Social media influencer marketing platform

IZEA Worldwide NASDAQ: IZEA stock surged to peak out at $7.45 on Jan. 25, 2021 and has since fallen over (-60%) to provide opportunistic pullbacks for high risk-tolerant speculators. The role of social media influencers on brands is well known. The Company provides a platform that connects influencers with

brands and provides the tools to create and follow through on campaigns. The

pandemic spurred growth in social networks and e-commerce. As

COVID vaccinations continue to accelerate, investors are wary about the stickiness of social media as workers return to the office. The conventional thinking may be shortsighted as social media has become a cornerstone of the new normal. Companies will still try to appeal to consumers heavily during the

reopening, which is why IZEA is a

rebound and

reopening play. The Company announced that Q2 2021 bookings are up a record 75% already with still more than half a quarter to go. The Company relies on continued investing in the

social media space placing campaigns on various platforms including

Pinterest NYSE: PINS,

Facebook NYSE: FB,

YouTube (NASDAQ: GOOG) and

Twitter NYSE: TWTR. Shares are low-priced and can continue much lower. High-risk tolerant speculators seeking exposure in the influencer brand marketing space can watch for opportunistic pullbacks in this lesser-known name.

Q1 FY 2021 Earnings Release

On May 13, 2021, IZEA released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported total revenues of $5.4 million, up 13% year-over-year (YoY) from $4.8 million in the same quarter year ago. The Managed Services unit revenue grew 18% YoY to $4.9 million compared to $4.1 million. SaaS Services unit revenue fell (-21%) to $504,000 from $639,000. Total costs and expenses fell (-32%) to $7.4 million compared to $10.9 million in year-ago same period. Net loss was (-$2 million) compared to (-$6.2 million). Adjusted EBITDA fell to (-$1.4 million) compared to (-$1.2 million) in Q1 2020. IZEA CEO Ted Murphy stated, “We saw our SaaS licensing revenue stabilize and grow slightly this quarter vs. Q4 od 2020, we are still making our way through the SaaS pricing points, particularly with our self-service offerings. We onboarded a record number of new IZEAx customers in Q1 2021, and despite the year over year decreases in overall SaaS Services revenue, our count of active SaaS customers continues to grow and hit an all-time high again at the end of the quarter.” He continued, “As we look to Q2, we are off to a phenomenal start. Managed Services bookings have topped $7 million for the quarter, already making Q2 the best quarter we have ever had, and we have half the quarter remaining.”

Conference Call Takeaways

CEO and Founder Ted Murphy set the tone, “During my time at IZEA, I’ve seen Yik Yak, Friendster, Meerkat, Google Wave, Google Buzz, Dodgeball by Google, Orkut by Google, iTunes paying, Friend Feed, Daily Booth and most recently Mixer by Microsoft. All of these have come and gone leaving behind them a trail of both creators and brands that have invested countless hours building their audience on these platforms. The decision to be a platform agnostic was one of the most important and fundamental strategies we adopted when we started this Company. It was underpinned by the development of IZEAx as we sought to serve as a bridge between multiple platforms simultaneously…We wanted IZEA to be an independent facilitator, connecting brands and creators.” He went on to articulate the birth of the influencer space and how the Company implements the connecting and marketing of influencers to brands and campaigns. He went on, “Most IZEA campaigns touch more than one social network by design. Our platform independence allows us to guide our customers toward the right activations based on their objectives.” He wants to grow annual revenue per employee by 45% from 2020 to 2023 as a baseline. Managed Services bookings are already up 75% in Q2 2021 with more than half the quarter still to go. The bad news, IZEA filed for a $100 million shelf registration, which should help fuel the Company through the next three years to move forward on its next stage of expansion.

