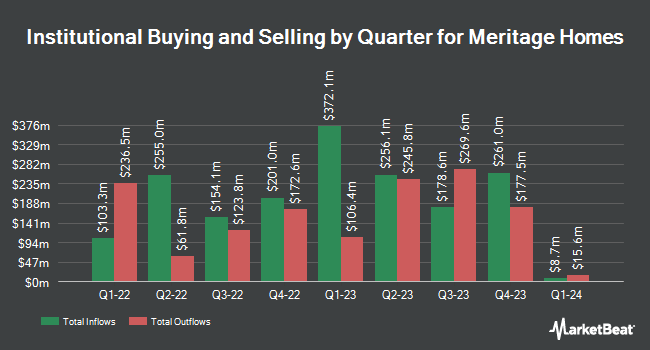

4D Advisors LLC bought a new position in shares of Meritage Homes Co. (NYSE:MTH - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 20,000 shares of the construction company's stock, valued at approximately $3,076,000. Meritage Homes accounts for approximately 2.1% of 4D Advisors LLC's investment portfolio, making the stock its 23rd largest holding.

Other hedge funds and other institutional investors have also modified their holdings of the company. Norges Bank bought a new position in shares of Meritage Homes in the fourth quarter valued at approximately $101,695,000. Groupama Asset Managment acquired a new stake in Meritage Homes during the 4th quarter worth about $76,910,000. Victory Capital Management Inc. increased its holdings in shares of Meritage Homes by 2,199.9% in the 4th quarter. Victory Capital Management Inc. now owns 305,605 shares of the construction company's stock valued at $47,008,000 after purchasing an additional 292,317 shares during the period. Hennessy Advisors Inc. acquired a new position in Meritage Homes in the 4th quarter valued at approximately $43,147,000. Finally, First Trust Advisors LP raised its stake in shares of Meritage Homes by 61.6% during the 4th quarter. First Trust Advisors LP now owns 571,120 shares of the construction company's stock worth $87,850,000 after purchasing an additional 217,618 shares in the last quarter. 98.44% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the company. UBS Group set a $107.00 price target on Meritage Homes in a research report on Friday, April 25th. JPMorgan Chase & Co. reduced their price objective on Meritage Homes from $89.00 to $70.00 and set a "neutral" rating for the company in a research report on Thursday, May 1st. Keefe, Bruyette & Woods reduced their target price on shares of Meritage Homes from $90.00 to $77.00 and set a "market perform" rating for the company in a research note on Monday, April 28th. StockNews.com lowered Meritage Homes from a "hold" rating to a "sell" rating in a research note on Monday, March 24th. Finally, The Goldman Sachs Group lowered their target price on shares of Meritage Homes from $117.50 to $100.00 and set a "buy" rating on the stock in a research note on Tuesday, January 14th. One research analyst has rated the stock with a sell rating, five have given a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $97.72.

Check Out Our Latest Stock Report on MTH

Insider Buying and Selling

In related news, CAO Alison Sasser sold 676 shares of the stock in a transaction on Wednesday, February 19th. The shares were sold at an average price of $72.03, for a total transaction of $48,692.28. Following the completion of the transaction, the chief accounting officer now owns 5,933 shares in the company, valued at approximately $427,353.99. This represents a 10.23 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, COO Clinton Szubinski sold 595 shares of Meritage Homes stock in a transaction dated Wednesday, February 12th. The shares were sold at an average price of $73.29, for a total value of $43,607.55. Following the completion of the sale, the chief operating officer now directly owns 30,547 shares in the company, valued at approximately $2,238,789.63. This represents a 1.91 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 1,683 shares of company stock valued at $122,547 in the last 90 days. 2.20% of the stock is owned by insiders.

Meritage Homes Price Performance

Shares of NYSE MTH traded up $2.42 during trading on Wednesday, reaching $68.93. The company had a trading volume of 360,916 shares, compared to its average volume of 882,409. The company has a debt-to-equity ratio of 0.26, a quick ratio of 1.75 and a current ratio of 1.61. The business's 50 day moving average price is $69.07 and its 200-day moving average price is $79.51. Meritage Homes Co. has a 52 week low of $59.27 and a 52 week high of $106.99. The stock has a market cap of $4.95 billion, a PE ratio of 5.27 and a beta of 1.50.

Meritage Homes (NYSE:MTH - Get Free Report) last issued its quarterly earnings results on Wednesday, April 23rd. The construction company reported $1.69 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.71 by ($0.02). The firm had revenue of $1.36 billion for the quarter, compared to analyst estimates of $1.34 billion. Meritage Homes had a net margin of 12.29% and a return on equity of 15.90%. The company's revenue was down 8.5% compared to the same quarter last year. During the same period last year, the company earned $5.06 EPS. Analysts expect that Meritage Homes Co. will post 9.44 earnings per share for the current year.

Meritage Homes Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Monday, March 17th were paid a dividend of $0.43 per share. The ex-dividend date of this dividend was Monday, March 17th. This is a boost from Meritage Homes's previous quarterly dividend of $0.38. This represents a $1.72 dividend on an annualized basis and a dividend yield of 2.50%. Meritage Homes's payout ratio is 14.06%.

Meritage Homes Profile

(

Free Report)

Meritage Homes Corporation, together with its subsidiaries, designs and builds single-family attached and detached homes in the United States. The company operates through two segments, Homebuilding and Financial Services. It acquires and develops land; and constructs, markets, and sells homes for entry-level and first move-up buyers in Arizona, California, Colorado, Utah, Texas, Florida, Georgia, North Carolina, South Carolina, and Tennessee.

See Also

Before you consider Meritage Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meritage Homes wasn't on the list.

While Meritage Homes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report