgate should have no problem slowly increasing that payout over time – rain or shine.

The Final Word

It’s tempting to get into CL right now. The consistent long-term performance and emerging-markets upside – all at a reasonable valuation – is tough to match.

But shares will now face a lot of resistance in the mid $70s. As stated earlier, it’s best to wait for a strong high-volume breakout above $77 a share. Ideally, shares would close near the high of the day’s range.

Keep a close eye on Colgate; this one could be a winner over the next 3-5 years.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report