Tire and service provider

Goodyear Tire and Rubber Company NYSE: GT shares have recently spiked on the surprise acquisition of its top publicly traded competitor

Cooper Tire and Rubber Company NYSE: CTB. The acceleration of

COVID-19 vaccinations are fueling the rotation back into reopening plays in the travel, lodging, hospitality and

consumer discretionary stocks. The Company is also building its leadership with original equipment manufacturers (OEM) in the electric vehicle (EV) markets with its eco-friendly line of tires. The combination of the two top players in the tire segment pretty much gives retail investors more bang for the buck with powerful recovery tailwinds. Prudent investors looking to still enter a recovery play can monitor shares of Goodyear for opportunistic pullback levels to build a position.

Q4 FY2020 Earnings Release

On Feb. 9, 2021, Goodyear released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported an earnings-per-share (EPS) profits of $0.44 versus consensus analyst estimates for $0.16, a $0.28 beat. Revenues fell (-1.5%) year-over-year (YoY) to $3.66 billion beating analyst estimates for $3.61 billion. Forex fluctuations and lower volume contributed to revenue declines partially offset by favorable pricing and mix. Tire unit volumes declines (-5%) YoY to 37.7 million due to the effects of COVID-19. Replacement tire shipments fell (-7%) reflecting lower consumer demand and European distribution realignment. Original equipment unit volume rose 3% YoY stemming for increased market share in the U.S. and EMEA region. The Company generated $1.2 billion in free cash flow in Q4, the fourth-highest since 2011.

Conference Call Takeaways

Goodyear Tire CEO Rich Kramer set the tone, “The fourth quarter was an outstanding conclusion to a truly unprecedented and challenging year. Our segment operating income in the quarter was $302 million, up 25% from last year. Our volume improved sequentially, reflecting a modest uptick in global industry demand compared to the third quarter as well as improvements in market share in several of our businesses.” Volumes in the Americas commercial business rose 7% YoY and will continue in 2021. CEO Kramer highlighted, “Chart tonnage, freight rates and Class A truck orders are trending favorably in the U.S., suggesting we are likely to see accommodative industry conditions.” There were many notable customer wins including Ryder, Albertsons, Dart, and Pepsi Mid-America. The Fleet Central interactive tool has helped the Company continue winning fleet deals.

EV Growth

Goodyear has secured its leadership position in electric mobility with higher win rates on targeted filaments in a flat market with 16% YoY volume increases. EVs account for nearly half of OE development projects in Europe. Volkswagen (OTCMKTS: VWAGY) selected the Goodyear Efficient Grip Performance and Goodyear Ultra Grip Performance its first vehicle designed exclusively for electric mobility, the ID3. Goodyear plans to roll out Fuel Max LHD2, a drive tire designed for long haul fleets lowering fuel costs and carbon footprints, and Fuel Max RSD, designed for regional haul carriers for fuel efficiency and robust durability and traction. Both tires will feature proprietary sealant technology and delivered in 2021. CEO Kramer summed it up, “OEMs are recognizing the commitment we have made to developing tires that will help them transform their portfolios to more energy-efficient and eco-friendly vehicles while delivering performing capabilities consumers demand.”

Cooper Tire Merger

On Feb. 22, 2021, Goodyear announced the acquisition of competitor Cooper Tire and Rubber Company for $2.8 billion, composed of $41.75 per-share in cash and 0.907 shares of GT. The acquisition strengthens Goodyear’s footprint in mid-tier tire segment as well as emerging markets including China and Latin America. It also gains market share in the hot light truck and SUV markets. The accretive transaction will bolster top-line revenues to $17.5 billion and is expected to close in the second-half for 2021, pending any regulatory issues.

