With prices for fertilizer and agricultural chemicals on the rise for the better part of a year, companies such as

Mosaic NYSE: MOS, CF Industries NYSE: CF and

Nutrien NYSE: NTR are showing outstanding sales and earnings growth.

One factor contributing to higher fertilizer prices is higher rates for natural gas, which is used in the fertilizer production process. Many elements are contributing to this. For example, the nitrogen sources used to make fertilizer are pegged to the price of oil, which has been fluctuating. That in turn causes uncertainty for fertilizer producers and customers alike.

Because the inputs are always affecting producer prices, earnings can be erratic for these agricultural companies. However, analysts expect strong growth from many names in this industry for the coming year.

Mosaic is a Tampa, Florida-based manufacturer of phosphate fertilizers, feed phosphate and potash fertilizers sold around the world. It has a market capitalization of $15.48 billion. It’s been part of the S&P 500 since 2011.

Being a major index component can help stabilize a stock’s price as mutual funds and ETFs must maintain a level of shares to match the index weighting.

Mosaic is estimated to report earnings sometime around February 16, or possibly sooner. The consensus estimate calls for earnings of $1.98 per share on revenue of $3.62 billion. If met, those would mark year-over-year gains on the top-and-bottom lines.

The company’s revenue growth has accelerated over the past three quarters, while earnings have grown at triple-digit rates in the past five quarters, inclusive of two quarters with a comparison against prior-year losses.

Mosaic is currently forming a third-stage cup-shaped base. A third-stage base can mean a rally is a bit long in the tooth. In fact, Mosaic rallied 76% in the past year, so it may be due for a base re-set. Earnings could be a catalyst for a pullback, even if the company beats views handily.

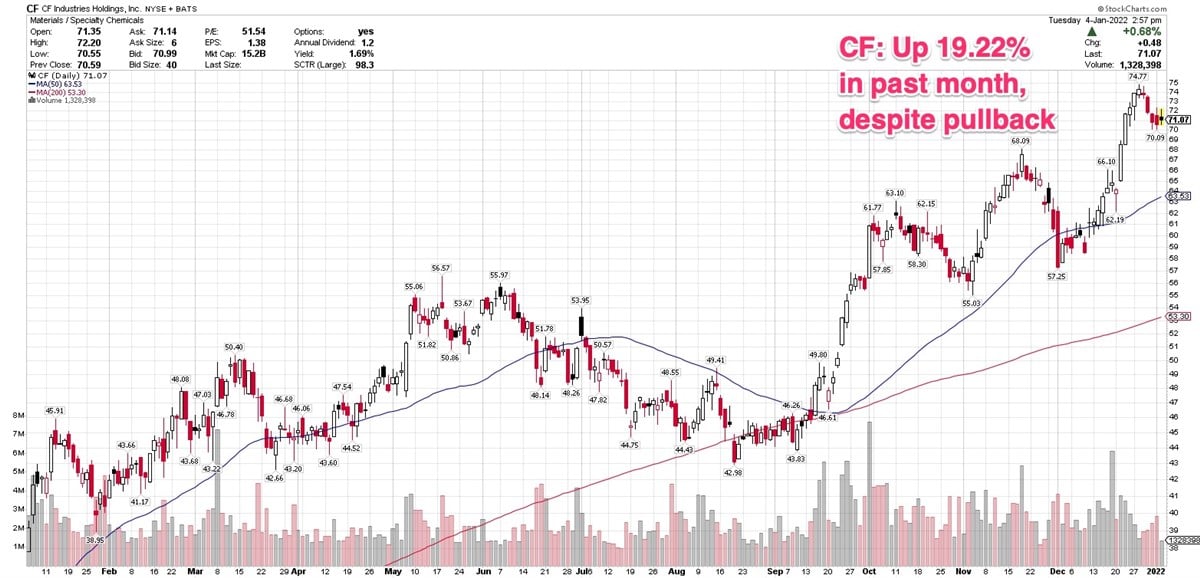

CF Industries is an Illinois company that manufactures nitrogen fertilizers. The stock rallied to a new high on December 28 and has pulled back to successfully test its 10-day moving average.

It formed an ascending base throughout late 2020 and early 2021, then pulled into a cup in May of last year. The low of that cup pattern undercut the previous structure low, which led to a base-count re-set.

I personally like to see that happen in a stock following a healthy rally. It can flush out some of the excess, and offers an opportunity for investors to enter a position or add shares at a lower valuation. When that happens, it often signals the beginning of a fresh runup.

CF cleared that base in October, and then went on to rally. The stock is up 19.22% in the past month and 15.95% in the past three months.

Earnings estimates are strong, which is what initially caught my attention on a profitability screen. Analysts expect earnings to grow a whopping 302% for 2021, and another 93% this year. The company should report fourth-quarter and full-year 2021 results sometime in early February.

Nutrien is a Canadian company that makes potash, nitrogen and phosphate fertilizer products. This company also got my eye with estimates for a triple-digit earnings increase when it reports 2021, and for an additional 41% gain this year.

However, shares were down 5.52% in afternoon trade Tuesday, on news that CEO Mayo Schmidt stepped down after just eight months on the job. He’s replaced by Ken Seitz, head of the company’s potash business, who will serve as interim CEO.

A company spokesperson told Reuters that the executive shuffle would not affect the company’s strategies.

Tuesday’s pullback stopped just short of the stock’s 50-day moving average, a possible signal that investors aren’t scrambling for the exits just yet, but waiting to see how developments play out.

If demand for the company’s products remains high and the Nutrien can continue delivering strong sales and earnings results, there’s no reason to think the rally won’t resume.

Before you consider Mosaic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mosaic wasn't on the list.

While Mosaic currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report