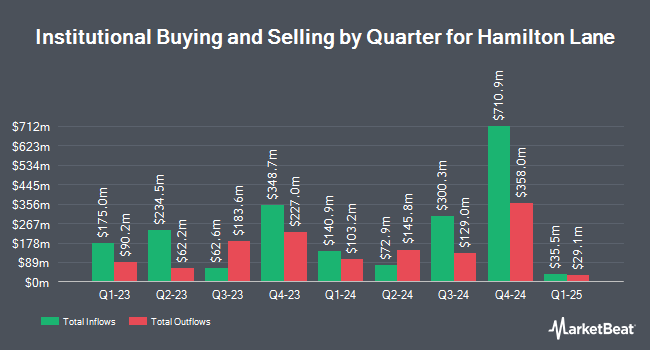

Crestline Management LP acquired a new position in Hamilton Lane Incorporated (NASDAQ:HLNE - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund acquired 5,166 shares of the company's stock, valued at approximately $765,000.

Several other hedge funds and other institutional investors have also bought and sold shares of the business. CBIZ Investment Advisory Services LLC increased its holdings in Hamilton Lane by 27.0% in the 4th quarter. CBIZ Investment Advisory Services LLC now owns 287 shares of the company's stock valued at $43,000 after buying an additional 61 shares during the period. Farther Finance Advisors LLC increased its holdings in Hamilton Lane by 283.3% in the 4th quarter. Farther Finance Advisors LLC now owns 299 shares of the company's stock valued at $44,000 after buying an additional 221 shares during the period. Kapitalo Investimentos Ltda bought a new position in Hamilton Lane in the 4th quarter valued at about $65,000. R Squared Ltd bought a new position in Hamilton Lane in the 4th quarter valued at about $213,000. Finally, Aigen Investment Management LP bought a new position in Hamilton Lane in the 4th quarter valued at about $221,000. Institutional investors and hedge funds own 97.40% of the company's stock.

Hamilton Lane Price Performance

Shares of Hamilton Lane stock traded down $3.58 during midday trading on Thursday, hitting $171.24. 132,870 shares of the company traded hands, compared to its average volume of 435,483. The stock has a market cap of $9.49 billion, a price-to-earnings ratio of 31.61 and a beta of 1.31. The company has a debt-to-equity ratio of 0.34, a quick ratio of 4.19 and a current ratio of 4.19. The firm's fifty day moving average price is $147.94 and its 200-day moving average price is $160.04. Hamilton Lane Incorporated has a 12 month low of $114.85 and a 12 month high of $203.72.

Hamilton Lane Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, April 4th. Investors of record on Friday, March 14th were given a dividend of $0.49 per share. The ex-dividend date was Friday, March 14th. This represents a $1.96 annualized dividend and a yield of 1.14%. Hamilton Lane's dividend payout ratio is presently 36.16%.

Analyst Upgrades and Downgrades

HLNE has been the topic of several recent analyst reports. Keefe, Bruyette & Woods raised their target price on shares of Hamilton Lane from $158.00 to $168.00 and gave the company a "market perform" rating in a report on Wednesday, February 5th. Morgan Stanley decreased their target price on shares of Hamilton Lane from $190.00 to $157.00 and set an "equal weight" rating on the stock in a report on Monday, April 14th. Wells Fargo & Company decreased their target price on shares of Hamilton Lane from $152.00 to $147.00 and set an "equal weight" rating on the stock in a report on Tuesday, April 8th. JPMorgan Chase & Co. decreased their price target on shares of Hamilton Lane from $176.00 to $167.00 and set a "neutral" rating on the stock in a report on Tuesday, April 29th. Finally, Oppenheimer lowered shares of Hamilton Lane from an "outperform" rating to a "market perform" rating in a report on Thursday. One investment analyst has rated the stock with a sell rating and six have given a hold rating to the company. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $164.14.

View Our Latest Research Report on HLNE

About Hamilton Lane

(

Free Report)

Hamilton Lane Incorporated is a private equity firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies. It prefers to invest in energy, industrials, consumer discretionary, health care, real estate, information technology, utilities, and consumer services.

Recommended Stories

Before you consider Hamilton Lane, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hamilton Lane wasn't on the list.

While Hamilton Lane currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.