What are FAANG companies and what are FAANG stocks, exactly?

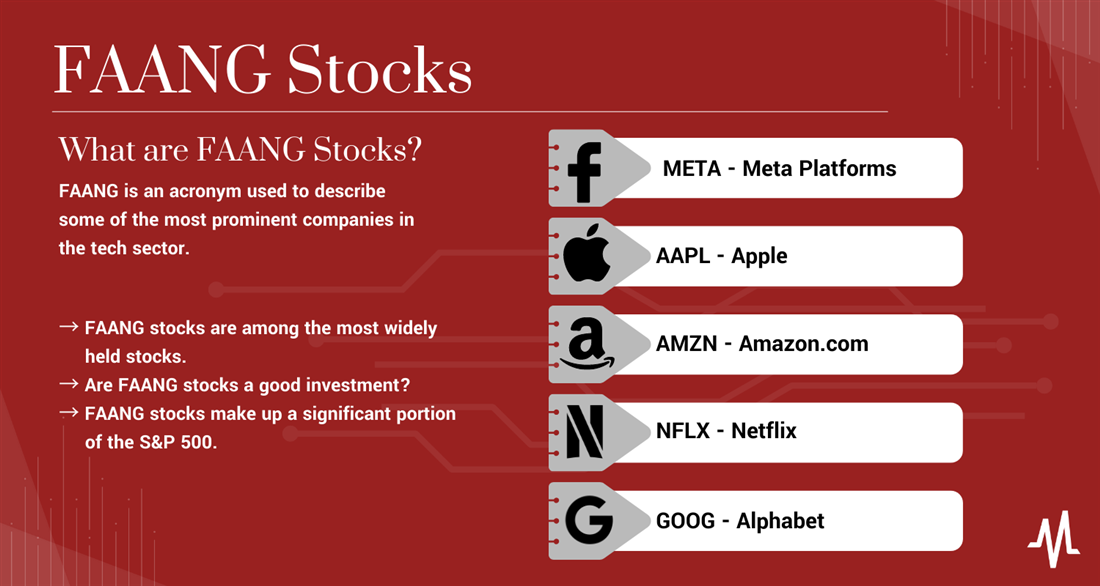

"FAANG" is an acronym referring to Facebook, Amazon, Apple, Netflix and Google — five similar tech stocks that are well-known for their major market capitalizations and innovative development processes. Monitoring the performance of FAANG stocks can help you predict the resulting effects on major indexes, as these companies make up major components of indexes like the S&P 500.

While the FAANG stock meaning refers to a specific list of companies, familiarizing yourself with past and future performance of these assets can help predict which emerging tech stocks are worth investing in. Read on to learn more about past FAANG stock performance, the future of these companies and how you can invest in these tech powerhouses.

What Exactly Are FAANG Stocks?

What Exactly Are FAANG Stocks?

What are the new FAANG stocks?

Coined by financial analyst Jim Cramer, FAANG stocks refer to five specific companies; however, the catchy term is a bit outdated due to corporate name changes. What are the FAANG stocks, including the "new" ones on the list?

The companies that now make up this list and define the FAANG stocks meaning include:

