The much-awaited Q2 earnings of

Facebook (NASDAQ: FB) hit the wire shortly after the bell rang to end Wednesday’s session. With shares of the social media giant have hit fresh all-time highs in the run-up to the release, Wall Street and Main Street alike were keen to see if the numbers justified the move. For some, they most certainly would have, but for others, it wasn’t that clear.

As expected, the high-level numbers were undeniably impressive. Their EPS of $3.61 was 20% higher than what analysts were expecting, while revenue also beat the consensus as it jumped more than 55% higher compared to the same quarter last year. The company’s operating margin came in at a solid 43% versus the 37.6% that had been expected, which helped Facebook to

more than double their operating income.

Digesting The Figures

However, the multiple beats were dampened as management issued an uncharacteristic warning to investors. They made it clear that "in the third and fourth quarters of 2021, we expect year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth. When viewing growth on a two-year basis to exclude the impacts from lapping the COVID-19 recovery, we expect year-over-two-year total revenue growth to decelerate modestly in the second half of 2021 compared to the second-quarter growth rate".

This echoed the comments from Alphabet / Google (NASDAQ: GOOGL) who also released Q2 earnings this week, and who also made it clear that the post COVID recovery shine was going to start losing some of its sparkle. To be fair, not many would have expected Facebook, Google, or any of their fellow high-flying tech peers to continue growing at the staggering pace they’ve set over the past twelve months, but seeing the likelihood laid out in black and white has certainly had an effect.

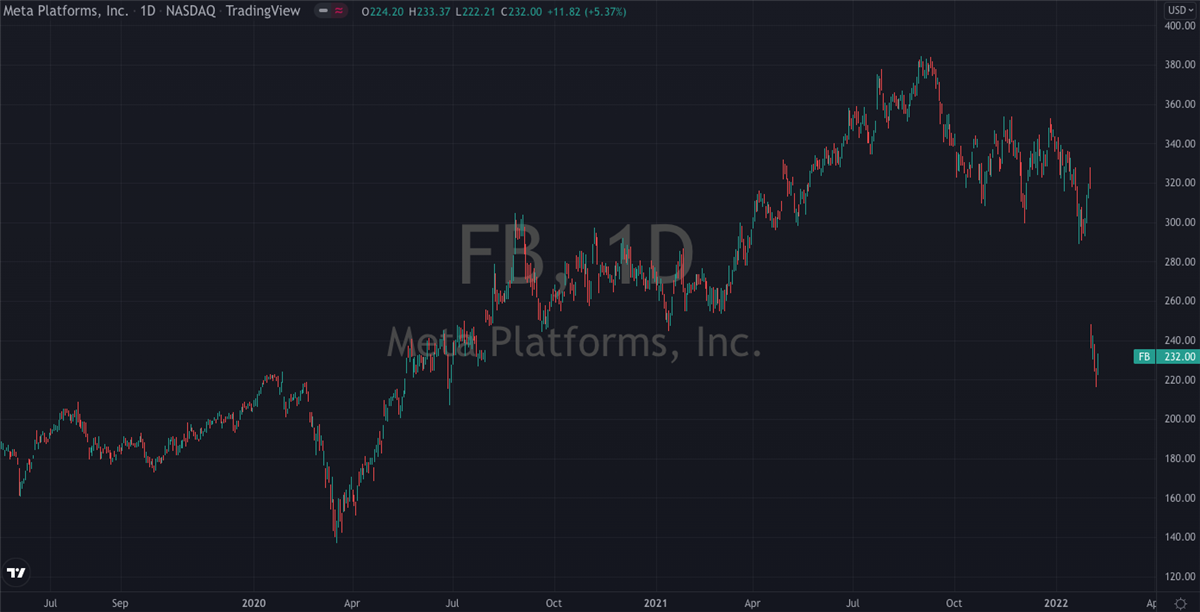

Facebook shares dropped more than 4% on Thursday’s session as investors took them back from the all-time highs they’d just hit. They were down a further 1% and more in Friday’s pre-market trading session so it will likely take the weekend for the full report to be digested properly. For now, it looks like investors are seeing a few red flags from the likes of daily active user numbers, which were only in line with expectations, as well as “increased ad targeting headwinds this year from regulatory and platform changes, notably the recent iOS updates," which the company expects to start to have a greater impact on the bottom line in the third quarter.

Looking Ahead

There’s still a lot for investors to be excited about, however. CEO Mark Zuckerberg spoke confidently about the company’s future in the post-earnings call, with a focus in particular on the key drivers of growth that will take Facebook further into this decade. For anyone considering backing off from a long position, his bullish comments are worth tuning into; "we had a strong quarter as we continue to help businesses grow and people stay connected. I'm excited to see our major initiatives around creators and community, commerce, and building the next computing platform coming together to start to bring the vision of the metaverse to life."

He sees Facebook becoming a "metaverse company", one which enables people around the world to live, work, and play in virtual environments. Considering the company pulls in about 3 billion unique visits every month, close to half the world’s population, you’d be hard pushed to bet against them evolving into that kind of 21st-century service.

Shares of Facebook would need to fall below $330 before it could be said that this was a poor earnings report and investors start eyeing the exit en masse, but for now, we can consider the volatility that we’ve seen to be fairly normal, all things considered. While it may be some time before the conditions arise to allow for a repeat of 2020’s extraordinary growth tailwinds, this week’s report has confirmed that Facebook is still a $1 trillion company that’s able to grow revenue at more than 50% year on year. Who wouldn’t want a slice of it in their portfolio?

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report