Iconic luxury fashion brand

Ralph Lauren NYSE: RL stock has been in a trading range despite the benchmark index sell-off in 2022. The Company has

emerged from its reorganization running on all cylinders. Ralph Lauren was successful in offsetting increased logistics and freight costs with a successful pricing and product mix helping boost margins by 60 basis points. The Company has prioritized digital innovation bolstering its digital channel and appealing to a new generation of younger under 35 and high-value

consumers. Its teamed with

Roblox NASDAQ: RBLX and launched exclusive digital apparel collections in popular

metaverse ZEPETO, where it has received over 2.5 million visitors and remains the top brand on the platform. The Company raised fiscal full-year 2022

guidance after a blowout fiscal Q3 and authorized a new $1.5 billion buyback. Shares have been consolidating between $100 and $135. Prudent investors seeking exposure in a turnaround-driven apparel brand leader can watch for opportunistic pullbacks in shares of Ralph Lauren.

Q3 FY Fiscal 2022 Earnings Release

On Feb 2, 2021, Ralph Lauren released its third-quarter fiscal 2022 results for the quarter ending December 2021. The Company reported earnings-per-share (EPS) of $2.94 excluding non-recurring items versus consensus analyst estimates for a profit of $2.19, a $0.75 per share beat. Revenues rose 26.7% year-over-year (YoY) to $1.82 billion, beating consensus analyst estimates for $1.65 billion. Inventory ended Q3 at $929 million, up 7% YoY. Gross margins for the quarter were 66% and adjusted gross margin rose 60 bps driven by better a pricing and promotion mix which offset the headwinds of COVID and freight costs. All regions reported double-digit growth. Ralph Lauren ecosystem revenue rose over 40% and owned digital commerce grew more than 30%. The Company bought back 2.5 million shares and authorized a new $1.5 billion stock buyback program.

CEO Patrice Louvet “Our better-than-expected results across all three regions are a testament to the outstanding work our teams have done to fundamentally reposition our business, elevate our brand and pivot to offense – including in North America, where our turnaround is well underway. With our significant reset work behind us, we are encouraged that our long-term growth is supported by multiple engines – from geographic and channel expansion to recruiting new high-value consumers and developing high-potential product categories."

Upside Guidance

Ralph Lauren issued upside guidance with full-year 2022 revenues to grow between 29% to 41% from 34% to 36% earlier guidance or $6.12 billion to $6.21 billion versus $5.94 billion consensus analyst estimates. Capex is expected to range between $200 million to $225 million for the year and operating margins of approximately 13%.

Conference Call Takeaways

CEO Louvet stated that the turnaround is well underway as evidenced by its impressive earnings report. Its growth levers are sustainable and driving profits as well as expanding to recruiting higher-value consumers. He reviewed some of the examples of its five strategic pillars of the Next Great Chapter plan. The Company made a strong push to win over a new generation on consumers worldwide from driving brand momentum and demand creation. This included everything from celebrity activations to digital innovations to the metaverse to drive its digital channels to help recruit younger consumers. New consumer digital sales rose 58% including next-gen under 35 and high-value customers. Online search trends across it brand of products rose double digits. The Company saw much success reaching the younger demographic through its promotions with Roblox with its Lauren Winter Escape program emphasizing its immersive holiday theme and digital apparel purchase exclusives. Ralph Lauren also launched on ZEPETO, a popular metaverse with over 2.5 million visitors and #1 ranking among all brands on the platform. He concluded, “All channels and geographies are showing strong momentum as we build on an increasingly healthy foundation, leveraging work that we started well before the pandemic, but accelerated through this time of challenge.”