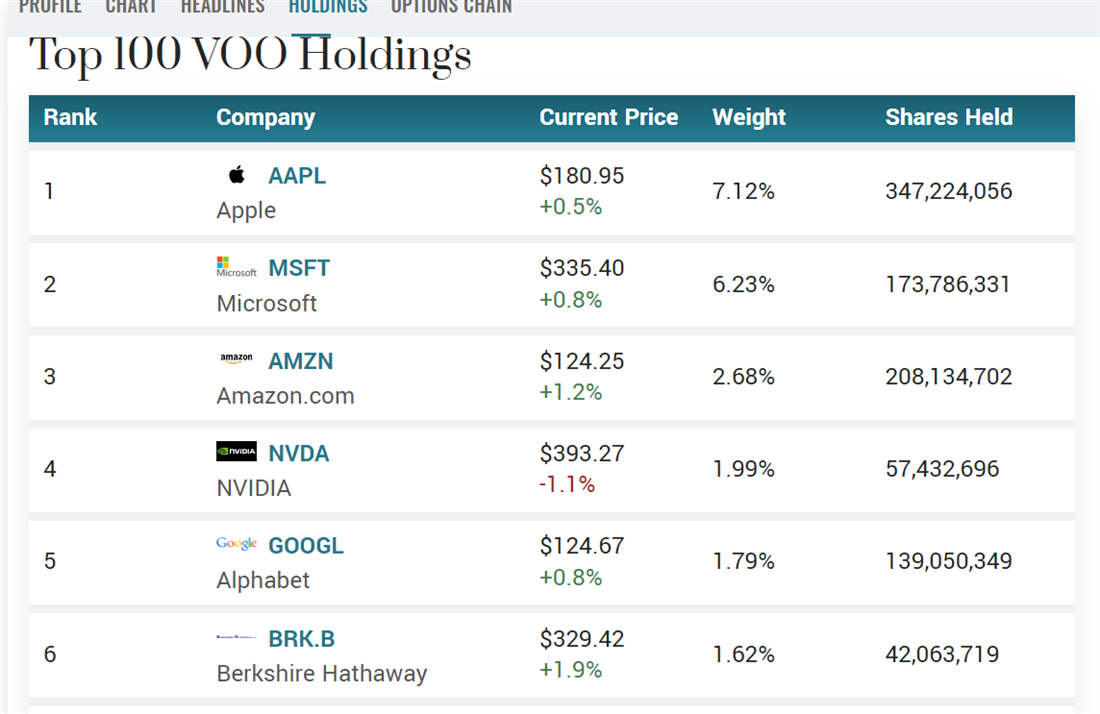

FAANG stocks are important because they have a major influence on the world economy, primarily thanks to their high total market capitalizations. For example, in June of 2023, Google had a total market capitalization of more than $1.59 trillion, one of the largest in the world. It also makes up more than 2% of the Vanguard Mega Cap ETF (NYSE: MGC), an exchange-traded fund (ETF) comprised of companies with the largest market caps. FAANG stocks make up almost 14% of the fund, showcasing these companies' importance.

Image: Apple (a FAANG stock), makes up more than 7% of VOO, a major S&P 500 index fund.

Exploring the Components of FAANG: A Closer Look

Now that you understand FAANG stocks and why these companies have significant impacts on the overall economy, let's learn more about the specific companies that make up the FAANG companies list.

Meta Platforms (NASDAQ: META), formerly known as Facebook, is a leading social media and technology company. While you might already be familiar with Meta for its sprawling social media infrastructure (including names like Instagram, WhatsApp and Facebook), it also invests in various emerging technologies.

Meta has shifted its focus largely to building the "metaverse," a virtual shared space that aims to provide immersive and interactive experiences. The company envisions a future where people can work, play and connect in this digital realm. This strategic shift reflects Meta's aim to explore new revenue streams beyond its traditional social media offerings. Other major names in tech, including Apple, have also partnered with Meta to further integrate new tech (like augmented reality) into the metaverse.

Image: Since transitioning from the singular Facebook to the comprehensive Meta platform, the company and investors have seen handsome returns.

Image: Since transitioning from the singular Facebook to the comprehensive Meta platform, the company and investors have seen handsome returns.

Meta Platforms acquired Oculus VR in 2014, a leading virtual reality company. It has since developed the Oculus Rift and Oculus Quest virtual reality headsets, popular niche gaming devices that provide convenient access to VR experiences. Meta aims to leverage these technologies to enhance user experiences within the metaverse and explore applications in gaming and communication. In June 2023, Meta Platforms boasted a total market capitalization of almost $700 billion.

Amazon.com

Regarding online shopping and consumer discretionary purchases, it's impossible to converse without mentioning Amazon.com (NASDAQ: AMZN). While most investors are familiar with the company's retail site, Amazon operates multiple business segments, including cloud computing, digital content and smart device app and manufacturing.

Amazon can be a strong option for inventors looking for FAANG stocks with high growth potential. The company has consistently expanded its product offerings, entered new markets, and innovated in areas like logistics and delivery. Amazon Web Services has emerged as a dominant player in the cloud computing industry, providing a significant revenue stream for the company. In 2023 and beyond, Amazon is continuing to look for additional avenues of product expansion, including pharmaceuticals and other healthcare services.

