Display imaging processing semiconductor company Himax Technologies NASDAQ: HIMX stock has been a pandemic winner that will continue to flourish in the reopening and return to the normal process. The fabless maker of display chips and an assortment of diversified applications including touch and display technologies for augmented reality (AR), consumer electronics and mobile devices is running on all cylinders. The pandemic caused a demand spike in consumer electronics, smart televisions, mobile devices, laptops, automotive, and anything with a display. This demand acceleration led to a supply chain disruption and global chip shortage. The Company still thrived during the extreme ship shortage and will benefit greatly from the return to normal as it applies to the supply chain. Prudent investors looking for a core player in the new digitally connected normally can watch for opportunistic pullbacks in shares of Himax.

Q1 FY 2021 Earnings Release

On May 6, 2021, Himax released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) profit of $0.38 excluding non-recurring items versus consensus analyst estimates for a profit of $0.32, a $0.06 beat. Revenues grew 67.4% year-over-year (YoY) to $309 million beating analyst estimates for $296.3 million. Gross margins were at all-time highs at 40.2% (up from 31.2% in Q4 2020) and strong demand was across all major business segments. Large driver integrated circuits (ICs) rose 8.8% quarter-over-quarter (QoQ), small and medium-sized driver ICs rose 14.7%, and non-driver products were up 4% QoQ. Automotive sales rose 16.4% QoQ amidst severe capacity shortage. Notebook revenues increased more than 70% QoQ and up 13.9% YoY. The Company noted, “As the capacity shortage in the semiconductor industry intensified across foundry, packaging and testing, the Company further optimized its product mix by strategically favoring more high margin products while pricing products higher to reflect rising costs among all product segments.”

Raised Q2 2021 Guidance

Himax raised its Q2 fiscal 2021 guidance with EPS coming in between $0.54 to $0.60 versus $0.32 consensus analyst estimates. The Company sees sequential revenue growth of 15% to 20%, equating to revenues coming in between $355.4 million to $370.8 million versus $302.78 million consensus analyst estimates.

The Chip Shortage

Himax CEO Jordan Wu stated, “We are still seeing a serious supply-demand imbalance where demand far outpaces supply despite foundries running at more than 100% capacity. Accompanying the rapid growth of 5G and high-performance computing, there is a noticeable increase in demand for semiconductors for advanced processes. The trend towards an ever more connected digital world also drives higher needs for mature nodes, notable demands from display driver IC, power management IC, CMOS image sensor, automotive industry and various AIoT devices that are already all around us and still increasing rapidly in number. Adding these all up, what we have is a structural shift in demand and supply dynamics, especially for the mature nodes which have lacked meaningful capacity expansion for many years.” He went on, “We have secured more capacity for this year compared to last year, with accessible capacity expected to grow quarter by quarter during 2021.” He concluded, “We have managed to secure more capacity for this year compared to last year, with accessible capacity expected to grow quarter by quarter during 2021. Looking further ahead, we are taking measures to work with our strategic foundry partners to further enlarge our longer-term capacity pool.” The Company is pumping on all cylinders and should continue to see momentum throughout the year as worker return to the office. Shares trade at a P/E of 9, making it a value play as well.

