Key Points

- Proterra Inc. is emerging as a player in the EV industry with specialty vehicles and commercial services.

- It is a high-risk penny stock that could see its shares move lower.

- A new deal with the SCDOE could lead to additional business.

- 5 stocks we like better than Proterra

Proterra Inc. NASDAQ: PTRA is emerging as an up-and-comer among a new wave of EV stocks. These stocks include the likes of GreenPower Motors NASDAQ: GP, Hypercharge Networks (OTCMKTS) and even REV GroupNYSE: REVG, which all produce EV infrastructure, specialty EVs and EV services. These stocks are not without risk. There are high-risk penny stocks with hurdles ahead of them but also the potential to make millionaires of their investors.

The takeaway is that EV is a growing industry taking over the ICE market. These companies are on the leading edge of the shift toward electrification and will benefit from those trends. The question is if they can survive long enough to produce returns for their investors.

Who Is Proterra Inc.?

Proterra Inc. is a California-based EV company focused on 3 operating segments. Those are Powered, Transit and Energy. The Powered segment produces batteries and electrification equipment for commercial vehicle OEMs globally. The Transit segment manufactures buses for various commercial and transit fleets. The Energy segment manufactures and deploys turnkey charging solutions and fleet management software for commercial fleets, a high-demand industry.

A recent test run at LAX by Menzies using Mullen Automotive NASDAQ: MULN vans, Loop Global charging stations, and fleet management software was a resounding success. Details include 66% cost savings and an 83% reduction in CO2 emissions on top of 100% up-time with no maintenance issues.

Proterra’s Transit segment is also off to a solid start, with a new order from the South Carolina Department of Education expected to drive sales in other jurisdictions. The deal is for 160 Proterra-powered busses built by Thomas Built Busses. The buses will be delivered over the next year, including complete start-up and support.

The system includes charging networks and software to run the fleet; buses will be powered with the Saf-T-Liner C2 Jouley system and come with a range of 135 miles. It should be noted that Proterra’s east coast manufacturing plant is in South Carolina.

“The South Carolina Department of Education is proud to partner with Thomas Built Buses and Proterra to bring more zero-emission, all-electric school buses to our state. We’re excited to see the positive impact these buses will have on our community,” said Mike Bullman, transportation director for the South Carolina Department of Education. “This partnership puts South Carolina at the forefront of the vehicle electrification movement and brings us one step closer towards building a healthier and more sustainable future for the next generation of students.”

One Risk For Proterra

While the outlook for Proterra appears bright, it is not without clouds. Among those clouds is an issue with liquidity and terms of debt agreements issued in 2020. The company has had to renegotiate the terms of the debt and appears to have reached a satisfactory arrangement with debt holders, but the risk of default remains.

The chart could be better. The stock is in a downtrend, and that trend is not over. The risk for investors is that price action will fall to a new low and confirm a Flag Pattern forming on the weekly charts. In that scenario, this stock could shed another $0.50 to $.80 before hitting bottom.

Before you consider Proterra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Proterra wasn't on the list.

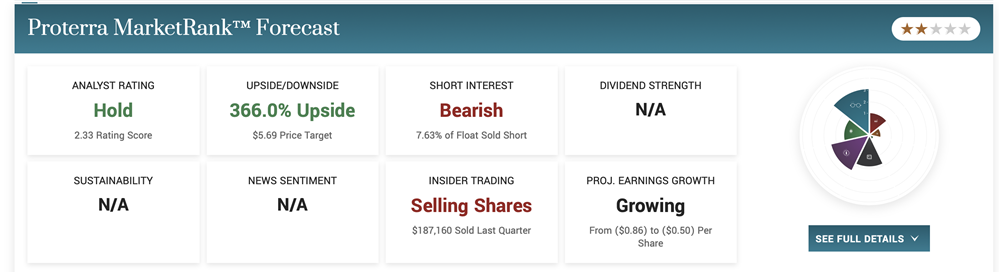

While Proterra currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report