Granahan Investment Management LLC purchased a new position in shares of Digimarc Co. (NASDAQ:DMRC - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 249,435 shares of the information technology services provider's stock, valued at approximately $9,341,000. Granahan Investment Management LLC owned 1.16% of Digimarc as of its most recent filing with the Securities & Exchange Commission.

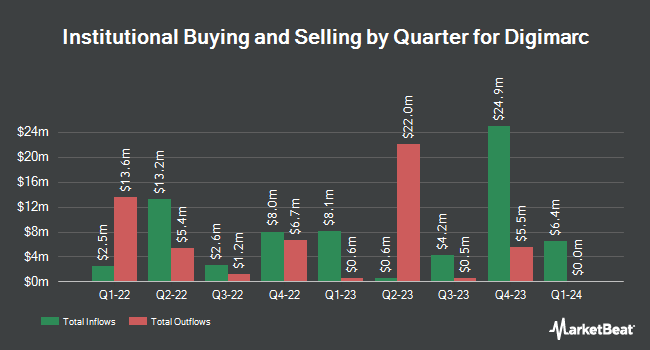

Several other hedge funds have also recently bought and sold shares of DMRC. Barclays PLC increased its stake in Digimarc by 240.9% in the third quarter. Barclays PLC now owns 25,172 shares of the information technology services provider's stock valued at $677,000 after acquiring an additional 17,788 shares during the last quarter. JPMorgan Chase & Co. increased its stake in Digimarc by 41.5% in the third quarter. JPMorgan Chase & Co. now owns 9,187 shares of the information technology services provider's stock valued at $247,000 after acquiring an additional 2,695 shares during the last quarter. Moody National Bank Trust Division bought a new position in Digimarc in the fourth quarter valued at approximately $574,000. SG Americas Securities LLC increased its stake in Digimarc by 65.6% in the fourth quarter. SG Americas Securities LLC now owns 6,538 shares of the information technology services provider's stock valued at $245,000 after acquiring an additional 2,590 shares during the last quarter. Finally, Allspring Global Investments Holdings LLC bought a new position in Digimarc in the fourth quarter valued at approximately $300,000. 66.85% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Needham & Company LLC decreased their target price on shares of Digimarc from $40.00 to $30.00 and set a "buy" rating on the stock in a research note on Thursday, February 27th.

Read Our Latest Research Report on DMRC

Digimarc Stock Up 0.2%

Shares of NASDAQ DMRC traded up $0.03 during midday trading on Tuesday, reaching $13.52. 14,110 shares of the company were exchanged, compared to its average volume of 164,557. Digimarc Co. has a one year low of $10.44 and a one year high of $48.32. The stock has a market cap of $291.30 million, a P/E ratio of -6.91 and a beta of 1.44. The stock's 50-day moving average price is $13.10 and its 200-day moving average price is $27.09.

Digimarc Company Profile

(

Free Report)

Digimarc Corporation, together with its subsidiaries, provides automatic identification solutions to commercial and government customers in the United States and internationally. The company offers Digimarc Validate protects, a cloud-based record of product authentication information; Digimarc Engage, an interactive communications channel connecting brands and consumers; and Digimarc Recycle.

Read More

Before you consider Digimarc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digimarc wasn't on the list.

While Digimarc currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.