Is it even possible that companies like

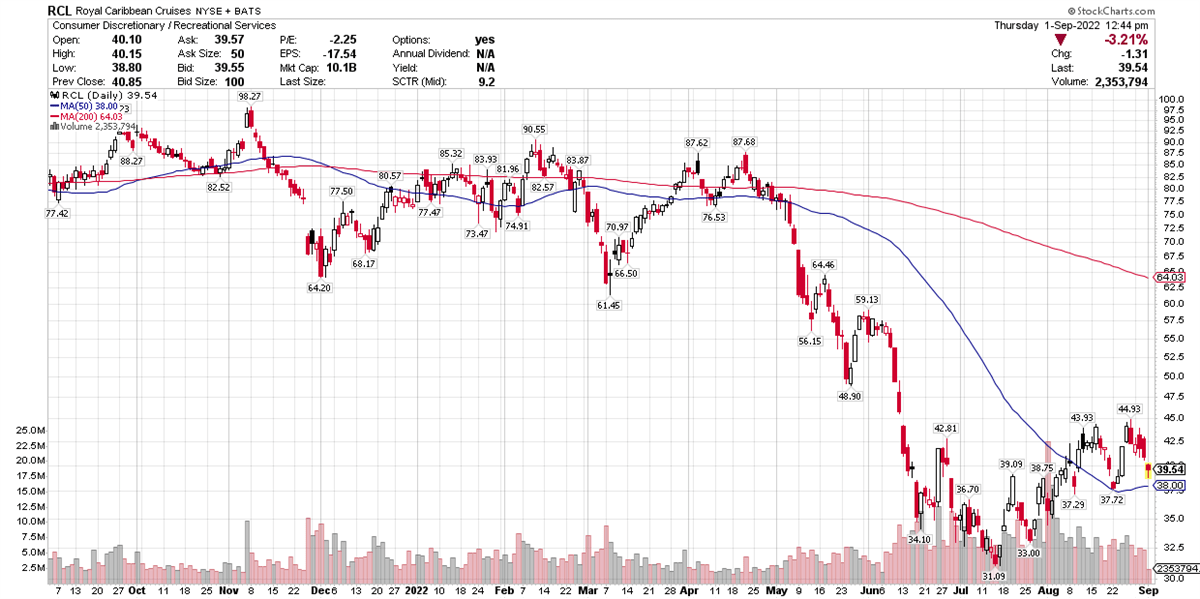

Royal Caribbean Cruises NYSE: RCL can ever return to smooth sailing?

Prior to 2020, the company was posting steadily increasing earnings. Then, of course, it hit that iceberg. It reported a loss of $18.31 per share in 2020, and an even bigger loss, $19.19 per share, last year.

This year, analysts expect a much narrower loss, of $6.81 per share. The company is expected to turn a profit next year.

Revenue has been improving in recent quarters, and the company has even beaten earnings estimates in the past two, as MarketBeat data show.

Not only did the reality of Covid closures devastate business, but you could debate whether sentiment toward the virus and its spread in relatively close quarters continues to hurt the industry. In the very early days of the pandemic, there were headlines about cruise ship passengers quarantined due to the virus. It’s possible that some potential cruise customers remain frightened.

However, on the flip side, Carnival NYSE: CCL shares climbed 4.74% in August, following the company’s report of a sharp increase in bookings as it lifted some Covid-era restrictions. Like Royal Caribbean, Carnival has also seen a sharp revenue increase in the past few quarters.

Balancing Safety And Growth

Yes, it’s tempting in this day and age to make this a political argument, as everything is, that pertains to Covid. But for investors in cruise companies, customer safety is absolutely a concern that factors into revenue and earnings growth. So it’s an issue of both health and economics.

But cruise operators know they have to do more to attract customers back, as well as making the ships more attractive to new customers, and simply keeping up with 21st century technology.

Toward that end, Royal Caribbean is rolling out a partnership with Elon Musk’s privately held SpaceX, to include Starlink satellite broadband on its ships. The cruise line tested the service on its Freedom of the Seas vessel, which sails for three or four days out of Miami.

The official Starlink launch is September 5, although on its Twitter account, Royal Caribbean is not yet offering specifics about the price for users. In response to questions, Royal Caribbean’s Twitter account has repeatedly posted, “We're currently working on deploying Starlink on Royal Caribbean International, Celebrity Cruises and Silversea Cruises ships, with complete installment expected by the end of the first quarter 2023. As we move further along, we’ll be providing more updates and information.”

In a statement announcing the partnership, Royal Caribbean CEO Jason Liberty said, “Our purpose as a company is to deliver the best vacation experiences to our guests responsibly, and this new offering, which is the biggest public deployment of Starlink’s high-speed internet in the travel industry so far, demonstrates our commitment to that purpose. This technology will provide game-changing internet connectivity onboard our ships, enhancing the cruise experience for guests and crew alike. It will improve and enable more high-bandwidth activities like video streaming as well as activities like video calls.”

Keeping Pace With Customer Demand

With cruisers expecting the same connectivity they would find on a land-based vacation, the move is not really to add a luxury, but to keep pace with customer demand. That also means rival cruise operators will have to add the same level of connectivity.

Technology isn’t the only area where the company, as well as industry peers, are continuing to expand.

Royal Caribbean is in the final months of completing a $125 million cruise terminal in Galveston, Texas. The 170,000-square-foot building is slated to open in November. According to Royal Caribbean, the opening “will mark the first time Galveston welcomes the world's largest cruise ships, beginning with Allure of the Seas of the cruise line's signature Oasis Class.”

The terminal will feature state-of-the-art technology including mobile check-in and facial recognition. It also features an environmentally sustainable design.

The continued investment and innovation bode well for the industry’s future, especially as Covid fears continue to ease.

Before you consider Royal Caribbean Cruises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Caribbean Cruises wasn't on the list.

While Royal Caribbean Cruises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report