Visual social media lifestyle brand platform Pinterest NYSE: PINS stock has been devastated by its earnings shortfall as the post-pandemic reopening trend is having a negative impact on sentiment. While other social media platforms have been able to weather the reopening, Pinterest is actually the odd man out as its warnings come to fruition. Any thoughts of lowballing have been thrown out the window as the worst-case reality has been reflected in its shares. Its Q2 2021 earnings report indicates a (-5%) drop in U.S. monthly active users (MAUs) from the year-ago period compared to the 9% global monthly users. The question is whether the market has overreacted on the sell-off compared to its peers like Facebook NASDAQ: FB, Twitter NYSE: TWTR, and Snapchat NYSE: SNAP, which are still trading near all-time highs. Its competitors have been able to shake off any slowdown concerns. The fear is that the acceleration of Covid-19 vaccination will also slow down the global MAU growth as it has affected the U.S. MAUs into negative territory. Global growth has already slowed to 9% from double digits, so the growth trajectory is slowing down (Q1 2021 global growth was 30.2%). Also, while only 20% of its users are in the U.S., they also generate 78% of the revenues. As of July 27, 2021, U.S. MAUs continue to decline (-7%) and global MAUs growth fell to 5% and no Q3 2021 guidance was given. Time will tell if it’s a realistic thesis of the inverse relationship to reopenings. Risk tolerant investors seeking a bargain entry can watch for opportunistic pullbacks in shares of Pinterest.

Q2 FY 2021 Earnings Release

On July 29, 2021, Pinterest released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.25 excluding non-recurring items versus consensus analyst estimates for a profit of $0.13, beating estimates by $0.12. Revenues surged by 125% year-over-year (YOY) to $613.21 million beating analyst estimates for $562.12 million. Global monthly active users (MAUs) rose 9% YoY in Q4 to 454 million, but U.S. growth fell (-5%) YoY to 91 million. Pinterest CEO Ben Silbermann commented, “Our second-quarter results reflect both the strength of our business and the recent shift in consumer behavior we’ve seen as people spend less time at home. While we navigate through pandemic impacts, Pinterest is focused on building for the long-term by transforming from a place to browse, save and organize to a community of inspiring people sharing their passions and expertise.” That spending less time at home statement spooked investors as they panicked out of the shares.

Conference Call Takeaways

Pinterest CEO, Ben Silberman addresses the elephant in the room, “On the user growth front, we grew globally monthly active users 9% year-over-year. And I'm sure there are questions about this, so I thought I'd take a few of the obvious ones head-on. The first question is what happened with user behavior? As we all know, the pandemic was an unprecedented and unique global event. In past earnings calls, we talked about how stay-at-home orders significantly increased usage of Pinterest. And for the past year, we've highlighted how people came to Pinterest for inspiration to reinvent their lives during such a difficult time. Now as the world opens up, we're seeing a similar effect in the opposite direction. That impacted our growth, particularly because some of the core use cases, we see on our platform are less common in 2021 than they were a year ago. That shift in behavior in Q2 impacted engagements. Which brings me to the second question, what users did this impact the most? Well, most of the difference between what we guided and what we reported are people who came to Pinterest from the web versus from mobile apps. These users tended to be, on average, less engaged and generated less revenue than people who came directly to Pinterest. In contrast, in Q2, monthly active users on our mobile apps grew in the U.S. year-over-year and internationally by more than 20%. We're continuing to closely monitor Pinner's engagement. So later, Todd will talk you through more about what we've learned a few weeks into our current quarter.” He continued, “While we navigate the current volatility caused by COVID, we remain focused on building for the long term. Pinterest is at the beginning of a fundamental transition, going from a place of lifestyle expertise in the form of rich interactive videos. We're doing this in a number of ways. First, Idea Pins are our first publishing tool, enabling creators to share ideas with lasting value. Second, the creator code is our initiative to make sure Pinterest remains a positive and supportive environment. And third, we'll be adding new features to help creators foster community. We intend to go beyond likes and comments, and we'll build tools that let people share their creations, ask, and answer questions and offer encouragement, and share tips. We're still early in this transition, but those early results are positive.”

Gen-Z Growth

CEO Silbermann is a straight shooter which may lend him more credibility if and when growth trajectories return. He wouldn’t commit to the trend in MAUs due to a lack of visibility as to whether Q2 2021 was an anomaly or the start of more declines. He noted the silver lining with the growth in Generation Z users of the platform, “The number of Idea Pins created daily has grown more than sevenfold since the beginning of the year. More and more, creators are publishing ideas and opening up new worlds on Pinterest on everything from outfit ideas, school activities, workout routines, and vacation ideas. And Idea Pins are resonating with our fastest-growing audience, Gen Z. This audience grew double-digits year-over-year. We plan to continue to execute this strategy with more product launches like product tagging, which came out this week to help reward creators for their work and get Pinners another way to go from inspiration to purchase till later this year when we make it possible for all Pinners to create Idea Pins as well as many more capabilities.”

