Gaming technology services and products maker

International Gaming Technology NYSE: IGT stock has held up relatively well in 2022 despite the

benchmark indices sell-off. While the

Omicron variant impacted some markets with labor shortages,

supply chain pressures and cost inflation, IGT still managed to generate its highest EBITDA in Company history while cutting its debt ratio to 3.5X. Once an

epicenter stock during the pandemic, the reopening has been a boon further accelerated by the spread of sports betting and iGaming legalization. While the Company has minimal direct exposure to

Russia and Ukraine, the ripple effect throughout Europe is yet to be seen. Prudent investors seeking exposure in a one-stop shop for the global gaming can watch for IGT for opportunistic pullbacks.

Q4 Fiscal 2021 Earnings Release

On March 1, 2022, IGT reported its fiscal Q4 2021 earnings for the quarter ended in December 2021. The Company reported an earnings-per-share profit of $0.09, missing consensus analyst estimates for a profit of $0.35 by (-$0.26). Revenues rose 18.6% year-over-year (YoY) to $1.05 billion beating consensus analyst expectations for $1.02 billion. IGT generated the highest operating income in Company history at $902 million with over $1 billion in cash from operations and $770 million in free cash flow. The Company reduced net debt by (-$1.4 billion) improving leverage to 3.5X, which is the lowest in Company history. The quarterly dividend was reinstated at $0.20 cash per share. IGT CEO Vince Sadusky commented, "Our 2021 financial results reflect the best revenue, profit, and cash flow performance in the last four years, meeting, or exceeding target levels on strong performance across the portfolio. We made important progress on several strategic objectives, and I am excited to be leading IGT in the next chapter of its evolution. We have set aggressive but achievable multi-year goals and we have a focused strategy to maximize value for all stakeholders."

Mixed Revenue Guidance

The Company affirms in-line revenue guidance for fiscal Q1 2022 to come in between $1 billion to $1.1 billion versus $1.04 billion consensus analyst estimates. The Company expects fiscal full-year 2022 revenues to come in between $4.1 billion to $4.3 billion versus $4.21 billion.

Conference Call Takeaways

CEO Sala set the tone, “ Our mission is to strengthen IGT’s global leadership position in the regulated gaming industry by offering innovative content services and solutions. That is the foundation of our strategy to grow top line and margins across all segments, while increasing operational efficiency and optimizing capital allocation.” He pointed out the Company is well positioned in markets experiencing digital growth and secular tailwinds. Its portfolio is both complementary and leverageable across lottery, slots, iGaming, and sports betting. The Company has divested its Italy commercial services for over 15X EBITDA as proceeds will be utilized for other possible acquisitions and debt reduction. Its Global Lottery segment saw 20% YoY growth in same store sales. iLottery same store sales rose 60% in 2021. Instant lottery ticket services saw 35% increase in standard units produced. It’s resort wallet received regulatory approval in Nevada, which enables the Company’s cashless gaming solutions to be deployed. It’s play sports platform powers over 60 venues across 20 states.