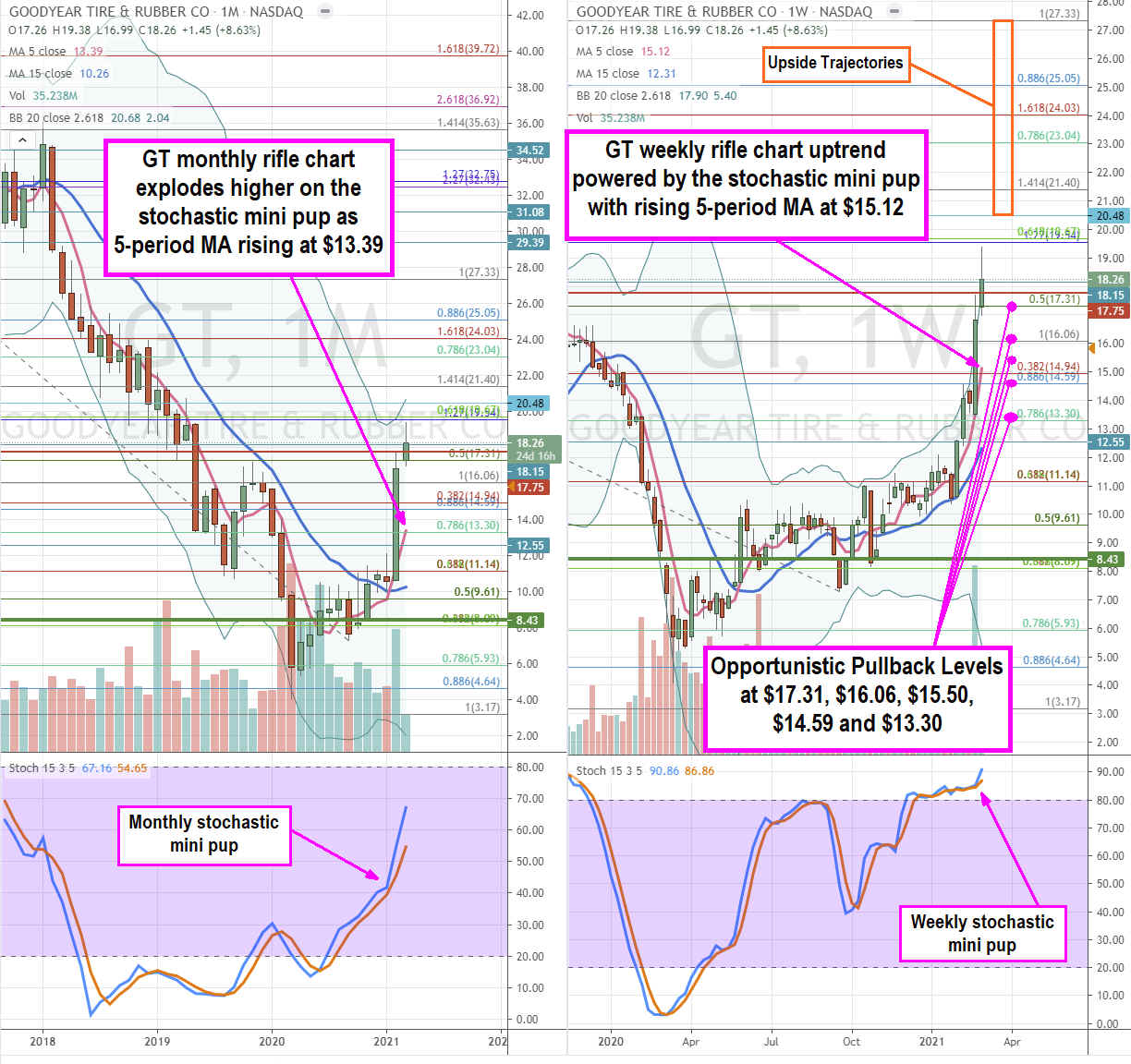

GT Price Trajectories

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for GT stock. The monthly rifle chart exploded higher on the Cooper Tire acquisition announcement as shares peaked near the $19.54 Fibonacci (fib) level. The rising monthly 5-period moving average (MA) is at $13.39 as shares press towards the monthly upper Bollinger Bands (BBs) at $20.68 powered by the monthly stochastic mini pup. The monthly market structure low (MSL) buy trigger above $8.43 back in June 2020. The daily market structure high (MSH) sell trigger forms under $17.75. The weekly rifle chart overshot its weekly upper BBs at $17.90 as its 5-period MA tries to catch up at $15.12 powered by a high band stairstep mini pup. Pullbacks have been hard to come by until the daily MSH triggers. Prudent investors can monitor for opportunistic pullback entry levels at the $17.31 fib, $16.06 fib, $15.50 sticky 5s level, and the $13.30 fib. Upside trajectories range from $20.48 on up to the $27.33 fib.

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report