PINS Opportunistic Pullback Levels

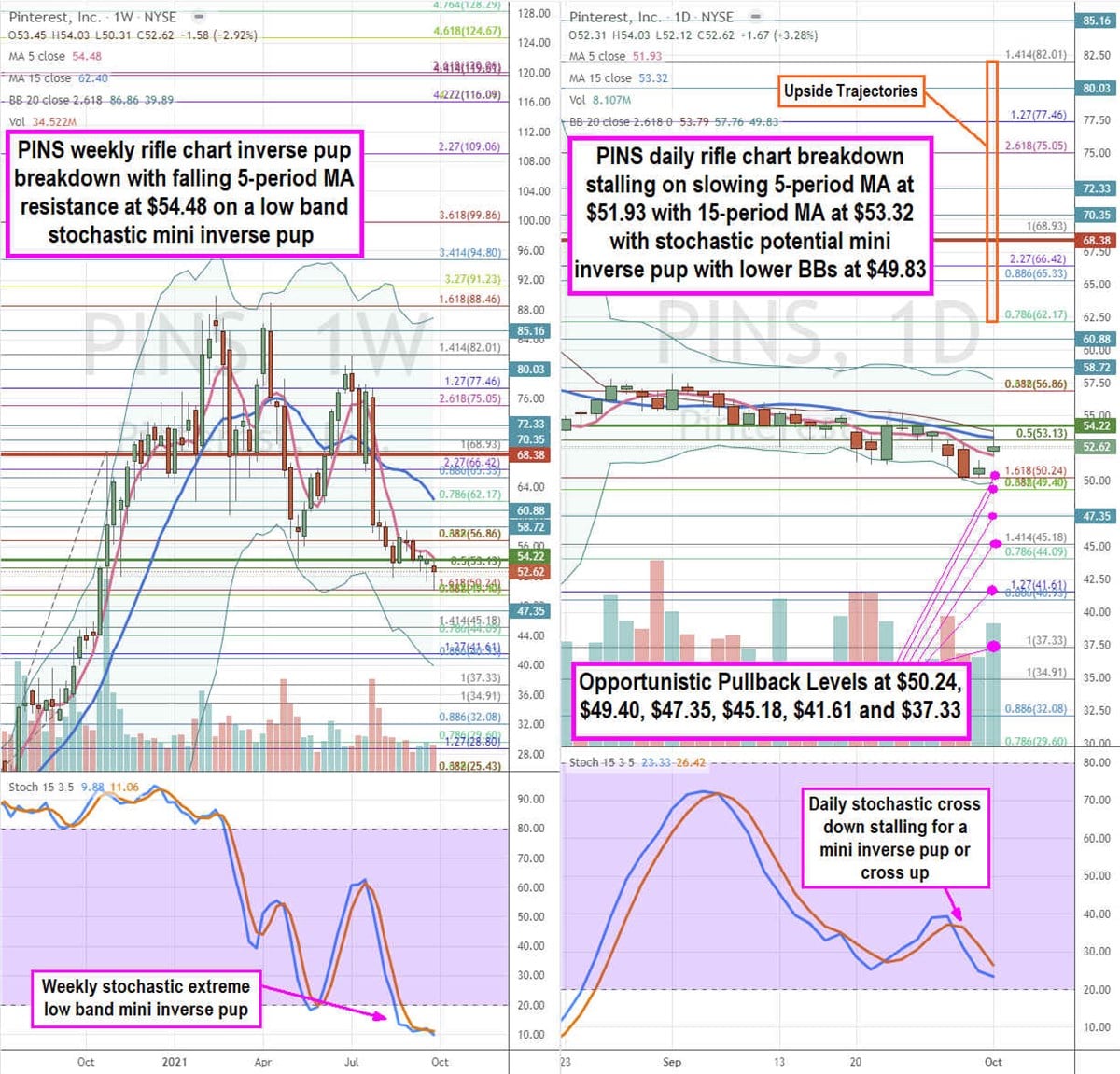

Using the rifle charts on the weekly and daily time frames provides a precision view of the price action landscape for PINS stock. The weekly rifle chart peaked at the $88.46 Fibonacci (fib) level before violently collapsing on earnings shortfall reversing the uptrend into a downtrend. Shares have struggled to find a bottom as the weekly inverse pup breakdown looms with a falling 5-period moving average (MA) resistance at $54.48 and falling 15-period MA resistance at $62.17. The weekly market structure high (MSH) sell triggered on the collapse under $68.38. The weekly lower Bollinger Bands (BBs) sit at $39.89. The daily rifle chart has been downtrending with a stalled out 5-period MA at $51.93 and 15-period MA at $53.32. The daily stochastic has been falling but stalled just above the 20-band. This sets up a potential mini inverse pup collapse or a cross-up on the daily market structure low (MSL) buy trigger above $54.22. The daily lower BBs sits at $49.83. Prudent investors can watch for opportunistic pullback levels at the $50.24 fib, $49.40 fib, $47.35, $45.18 fib, $41.61 fib, and the $37.33 fib. Upside trajectories range from the $62.17 fib up towards the $82.01 fib level.

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report