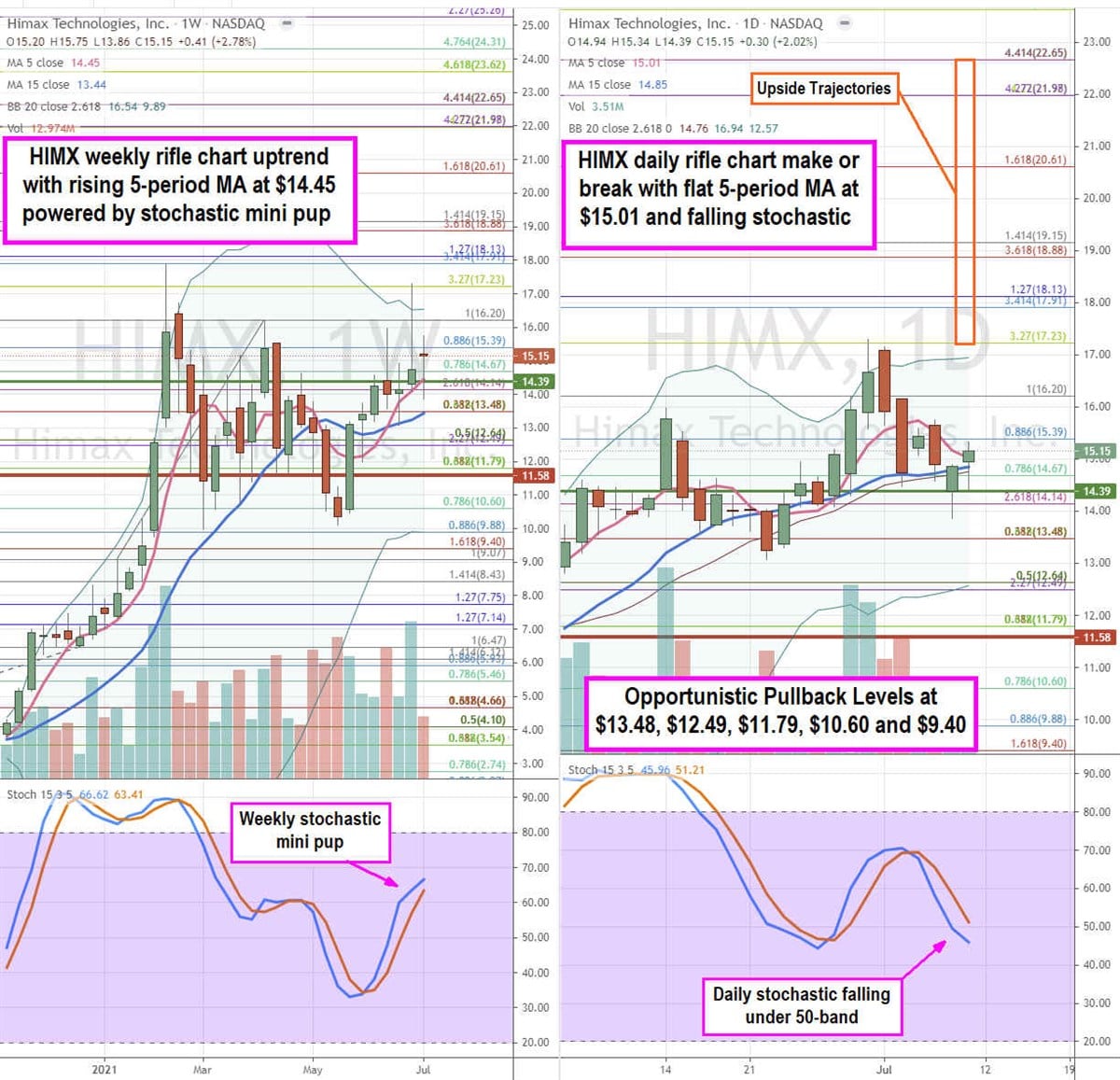

HIMX Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for HIMX shares. The weekly rifle chart peaked off $17.91 Fibonacci (fib) level. The weekly 5-period moving average (MA) is rising at $14.45 with the 15-period MA at the $13.48 fib. The weekly stochastic has a mini pup with upper weekly Bollinger Bands (BBs) at $16.54. The weekly market structure high (MSH) sell triggers on an $11.58 breakdown. The weekly BBs have been in a compression, which precedes a price expansion as the BBs look to turn outwards. The daily rifle chart has a make or break with the 5-period MA at $15.01 with a 15-period MA at $14.85. The daily can form a pup breakout if the stochastic crosses back up. Currently, the daily stochastic is still falling with a daily lower BBs at the $12.49 fib. The daily market structure low (MSL) buy triggered on the breakout through $14.39. Prudent investors can monitor for opportunistic pullback levels at the $13.48 fib, $12.49 fib, $11.79 fib, $10.60 fib, and the $9.40 fib. The upside trajectories range from the $17.23 fib up towards the $22.65 fib level.

Before you consider Himax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Himax Technologies wasn't on the list.

While Himax Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report