Key Points

- Avid Bioservices manufactures monoclonal antibodies and various biologics for biotech and pharmaceutical companies.

- The company hit record revenues in fiscal Q3 2023, up 21% YoY achieving non-GAAP profitability.

- Avid is adding manufacturing capacity with a new facility planned to open in Spring 2023.

- Avid Bioservices trade at 8X forward earnings and has a 7.59% short interest.

- 5 stocks we like better than Avid Bioservices

Avid Bioservices Inc. NASDAQ: CDMO is a contract development and manufacturing organization (CDMO) that specializes in producing monoclonal antibodies, biologics, and novel proteins for biotech, healthcare, and pharmaceutical companies. Monoclonal antibodies were a hot topic of discussion during the pandemic.

They are not the same as COVID-19 vaccines, which help the body create its immune response. The U.S. Food and Drug Administration approved emergency use authorizations for several monoclonal antibody treatments for people infected with COVID-19 to reduce the illness and prevent hospitalization.

What are Monoclonal Antibodies?

Antibodies are used to fight harmful antigens. Mono means single—clonal means to replicate. Monoclonal antibodies are lab-made molecules created from a single type of immune cell cloned and duplicated on a larger scale. They are designed to mimic the immune system's response to combat harmful pathogens like viruses and pathogens.

These antibodies bind to specific antigens to incapacitate them by blocking their functions or triggering an immune response. Monoclonal antibodies are used for treatment against infectious and autoimmune diseases and cancer therapy.

Other Services

Avid also provides services ranging from drug discovery, testing, and development to supplying clinical studies, analytics, and compliance. Avid plays a vital role in drug development, commercialization, and manufacturing. This helps smaller biotech companies that cannot mass produce their drugs.

Its commercially manufactured products are sold in more than 90 countries worldwide. Major pharmaceutical companies in the biologics segment include Amgen Inc. NASDAQ: AMGN, Biogen Inc. NYSE: BIIB, and Regeneron Pharmaceuticals Inc. NASDAQ: REGN. The company signed $67 million in net new business in its latest fiscal Q3, 2023. The total backlog rose 26% to $176 million.

20% Growth

On March 13, 2022, Avid released its fiscal Q3 2023 earnings for the quarter ending January 2023. The company reported an earnings-per-share (EPS) profit of $0.01, excluding non-recurring items, versus a loss of ($0.04) consensus analyst estimates, beating by $0.05. The company hit record revenues as they grew 21% year-over-year (YoY) to $38.02 million beating $36 billion consensus analyst estimates.

Avid reaffirmed full-year 2023 revenues of $145 million to $150 million. Gross margins fell to 21% during the first nine months of fiscal 2023 compared to 34% in the year-ago period, primarily due to rising labor and overhead expenses associated with its capacity expansion plans. Avid ended the quarter with $60 million in cash and cash equivalents.

Capacity Expansion

Avid Biosciences CEO Dan Hart commented, “During the period, we signed $67 million in new business, representing the strongest quarter in the company's history excluding Covid-related business. Given this demand, and the fact that our backlog has hit a new high, we feel the timing could not be better for Avid to complete our mammalian cell facilities expansion, which will provide new, state-of-the-art capacity to accommodate our growing backlog.”

Mammalian cell manufacturing has gone online, with process development facility expansions to be completed by spring. This will add $120 million in additional revenue capacity. Cell and gene therapy facility expansion is targeted to go online by the end of calendar Q3 2023. The company has completed constructing its Myford South Facility in California and is going online in calendar Q2 2023.

KeyBanc Capital Upgrade

On March 14, 2023, KeyBank Capital increased its rating on Avid Bioservices to Overweight with a $20 price target from Sector Weight.