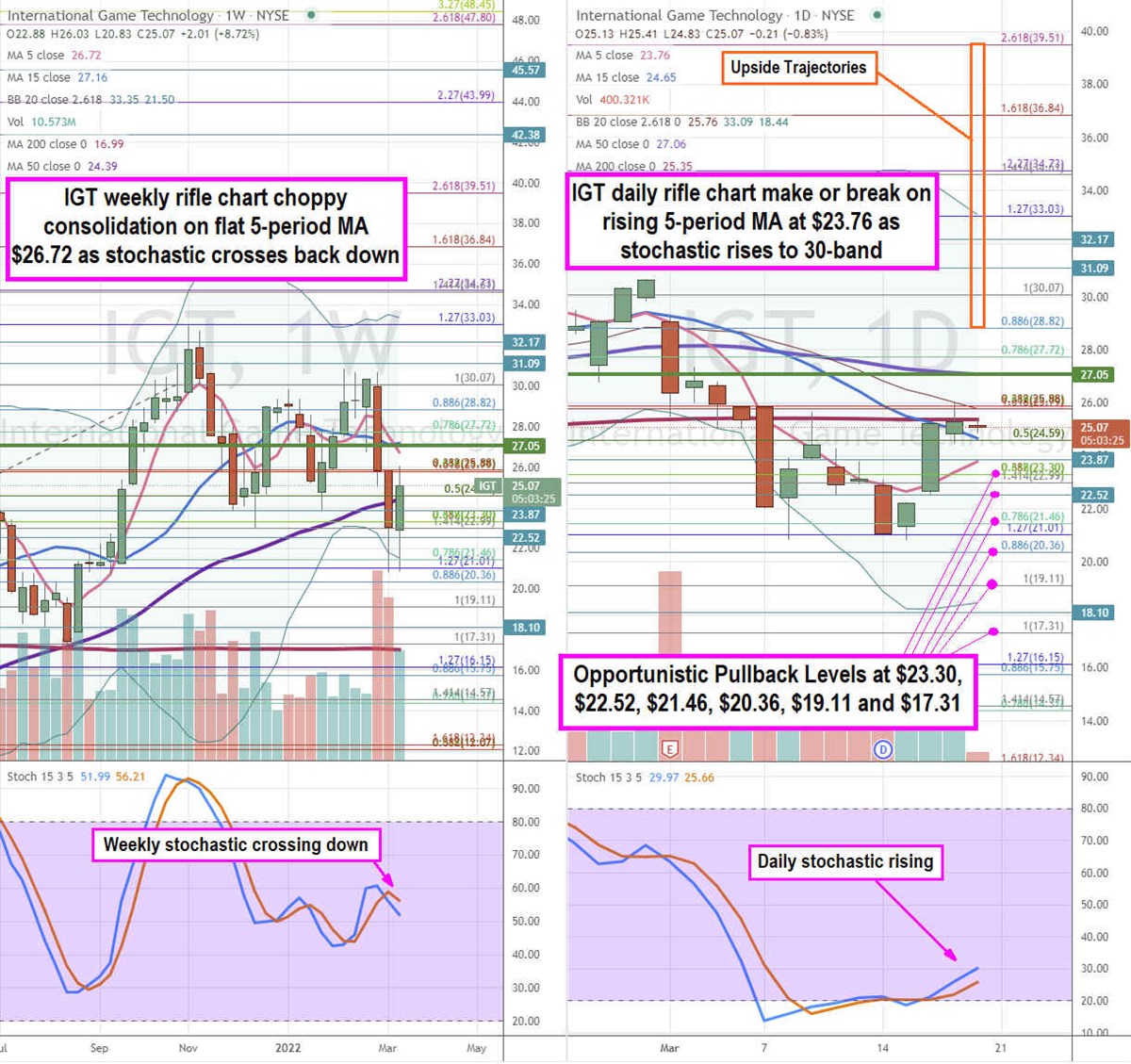

IGT Price Trajectories

Using the rifle charts on the weekly and daily times frames enable a precision view on the price action for IGT stock. The weekly rifle chart peaked near the $33.03 Fibonacci (fib) level and proceeded to sell-off in a choppy manner to bottom near the $21.01 fib, The weekly rifle chart has been choppy with the weekly 5-period moving average (MA) at $26.72 constantly crossing the 15-period MA at $27.16 both up and recently down. The weekly lower Bollinger Bands (BBs) sit at $21.50 as they start to expand. The weekly stochastic has crossed back down under the 60-band. The weekly market structure low (MSL) buy triggers on a breakout above $27.05. The daily rifle chart has a make or break as the downtrend is stalling on a rising 5-period MA at $23.76 tightening towards the 15-period MA at $24.65 and 200-period MA at $25.35 and 50-period MA at $27.06. The daily stochastic has bounced up through the 20-band. The daily lower BBs are compressing at $18.44. Prudent investors can wait for opportunistic pullback levels at the $23.30 fib, $22.52 level, $21.46 fib, $20.36 fib, $19.11 fib, and the $17.31 fib level. Upside trajectories range from the $28.82 fib level up towards the $39.51 fib level.

Before you consider International Game Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Game Technology wasn't on the list.

While International Game Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report