Christmas

came early this year for investors of semiconductor giant

Micron (

NASDAQ: MU), who released their fiscal Q1 earnings this day

last week. Even though topline revenue was down 7% quarter on quarter, it was still well ahead of what analysts had been expecting. So too was the company’s earnings per share print, which came in at $2.04. But the key takeaway from the report was the increased forward guidance for their fiscal Q2, with revenue now expected to come in around $7.5 billion, compared to the $7.3 billion previously expected, and EPS expected to come in at $1.95 versus the $1.87 consensus.

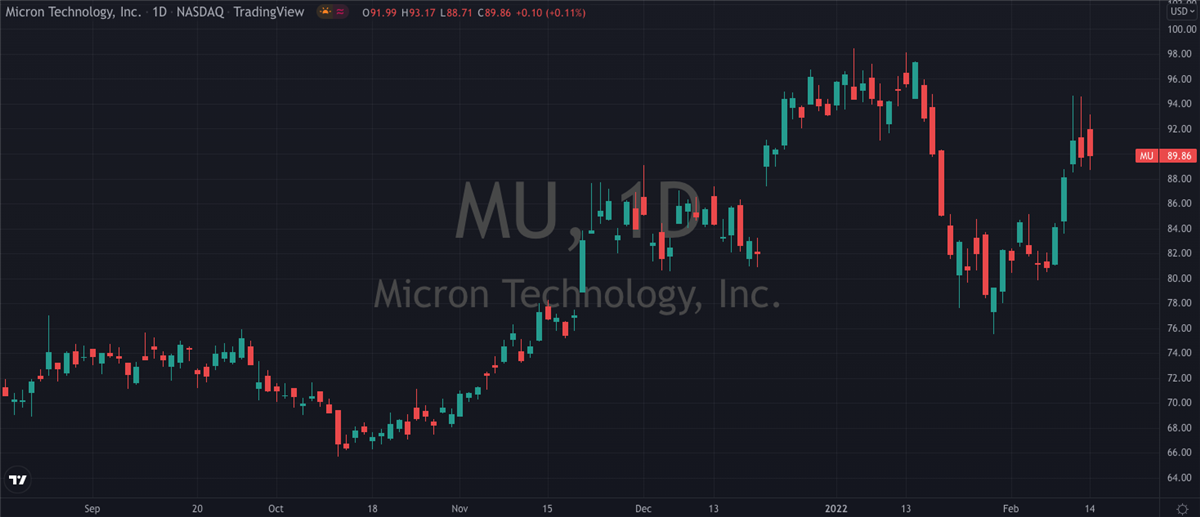

Unsurprisingly, shares reacted well and jumped more than 8% the day after the release. This bid remained throughout the shortened holiday week and shares were up a full 15% compared to pre-earnings levels by the time Santa Claus was squeezing down his first chimney on Friday night.

Excellent Conditions

President and CEO Sanjay Mehrotra spoke bullishly with the report, noting how “Micron delivered solid fiscal first quarter results led by strong product portfolio momentum. We are now shipping our industry-leading DRAM and NAND technologies across major end markets, and we delivered new solutions to data center, client, mobile, graphics and automotive customers. As powerful secular trends including 5G, AI, and EV adoption fuel demand growth, our technology leadership and world-class execution position us to create significant shareholder value in fiscal 2022 and beyond.”

It wouldn’t be unreasonable to expect Micron shares to continue rallying into the end of the year and the beginning of 2022. Prior to the report they were already topping many analyst wish lists for the holidays. Christopher Danely and the team at Citigroup were out earlier this month with positive comments on the semiconductor industry as a whole, and Micron in particular. They argued that considering that the chip-sector shortages don’t appear to be getting better anytime soon, now is a prime time to start buying semiconductor stocks. At the same time, Danely pointed out that business conditions for the industry haven’t been this attractive since 2000 and that order numbers look “strong” through 2022. Within what’s a fairly competitive field, they see Micron outperforming its peers.

The previous week Mizuho had gone so far as to reverse a call they’d made in October, and upgraded Micron from Neutral to a Buy rating. Analyst Vijay Rakesh noted how “we downgraded MU & WDC in October as the 'expectations of a soft 1H22 demand outlook' for PC/Server/Handset, with 1H22 DRAM/NAND spot/contract pricing declines accelerating. However, our recent checks indicate the 'ACTUAL' demand is improving across all three markets with 1) 1Q22 PC/NB builds only FLAT to down 5% q/q (ABOVE our prior assumption for down 10-15% q/q), with 2022 PCs FLAT to UP 5% y/y, 2) Handsets better as China OEMs could have a counter-seasonal FLAT 1Q22 (ABOVE our previous assumption of down 10% q/q), 3) Server demand could improve in 1Q22 with AMZN/GOOGL orders returning potentially early 1Q22, despite >10 wk DRAM inventory."

Getting Involved

For those of us who struggle with the tech jargon, suffice to say that Rakesh and his team saw fit to boost their price target on Micron stock by 25% as they upped it to $95. More recently, on the morning of last week’s earnings report to be exact, Rosenblatt Securities named Micron as one of their top picks for 2022. Similar to Citigroup’s bullish assessment of the industry as a whole, Rosenblatt's Hans Mosesmann, Kevin Cassidy and Kevin Garrigan took a look at the chip sector as part of continuation of their "Mother-of-All-Cycles" assessment of what they call "the biggest semiconductor cycle of all time" based on factors such as the growth of artificial intelligence.

Interestingly, Micron shares are approaching their all time high of $97, having turned back fairly quickly from there the last time they hit it which was in April of this year. While they’re in danger of forming a triple top this time and so putting pressure on the bulls to maintain

this forward momentum, it has to be said that there are just too many good things happening right now for shares not to break through to blue sky territory in the coming weeks.

Before you consider Micron Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Micron Technology wasn't on the list.

While Micron Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report