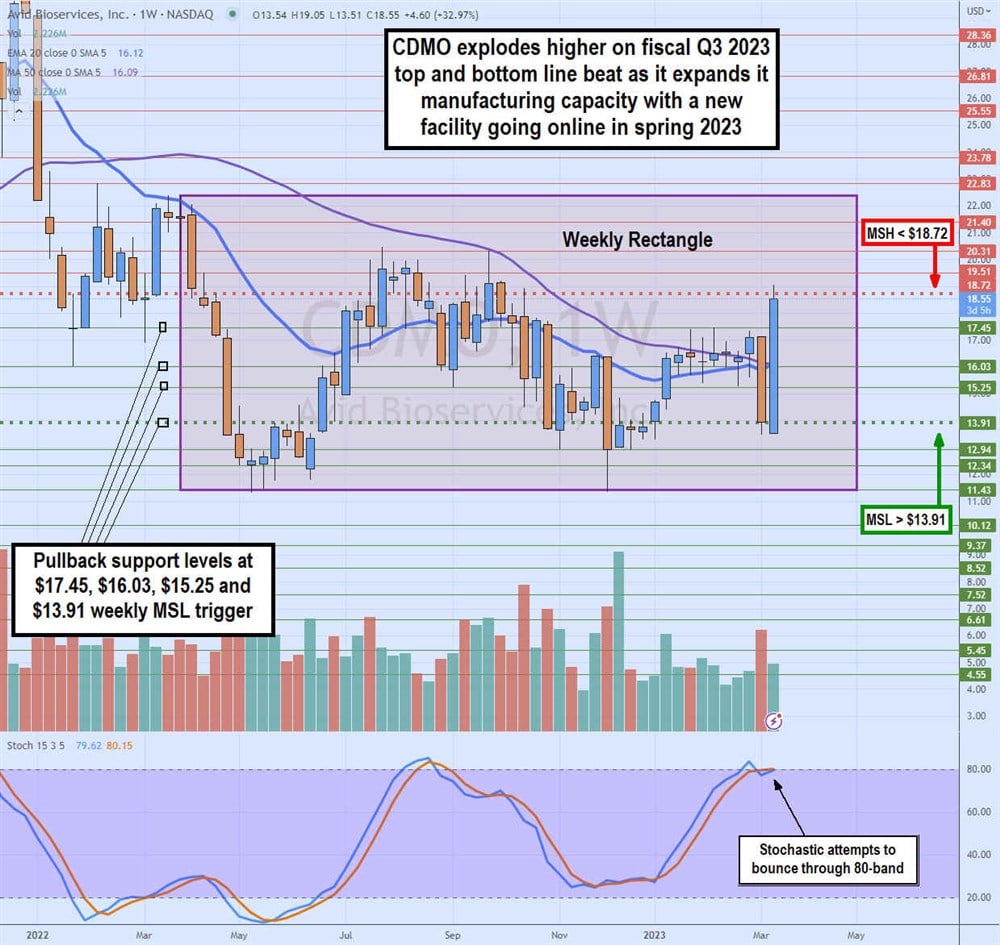

Weekly Rectangle Pattern

The weekly candlestick chart for CDMO illustrates the weekly rectangle that commenced after peaking at $22.38 in March 2022. Shares sold off for the next six weeks, making a low of $11.43 by May 2022. This was the rectangle's lower flat trendline. The weekly market structure low (MSL) was triggered on the breakout through $13.91 as shares bounced to $20.31 to double top before triggering the weekly market structure high (MSH) on the $18.72 breakdown.

CDMO sold off to retest the lower trendline near the $11.43 bottom in December 2022. Shares peaked at $17.50 on the bounce and fell to the weekly MSL trigger level of $13.91 before surging on its fiscal Q3 2023 earnings release. The weekly stochastic fully oscillated to the 80-band as shares traded between the weekly MSH trigger at $18.55 and the weekly MSL trigger at $13.91. Pullback support levels are $17.45, $16.03, $15.25, and $13.91 weekly MSL trigger.

Before you consider Avid Bioservices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avid Bioservices wasn't on the list.

While Avid Bioservices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report