Apple Inc.

Like Amazon.com is a global leader in e-commerce and online sales, Apple Inc. (NASDAQ: AAPL) is a globally-recognized tech company best known for its innovative consumer economics. The company's success lies in its ability to design and develop consumer electronics, software, and digital services that resonate with a large customer base, developing a cross between lifestyle and tech marketing.

Apple's current product lineup includes the iPhone, iPad, Mac computers, Apple Watch and various lifestyle and music software applications. These devices have become integral to people's lives, driving consumer demand and brand loyalty. Apple's ecosystem, including the App Store, iCloud, Apple Music and other services, further enhances its customer engagement and revenue streams. As a result, Apple has seen exceptional growth that has largely outpaced competing electronic manufacturers in the sphere, even following COVID-19.

Image: Apple’s continuous commitment to product innovation and its loyal consumer base are two qualities that attract investors to Apple.

Image: Apple’s continuous commitment to product innovation and its loyal consumer base are two qualities that attract investors to Apple.

Apple's focus on elegant design and intuitive user experiences has been a key factor in its continued success. Apple products are known for their sleek aesthetics, user-friendly interfaces that even grandparents can master and seamless integration across devices. This emphasis on design has created a strong emotional connection with customers and differentiated Apple from its competitors — a feature that shows in its company valuation. In June 2023, Apple had a total market capitalization of $2.85 trillion, making it the largest FAANG stock on our list.

Netflix

From drama-packed reality series like "Love is Blind" to dark comedies that make you laugh and think like "Bojack Horseman," Netflix Inc. (NASDAQ: NFLX) has something for everyone. Conceived as a DVD-by-mail rental system, the company has since expanded to become one of the world's largest streaming entertainment centers. In exchange for a monthly fee of around $15 per month or less, viewers can access a vast library of movies, TV shows, documentaries and mobile gaming.

Netflix's proprietary content and innovative partnerships with indie storytellers and major Hollywood names have propelled it to household name status. Netflix invests heavily in producing and acquiring high-quality original content, creating exclusive series and films that have garnered critical acclaim and a dedicated fan base. This model contradicts previous streaming models, which used to solely offer content licensed from third parties like Fox and Disney. It has also driven customer loyalty, as subscribers maintain their accounts waiting for new programming seasons that you can only see on the Netflix app.

Netflix is also committed to customer convenience, further driving its runaway success. TV and web applications feature personalized recommendation algorithms that enhance the viewing experience, making it easy for subscribers to discover and enjoy content tailored to their interests. The company's focus on data-driven insights and personalization has helped drive customer satisfaction and engagement, leading to a total market capitalization of $178 billion in June 2023.

Alphabet

Perhaps the largest-reaching of FAANG stocks, Alphabet Inc. (NASDAQ: GOOG) is a multinational corporation best known as the parent company of the search engine company Google. In June 2023, Alphabet had a total market capitalization of $1.59 trillion, making it the second-largest FAANG stock behind Apple.

Alphabet's core business centers around Google's internet-related products and services, including its search engine and its online advertising platform, Google Ads. Google Ads is an independent advertising service that allows retailers to target online advertisements to users looking at content that corresponds with the advertiser. This unique online ad experience has been wildly successful, allowing marketers to generate a more genuine connection with their audiences.

Image: GOOG has seen steady increases in its earnings per share, as its YouTube platform grows in popularity, creating a positive feedback loop of new users and higher revenue.

Image: GOOG has seen steady increases in its earnings per share, as its YouTube platform grows in popularity, creating a positive feedback loop of new users and higher revenue.

For example, a retailer selling used handbags can use Google Ads to ensure that their advertisements are displayed on fashion blogs. In exchange, the blogger hosting the ad receives a portion of the revenue generated per click, with the remainder going to Alphabet in exchange for coordinating the services. The company has extended this targeted advertising model using its YouTube platform, the world's largest free video entertainment site.

