What Will The September NFP Data Tell Us?

There has been a debate raging in both political and business circles that is about to be answered. The question? How are Federal unemployment subsidies enacted in the wake of the COVID-19 pandemic impacting labor markets now? On one side of the argument are those who say its low wages, a lack of attractive jobs, and COVID-19 that are to blame while on the other, critics claim unemployed persons are making more by not working and thereby sitting on the sidelines. Well, those subsidies ran out in early September so we should start getting evidence of the answer soon, as in this week when they release the NFP report.

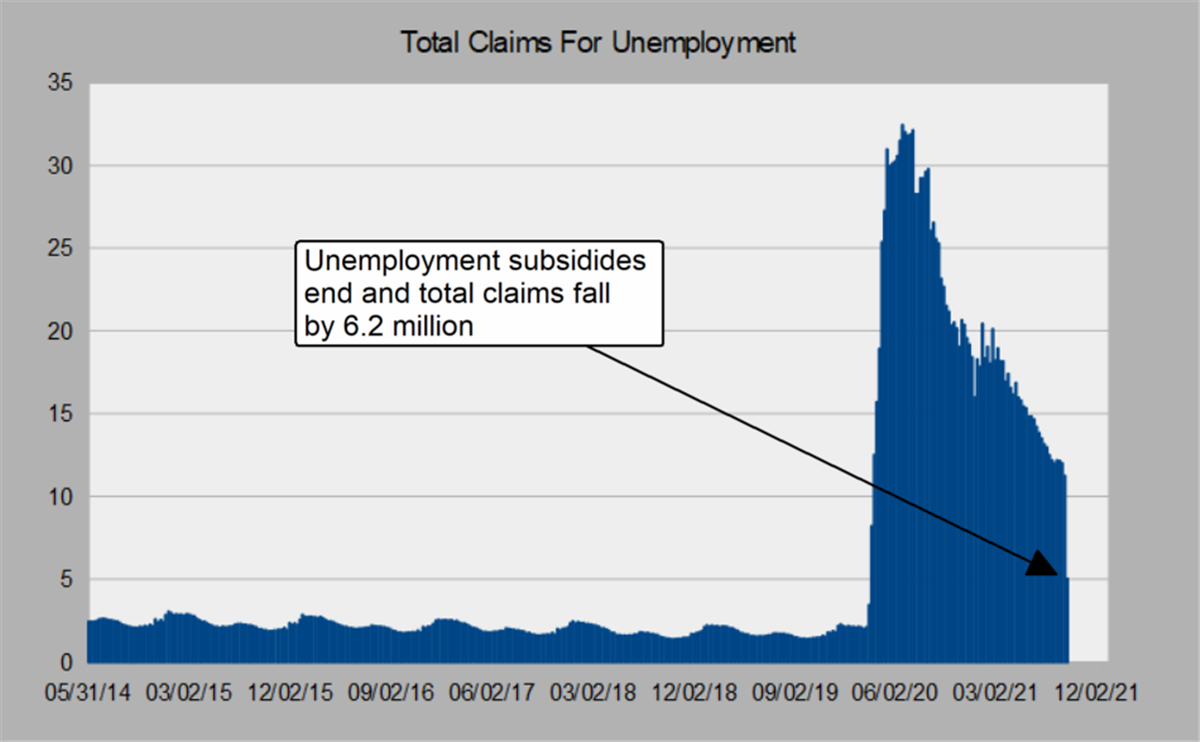

Unemployment levels should fall drastically

Federal unemployment subsidies ended in early September so those receiving them fell off the books the week beginning September 6th. That same week, the week ending Saturday, September 11th, saw the total number of unemployed Americans fall by over 6.2 million, the single largest drop in recorded history. The total number of Americans claiming unemployment is now just over 5.0 million and the lowest its been since the pandemic began. This does not guarantee that 6.2 million people went out to get jobs but, based on the high levels of job openings, it wouldn’t be difficult to put people to work.

The latest read on the JOLTs report has job openings running near 11 million in July, just weeks before the unemployment benefits ran out, and the number of openings was trending higher. The Challenger, Gray & Christmas report on layoffs and planned hirings confirms the outlook. While intentions for hiring have backed off from last year’s record levels intent for hiring is strong and has 2021 on track to be the second strongest hiring year on record. Likewise, the Marketbeat.com economic calendar reveals the ISM report on manufacturing, the Philly Fed’s MBOS, and the Empire State report on manufacturing conditions support the idea of job availability and positive hiring trends.

September Hiring Should Be Strong, But…

September hiring should be strong but there is a caveat to be aware of. While the data suggests September job creation could easily run in the 1 to 4 million range it really depends on when they take the survey. Job benefits ran out the first week of September and surely sparked a rush to employment but it may have taken a week or more for that rush to really get started. The NFP report is the result of two surveys that are taken on or about the 12th day of the month. Last month the 12th fell on a Sunday which means the two surveys were likely taken in different weeks and it’s possible neither truly reflects the impact of those 6 million new job-seekers.

As always, the NFP data should be taken with a grain of salt. The most important piece of the data this month should be job creation but it will more likely be the revisions to previous months. We expect to see upward revisions to the data and possibly strong upward revisions driven by steadily declining levels of unemployment and high availability of jobs. If there is no influx of new hires this month they may show up in the data next month.

Labor Markets Are Strong

Regardless of the number of new jobs created in September, we expect job creation to be positive and strong. Assuming this is the case, the consumer is also strong and that should support spending and economic activity over the next year. The state of current economic conditions, ie the global supply chain issues, is ultimately a net positive for hiring and the consumer.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report