LIDAR technology company

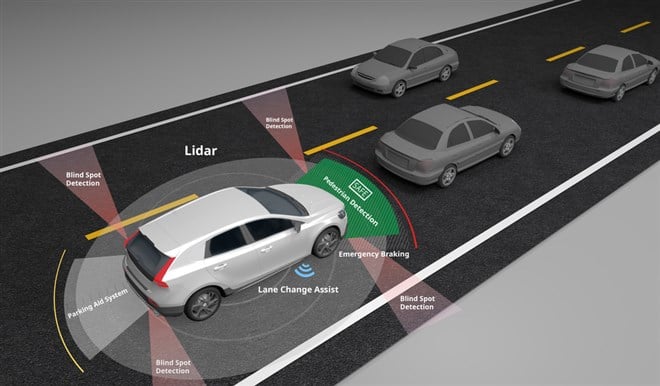

Velodyne Lidar, Inc. NASDAQ: VLDR stock has been a rollercoaster after its SPAC reverse merger on Sept. 29, 2020. The premier maker of light detection and ranging (LIDAR) sensor systems has seen a momentum surge in the segment as sentiment for autonomous vehicles improved. Velodyne founder, David Hall, was the father of the LIDAR industry. The money flow surging into

electric vehicles (EVs) to

charging stations to

EV battery technology found it way into autonomous vehicle components which LIDAR is critical. LIDAR sensors enable autonomous vehicles to navigate accurately and safely. The rumors surrounding

Apple Inc. NASDAQ: AAPLentering the EV market bolstered speculation LIDAR companies shooting up shares of LIDAR technology companies with Velodyne being arguably the purest play. Prudent risk-tolerant investors looking for exposure in a leading player in the autonomous vehicle revolution can monitor Velodyne shares for opportunistic pullback levels.

Q3 2020 Earnings

On Nov. 5, 2020, Velodyne reported its Q3 2020 non-GAAP earnings per shares (EPS) for the quarter ended in September 2020. The Company report a loss of (-$0.06) EPS as revenue grew 137% year-over-year to $32.1 million. At quarter’s end, the Company had 175 projects in the pipeline, an increase of 34% YoY. Velodyne lowered its full-year 2020 revenue estimates to $101 million versus $109.05 million consensus analyst estimates. The Company has shipped 47,500 sensors for cumulative revenues over $615 million to date and has “the largest market share of all LIDAR companies today”, as per CEO Anand Gopalan. He clarified, “We are on the brink of LIDAR-powered autonomous revolution. The applications for LIDAR are endless and continue to grow well beyond auto. LIDAR enables broader secular trends for moving goods, moving people, smart cities, and security. Velodyne is the only company today with both breadth of product portfolio and the manufacturing capability to deliver the lower-priced LIDAR with multiple specifications at scale for real world applications… including consumer vehicles for ADAS systems, industrial robotics, delivery systems, smart cities, shuttles and many more.”

Non-Automotive Applications Flourish

The Company is a first mover in the LIDAR industry supplying over 300 customers and partnered with companies like Ford Motors NYSE: F, Baidu NASDAQ: BIDU, Micron Technology NYSE: MU and Hyundai targeting over 25 market segments beyond automotive. Robotic delivery systems are now approved in 11 states, including Texas, Florida and cities like Palo Alto and San Francisco. Last-mile applications including, “transitioning from human to LIDAR equipped robotic delivery leaves a 96% cost savings by reducing an expense of $1.60 per package down to $0.06 per package.”, stated CEO Gopalan during the Q3 conference call. The Velarray M1600 is a solid-state LIDAR sensor that provides autonomous robots with near-field perception up to 30 meters and 32-degree vertical field of view enabling them to “traverse unstructured changing environments”. It provides autonomous mobile robotic operations in warehouse, retail centers, industrial plants, and medical facilities.

May Mobility

On Dec. 16, 2020, Velodyne announced sales agreement for its Alpha Prime sensors with May Mobility, a pioneer in autonomous vehicle (AV) technology. Velodyne will provide 360-degree surround view perception technology Alpha Prime sensors for May Mobility’s entire growing fleet of self-driving shuttles. May Mobility has been operating autonomous shuttle in Grand Rapids, MI, providing over 265,000 rides since 2018. The Company plans to deploy more shuttles in 2021 in Arlington, TX, and Higashi-Hiroshima City, Japan. Velodyne CEO Gopalan summed it up, “May Mobility is demonstrating how Velodyne’s LIDAR sensors help making self-driving shuttles safe and efficient, positioning them close to public transit gaps and bottlenecks.”

VLDR Opportunistic Pullback Levels

We use the rifle charts on the monthly and weekly time frames to provide a larger perspective of the playing field for VLDR shares. The monthly rifle chart has been in an uptrend with rising a 5-period moving average (MA) near the $18.53 Fibonacci (fib) level. The momentum is also strong with the monthly stochastic cross up at the 40-band. The monthly upper Bollinger Bands at $23.17 are expanding. The weekly rifle chart is forming a new uptrend powered by the stochastic mini pup. The 5-period MA is overlapping with the market structure low (MSL) buy trigger above $18.67. The weekly stochastic mini pup is powering the uptrend and relatively fresh as it grinds up through the 35-band. On the flipside, the weekly rifle chart also formed a market structure high (MSH) sell trigger below $24.33, formed on the earlier pup breakout in August 2020. Prudent investors looking for exposure can watch for opportunistic pullback levels at the $21.94 fib, $19.46 fib, $17.21 fib and the $16.56 fib. Potential upside trajectories range from the $29.39 fib to the $40.66 fib.

Before you consider Velodyne Lidar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Velodyne Lidar wasn't on the list.

While Velodyne Lidar currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report