In addition to its primary marketing and advertising businesses, Alphabet has diversified its portfolio with investments in third-party sectors. It currently holds a series of stakes in innovative startups, including autonomous vehicle company Waymo and health data organization platform Verily. These ventures aim to explore additional, unrelated technologies and potential future growth areas, which can appeal to investors looking to capture capital appreciation.

|

Component

|

Primary service

|

Total market capitalization

|

P/E ratio

|

Dividend yield

|

Exchange

|

|

Meta Platforms

|

Social media

|

$698.39 billion

|

33.82

|

N/A

|

NASDAQ

|

|

Amazon.com

|

Online retail and e-commerce

|

$1.27 trillion

|

295.82

|

N/A

|

NASDAQ

|

|

Apple, Inc.

|

Retail tech

|

$2.85 trillion

|

30.72

|

0.53%

|

NASDAQ

|

|

Netflix

|

Streaming services

|

$178.02 billion

|

43.06

|

N/A

|

NASDAQ

|

|

Alphabet

|

Search engine services

|

$1.59 trillion

|

27.89

|

N/A

|

NASDAQ

|

Where Do FAANG Stocks Trade?

The FAANG stocks all trade on the NASDAQ Exchange, and locating shares is never a problem. Every major American broker will have access to FAANG stocks; trade execution will be quick and smooth.

How to Buy FAANG Stocks

Buying FAANG stocks is easy since they've been some of the top-rated tech stocks over the last decade. However, consider planning your trades and have goals for your investments.

Step 1: Open a brokerage account.

Check out the features and tools various brokerage firms offer and choose the one that best fits your needs.

Step 2: Fund your account.

How much capital will you devote toward your FAANG stock investments? Buying individual stocks is always risky, especially in the tech sector. Be sure to limit your exposure to any particular stock or group of stocks if you want to build a diverse portfolio.

Step 3: Determine which FAANG stocks to buy.

Which FAANG stocks are choices for your portfolio? You can buy all five in equal proportions, but you don't have to. Buy the stocks you feel most confident about or equally weight your holdings across all five. Another option would be a FAANG ETF, which provides exposure to all five companies through a single security.

Step 4: Plan your trades.

Are you trading for the short term or investing for the long term? Know how long you want to hold your positions and your profit goals and loss limits for each stock.

Step 5: Open your positions.

With your account funded and trades planned, it's time to buy stocks. Look them up on your broker's website or app and open the positions you laid out in your investment plan.

The Significance of FAANG in the Stock Market

The older stocks like Amazon and Apple have all suffered significant declines, but the FAANG group looked impervious to long drawdowns. However, 2022 was the worst year in a decade for this group. Facebook suffered the worst, but all five companies saw their stocks decline by 30%, even the group's stalwart Apple. The outlook for the FAANG group remains murky, considering current inflation levels and the reversal of cheap money policies.

However, FAANG stocks are important to the overall stock market due to their significant size and market capitalization. Most stocks listed above are major components of overall market index funds and mutual funds — two core components of retirement savings for many Americans. Suppose you invest for retirement through a tax-advantaged account sponsored by your employer (as with most workers). In that case, your retirement funds directly link to the FAANG companies' performance.

Index composition isn't the only factor that makes FAANG companies important to the overall economy. These companies are major employers in their industry, directly and indirectly creating millions of jobs surrounding their respective product or service. These companies also must partner with smaller operations to keep their employees supported, healthy and happy, contributing to smaller business growth. Budget cuts and layoffs at FAANG companies can have compounding effects on other stocks and the economy for these reasons.

Finally, FAANG stocks inspire investor confidence because they have achieved the status of being household names. The original list of FAANG companies was selected in 2013 by CNBC Mad Money host Jim Cramer, who described them as "totally dominant in their markets," creating a positive feedback loop among investors, with new tech innovations driving new investments and new investments funding projects and expansions. Increased investment in FAANG stocks stimulates liquidity in the market, facilitates business expansion and contributes to overall economic activity.

How FAANG Stocks Have Influenced the Tech Industry

As the biggest names in the tech sphere, it's easy to see how FAANG stocks influence the economy as a whole. But how have these corporations shaped the tech industry itself?

FAANG companies are unique because they have each made a major impact on their respective arena of the tech industry. For example, Amazon.com's original direct-to-consumer bookstore revolutionized the e-commerce industry, providing customers one of the first opportunities to shop online. Similarly, Alphabet's Google search engine was one of the first to begin developing crawler technology, giving it a headstart in becoming today's industry leader.

