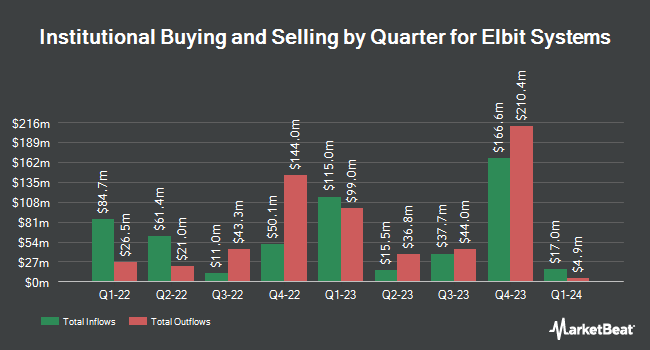

Sig Brokerage LP bought a new stake in Elbit Systems Ltd. (NASDAQ:ESLT - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm bought 2,291 shares of the aerospace company's stock, valued at approximately $591,000.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in ESLT. Vanguard Group Inc. boosted its holdings in Elbit Systems by 1.2% during the fourth quarter. Vanguard Group Inc. now owns 874,352 shares of the aerospace company's stock worth $229,268,000 after purchasing an additional 10,215 shares during the last quarter. Y.D. More Investments Ltd grew its stake in shares of Elbit Systems by 10.1% in the fourth quarter. Y.D. More Investments Ltd now owns 449,747 shares of the aerospace company's stock valued at $117,520,000 after acquiring an additional 41,401 shares in the last quarter. Invesco Ltd. raised its holdings in Elbit Systems by 13.1% in the 4th quarter. Invesco Ltd. now owns 338,256 shares of the aerospace company's stock valued at $87,294,000 after acquiring an additional 39,095 shares in the last quarter. Arrowstreet Capital Limited Partnership lifted its position in Elbit Systems by 177.7% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 227,102 shares of the aerospace company's stock worth $59,207,000 after purchasing an additional 145,324 shares during the period. Finally, Nuveen Asset Management LLC boosted its position in shares of Elbit Systems by 4.2% during the 4th quarter. Nuveen Asset Management LLC now owns 71,799 shares of the aerospace company's stock worth $18,779,000 after acquiring an additional 2,892 shares in the last quarter. 17.88% of the stock is owned by institutional investors.

Analyst Ratings Changes

Separately, StockNews.com lowered Elbit Systems from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, February 25th.

Check Out Our Latest Report on Elbit Systems

Elbit Systems Stock Performance

Shares of ESLT traded down $7.94 during trading hours on Wednesday, hitting $398.91. The company's stock had a trading volume of 69,858 shares, compared to its average volume of 71,763. Elbit Systems Ltd. has a 52-week low of $175.30 and a 52-week high of $426.40. The company has a debt-to-equity ratio of 0.10, a current ratio of 1.15 and a quick ratio of 0.64. The company has a market cap of $17.73 billion, a price-to-earnings ratio of 68.19 and a beta of 0.31. The business has a 50 day simple moving average of $393.33 and a two-hundred day simple moving average of $318.81.

Elbit Systems (NASDAQ:ESLT - Get Free Report) last released its earnings results on Tuesday, May 20th. The aerospace company reported $2.57 earnings per share for the quarter, topping analysts' consensus estimates of $2.30 by $0.27. Elbit Systems had a net margin of 4.00% and a return on equity of 11.34%. The firm had revenue of $1.90 billion for the quarter, compared to the consensus estimate of $1.69 billion. During the same period in the prior year, the firm earned $1.81 EPS. On average, equities analysts expect that Elbit Systems Ltd. will post 8.05 earnings per share for the current fiscal year.

Elbit Systems Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, May 5th. Stockholders of record on Tuesday, April 22nd were issued a $0.60 dividend. This represents a $2.40 annualized dividend and a dividend yield of 0.60%. This is a boost from Elbit Systems's previous quarterly dividend of $0.50. The ex-dividend date of this dividend was Tuesday, April 22nd. Elbit Systems's payout ratio is 27.72%.

Elbit Systems Profile

(

Free Report)

Elbit Systems Ltd. develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications primarily in Israel. The company operates through Aerospace, C4I and Cyber, ISTAR and EW, Land, and Elbit Systems of America segments.

Read More

Before you consider Elbit Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elbit Systems wasn't on the list.

While Elbit Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.