RL Opportunistic Pullback Price Levels

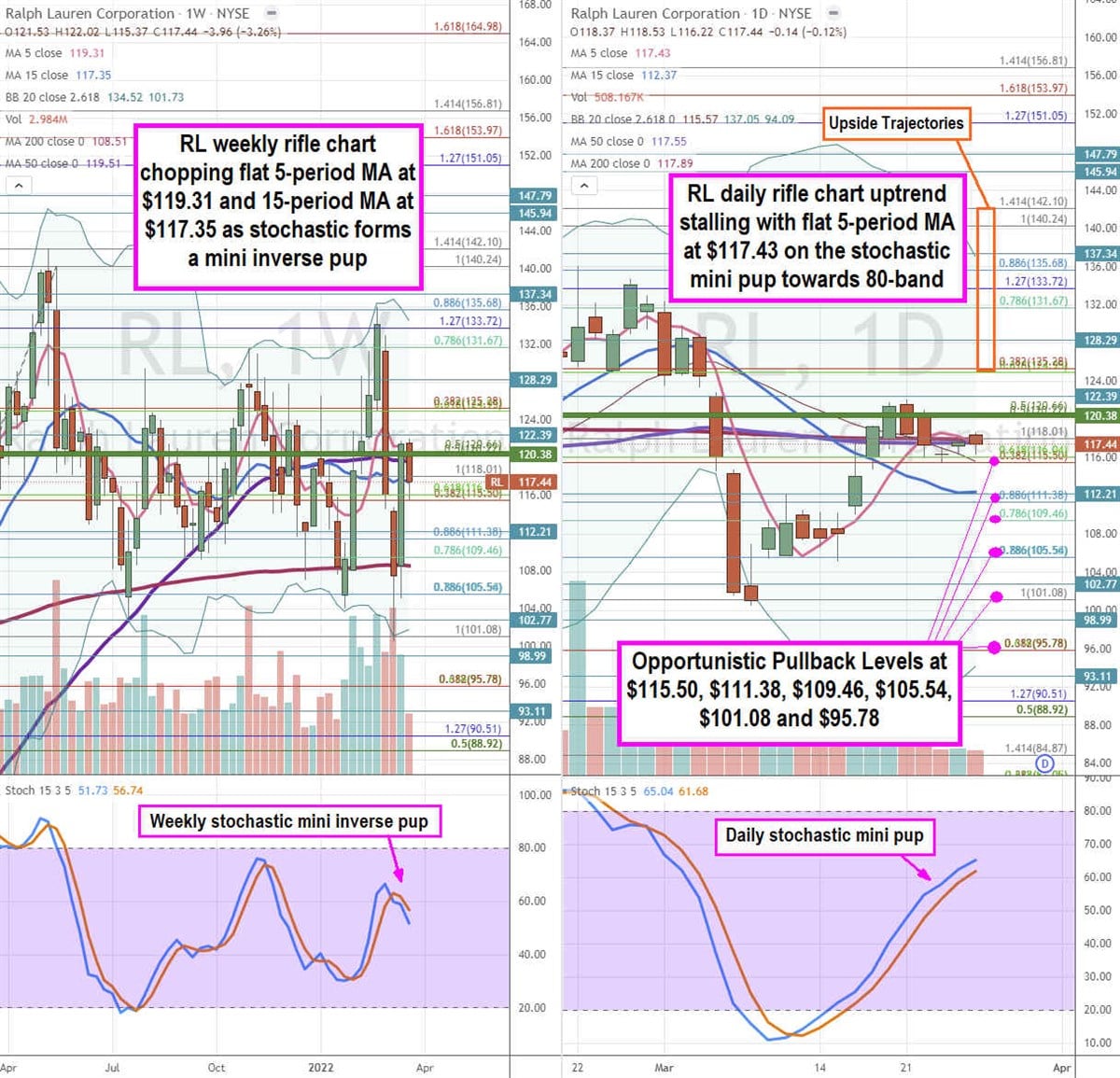

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for RL stock. The weekly rifle chart peaked near the $135.68 Fibonacci (fib) level. Shares proceeded to breakdown to the $101.08 fib before staging a rally. The weekly rifle chart has been in a consolidation with a flat 5-period moving average (MA) at $119.31 and flat 15-period MA at $117.35. The weekly 50-period MA sits at $119.51 and 200-period MA support sits at $108.51. The weekly stochastic is forming a mini inverse pup down. The weekly lower Bollinger Bands (BBs) sit at $101.73. The weekly market structure low (MSL) buy triggers on a breakout close above $120.38. The daily rifle chart is just as jumbled with a flat 5-period MA at $117.43 and 15-period MA at $112.37. The daily 50-period MA sits at $117.43 and 200-period MA sits at $117.89. The daily upper BBs sit at $137.05 and lower BBs sit at $94.09. The daily stochastic formed a mini pup towards the 80-band. Prudent investors can watch for opportunistic pullback levels sit at the $115.50 fib, $111.38 fib, $109.46 fib, $105.54 fib, $101.08 fib, and the $95.78 fib level. Upside trajectories range from the $125.28 fib up towards the $142.10 fib level.

Before you consider Ralph Lauren, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ralph Lauren wasn't on the list.

While Ralph Lauren currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report