FAANG companies also have unprecedented access to personal data thanks to their social components and ubiquity. Companies like Alphabet and Meta Platforms have leveraged the power of data to gain deep insights into user behavior, preferences and trends. While these data insights have not been integrated without criticism, they have proven to be a powerful sales tool.

These sophisticated algorithms and artificial intelligence systems enable personalized experiences, recommendations, and targeted advertising to serve customers and investors better. This data-driven approach has transformed how businesses understand and engage with their customers, leading to higher customer satisfaction and more effective marketing strategies. Smaller businesses and tech companies have mirrored these approaches, adopting personalized services and highly targeted marketing strategies.

When comparing the recent chart performance of FAANG stocks with non-FAANG tech stocks, it's clear to see why investors find these market leaders so attractive. However, these stocks also tend to retain value during periods of volatility better when compared to non-FAANG companies as well.

For example, Apple and EV powerhouse Tesla (NASDAQ: TSLA) saw sharp dips followed by meteoric rises shortly following the beginning of the COVID-19 pandemic. However, as you can see from the charts below, Apple showed more consistent value retention on its rise to the top when compared to the electronic car manufacturer. We can see this with additional FAANG stocks like Alphabet as well. This enhanced level of stability, while also providing consistent returns, has made FAANG stocks top-rated among long-term investors.

Image: Apple’s share price journey has been a rewarding ride for investors, retaining consistent price increases until 2022.

Image: Apple’s share price journey has been a rewarding ride for investors, retaining consistent price increases until 2022.

Image text: While Tesla share prices have also brought capital appreciation for investors, its stock has shown considerably more volatility when compared to the previous two NASDAQ contenders.

Investing in FAANG: Is it the Right Move for You?

As components of most major stock indexes, you likely already have some exposure to FAANG stocks in your portfolio. Consider the following before increasing your concentration of these major blue-chip holdings.

Factors to Consider Before Investing in FAANG Stocks

FAANG stocks operate in highly competitive market segments, making it important for potential investors to research before buying. Consider factors like:

- Competitive edge: Look at how each FAANG stock positions itself in the market and what makes it stand out from others in the sector. Look for stocks with an upcoming product launch or new revenue stream to add a competitive edge to your portfolio.

- Drivers of new growth: FAANG stocks are known for their innovative products and have large budgets devoted to research and development. These factors position FAANG stocks as ideal growth options for capital appreciation. Identify the key growth drivers for the company. Analyze factors such as announcements of new products and services, expansion into new markets, acquisitions and partnerships. Consider how these initiatives align with the company's overall strategy and their potential impact on revenue and profitability.

- Regulatory environment: Most FAANG companies are involved in data collection and marketing, which has been the subject of changing regulatory standards. Stay informed about regulatory developments that could impact each company's operations. Consider factors like data privacy regulation and potential regulatory scrutiny from the SEC, in particular, when evaluating FAANG stocks. Assess how the company manages regulatory risks and its ability to comply with evolving regulations.

Tips for Analyzing and Evaluating FAANG Stocks

You'll want to analyze the following factors before buying FAANG stocks:

- P/E ratio: The price-to-earnings (P/E) ratio is a valuation metric that compares a company's stock price to its earnings per share. It indicates how much investors will pay for each dollar of earnings. Most FAANG stocks have higher P/E ratios, which may indicate positive investor sentiment and overvaluation. Consider the company's prospectus and upcoming projects when comparing P/E ratios to competitors.

- Dividend payment: A dividend is a portion of company revenue paid back to shareholders in exchange for holding the stock. Most FAANG stocks do not pay a dividend. If you're looking for an immediate return on your investment, Apple's 0.53% dividend yield can make it the most attractive option from the FAANG list.

- Earnings per share: A company's earnings per share (EPS) represents the portion of common stock profit allocated to each outstanding share. A higher EPS indicates that a company is managing profits and costs effectively, which can be particularly important if you take a long-term investment strategy.

Are FAANG Companies a Good Investment?