IZEA Opportunistic Pullback Levels

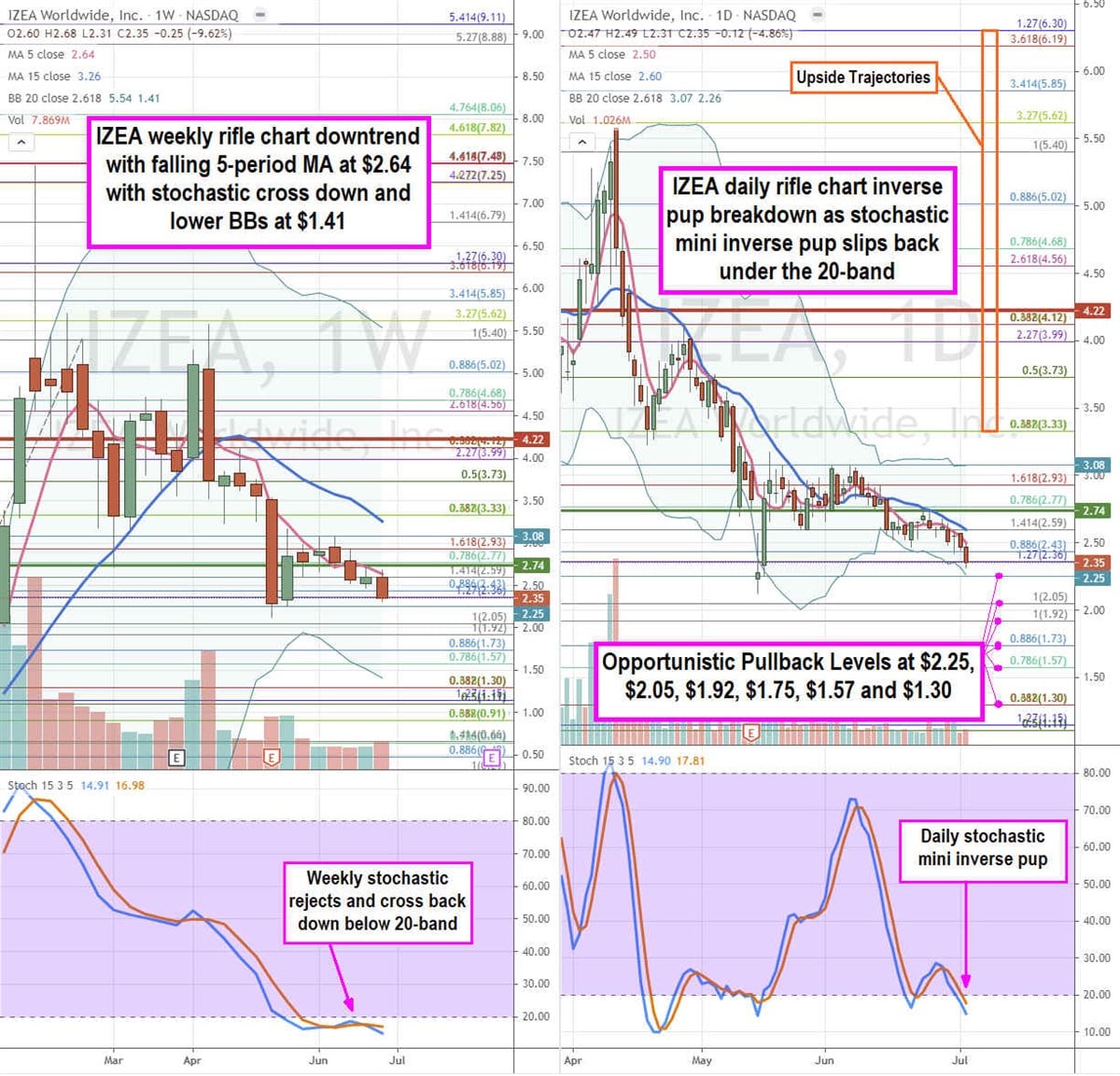

Using the rifle charts on the weekly and daily time frames provides a precision field view of the landscape for IZEA stock. The weekly rifle chart has been in a steady downtrend with the 5-period moving average (MA) around the $2.59 Fibonacci (fib) level. The weekly 15-period MA is falling at $3.26. The weekly lower Bollinger Bands (BBs) sit at $1.41. The daily rifle chart has an inverse pup breakdown and mini inverse pup with a falling 5-period MA at $2.50 with lower BBs at $2.26. The daily market structure low (MSL) triggers above $2.74. Speculators can watch for opportunistic pullback levels at the $2.25, $2.05 fib, $1.92 fib, $1.73 fib, $1.57 fib, and the $1.30 fib level. Upside trajectories range from the $3.33 fib to the $6.30 fib level.

Before you consider IZEA Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IZEA Worldwide wasn't on the list.

While IZEA Worldwide currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report