Weyerhaeuser NYSE: WY, one of the largest private owners of timberland worldwide, watched its stock lose more than half its value in the blink of an eye at the onset of the pandemic. Investors feared that the pandemic would cause housing – and by extension lumber – demand to tank. So, they rushed for the exits.

To say those fears have been unrealized would be an understatement. We’ve seen a housing boom, with record low-interest rates and a remote worker migration acting as catalysts.

The demand for lumber has skyrocketed, and timberland owners have been unable to ramp up production to meet the demand. Lumber is currently trading at $1,292 per thousand board feet. That number probably means nothing to you unless you’re a lumber trader or builder, so I’ll put it in terms that make sense to any trader: lumber prices have more than tripled since the start of 2020. But WY shares have actually only increased by 26.5% over the same time period.

Now, it’s not as if Weyerhaeuser has a perfect positive correlation with lumber prices, but it’s surprising to see shares lag by that much. The underperformance indicates that investors think that lumber prices are unlikely to stay near their current highs.

But the market’s expectations seem to be too low. Again.

Lumber Demand Isn’t Going Away

On Weyerhaeuser’s fourth-quarter earnings call, CEO Devin W. Stockfish offered a few reasons why high demand for lumber is likely to persist:

“As we progress into 2021, we expect numerous macroeconomic tailwinds will continue to drive favorable U.S. housing activity, including a post-COVID preference for larger single-family homes supported by ongoing work-from-home flexibility, mortgage interest rates near record lows, strong homebuilder confidence, record low inventory for existing home sales, demographic trends that support growing millennial homeownership while older adults are deciding to age in place and the possibility of a federal tax credit for first time homebuyers under the Biden administration.”

Speaking of the Biden administration, the proposed $2.3 trillion infrastructure package is going to increase demand for a lot of materials – including lumber.

But the projected number of new homes built is what will truly make-or-break WY shares.

There are three indicators that we will see a lot of new home construction over the next 3+ years.

- Since the 2008 recession, there haven’t been enough homes built in the United States. Housing starts only recently approached historical averages. We’re seeing record-high median home prices due to the supply shortage. Heck, countless homeowners have reported getting several calls from potential buyers asking if they’d considering selling.

- While interest rates have ticked up since bottoming out around New Years, the 30-year mortgage rate is still extremely low by historical standards at 3.13%. If anything, FOMO could motivate more people to pull the trigger on a home purchase before rates really

- The migration of city dwellers to the suburbs is only just beginning. Thousands of professionals are waiting to see if they will be able to work from home post-COVID before making a permanent move. Many of them will get clarification sometime this year, and a good percentage of the ones who know they will be able to work from home long-term will opt to move to the suburbs.

Granted, these tailwinds aren’t going to last forever, but it seems that the market has not fully priced them into shares.

How Should You Play Weyerhaeuser?

To be clear, it’s not like WY shares should have tripled along with lumber prices. Or even doubled, for that matter. But shares could easily rally 20-30% from here.

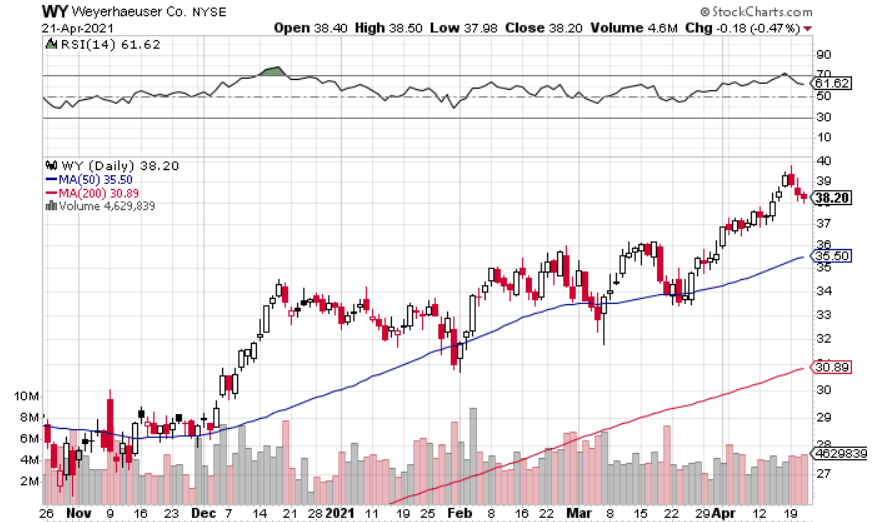

The company is set to report its first quarter earnings on April 30, which could lead to a quick rally if management strikes the right chords. Right now, WY is on a three-session losing streak, but shares have only dipped slightly.

Of course, it’s possible that WY shares will pull all the way back to the 50-day moving average. But with Biden’s infrastructure package potentially passing in the very near future and first quarter earnings just over a week away, it might be best to get in sooner rather than later.

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report