FAANG stocks have been a terrific investment if you began buying shares shortly after the origination of the acronym. But now this group is entering an unfamiliar economic environment, especially Meta Platforms, which has never traded publicly during rising interest rates. The tech sector is expecting layoffs and could hit if the U.S. enters a recession in 2023, so the outlook for the FAANG group is cloudier than in years past, just like the broader tech sector.

Diversifying Your Portfolio: Including FAANG Stocks

As an investor, you've probably heard that diversification is important. But what exactly does that mean? Portfolio diversification is a risk management strategy that spreads investments across different asset classes and sectors to reduce exposure to any single investment. By diversifying, you can mitigate the impact of potential losses from any one investment and increase the potential for overall portfolio stability and long-term growth.

You can diversify your investment by including multiple FAANG stocks into your portfolio. Your broker may also recommend FAANG competitors operating within the same industry as you invest. If you're a growth-oriented investor, consider adding multiple competitors in the tech sector to limit your exposure to any individual company.

Can You Invest in a FAANG ETF?

Yes, you can invest in a FAANG ETF from Direxion, but there are a few important caveats to discuss. First, the securities offered by Direxion that track FAANG stocks are leveraged, meaning they outperform when FAANG stocks do well and underperform when they do poorly.

Leveraged ETFs also have complex structures and often shift away from their targeted index over time, resulting in tracking errors. Use caution when investing in these FAANG ETFs (or any ETF or security that uses leverage).

Future of FAANG Stocks

FAANG is an acronym coined by financial pundits to group Facebook, Apple, Amazon, Netflix and Google in 2013. At the time, these stocks were the darlings of the tech sector and their growth in the decade following Facebook's IPO was nothing short of remarkable. But nothing lasts forever in markets, and all five companies saw their impressive runs cut short as tech melted down toward the end of 2021.

Four of the five companies in the FAANG group have all been public for 15+ years, but this type of market environment is unique for all of them. This group of stocks never traded during a period of high inflation and rising interest rates. Matching the gains produced through the pandemic period will be difficult and these stocks could underperform the market if inflation and high rates prove stickier than anticipated.

However, all five companies have substantial footprints in their industry and certainly aren't in mortal danger. The outlook may be uncertain due to economic conditions beyond the control of these firms, but they'll be a mainstay in millions of portfolios for a long time to come.

If you have a retirement account, chances are high that you already have exposure to FAANG stocks. To learn more, investigate your retirement savings and the specific holdings you have exposure to. Most retirement accounts include total market or S&P 500 mutual funds, providing guaranteed exposure to all five FAANG companies.

We'll likely still use FAANG's products many years from now. One of the problems of concentrated sector investing (like investing in FAANG stocks) is when economic conditions change. Low borrowing costs and minimal inflation boosted tech giants, but those factors are changing quickly. The stocks themselves will be fine but will FAANG still be synonymous with impressive outperformance in the coming decade?

FAQs

What are the next FAANG stocks? While "FAANG stocks" refer to a specific set of companies, understanding these stocks further can help you identify new tech opportunities. The following are some last-minute questions you might have about FAANG stocks and the tech market.

Why are FAANG stocks so popular?

FAANG stocks have a track record of delivering strong financial performance and have become household names, gaining significant brand recognition. They operate in sectors with substantial growth potential, such as technology, e-commerce and streaming services, adding even more potential return for investors. FAANG stocks are also known for their innovative products and services, which have disrupted traditional industries and captured consumer demand. All of these characteristics make FAANG stocks popular with long-term investors in particular.

FAANG stocks have performed strongly in recent years. From 2016, these stocks experienced substantial growth, outperforming many other sectors. Increasing demand for technology services, especially during the COVID-19 pandemic, drove growth for FAANG stocks. Despite some fluctuations and market volatility, the overall trend for FAANG stocks has been positive, with significant gains in market capitalization and shareholder value.

What are the risks associated with investing in FAANG stocks?

Going beyond "What are the five FAANG stocks?" FAANG stocks operate in highly competitive market segments, meaning they must constantly stay innovative to retain market share. FAANG stocks like Meta Platforms have also been the subject of regulatory lawsuits, with data collection and privacy concerns at the forefront of legislature issues.