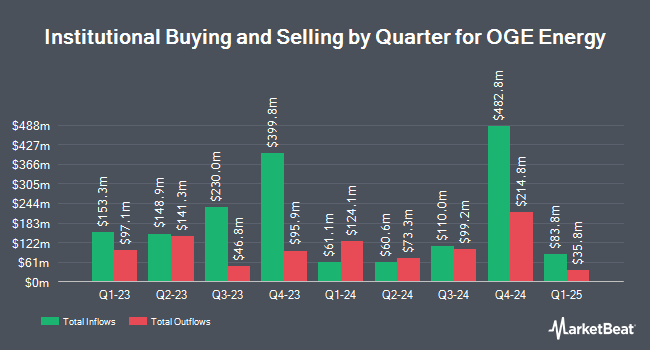

EP Wealth Advisors LLC acquired a new position in OGE Energy Corp. (NYSE:OGE - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 6,629 shares of the utilities provider's stock, valued at approximately $273,000.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Merit Financial Group LLC boosted its holdings in OGE Energy by 14.2% in the 4th quarter. Merit Financial Group LLC now owns 6,505 shares of the utilities provider's stock worth $268,000 after buying an additional 810 shares during the period. Hennion & Walsh Asset Management Inc. bought a new position in OGE Energy in the 4th quarter worth approximately $252,000. Jones Financial Companies Lllp boosted its holdings in OGE Energy by 38.2% in the 4th quarter. Jones Financial Companies Lllp now owns 24,085 shares of the utilities provider's stock worth $993,000 after buying an additional 6,657 shares during the period. Barclays PLC boosted its holdings in OGE Energy by 45.1% in the 3rd quarter. Barclays PLC now owns 126,230 shares of the utilities provider's stock worth $5,176,000 after buying an additional 39,263 shares during the period. Finally, CIBC Asset Management Inc boosted its holdings in OGE Energy by 5.1% in the 4th quarter. CIBC Asset Management Inc now owns 6,038 shares of the utilities provider's stock worth $249,000 after buying an additional 295 shares during the period. 71.84% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several research analysts recently commented on OGE shares. LADENBURG THALM/SH SH raised shares of OGE Energy to a "hold" rating in a report on Friday, May 9th. Wells Fargo & Company raised their price target on shares of OGE Energy from $46.00 to $47.00 and gave the company an "equal weight" rating in a report on Thursday, May 1st. Argus raised shares of OGE Energy from a "hold" rating to a "buy" rating and set a $47.00 price target for the company in a report on Friday, April 11th. Evercore ISI raised shares of OGE Energy from an "in-line" rating to an "outperform" rating and raised their price target for the company from $40.00 to $47.00 in a report on Tuesday, January 21st. Finally, Barclays raised their price target on shares of OGE Energy from $44.00 to $45.00 and gave the company an "equal weight" rating in a report on Tuesday, April 22nd. Three equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat.com, OGE Energy presently has a consensus rating of "Moderate Buy" and an average target price of $46.40.

Get Our Latest Analysis on OGE Energy

Insider Transactions at OGE Energy

In related news, insider William H. Sultemeier sold 6,650 shares of OGE Energy stock in a transaction on Tuesday, May 6th. The shares were sold at an average price of $45.54, for a total value of $302,841.00. Following the transaction, the insider now owns 72,548 shares in the company, valued at $3,303,835.92. This trade represents a 8.40% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 0.55% of the stock is currently owned by insiders.

OGE Energy Price Performance

NYSE:OGE traded up $0.44 during trading hours on Friday, hitting $44.36. The stock had a trading volume of 905,406 shares, compared to its average volume of 1,130,499. The company has a 50 day simple moving average of $44.61 and a two-hundred day simple moving average of $43.30. The company has a debt-to-equity ratio of 1.08, a current ratio of 0.73 and a quick ratio of 0.51. OGE Energy Corp. has a one year low of $34.20 and a one year high of $46.91. The firm has a market capitalization of $8.93 billion, a price-to-earnings ratio of 20.16, a P/E/G ratio of 3.30 and a beta of 0.61.

OGE Energy (NYSE:OGE - Get Free Report) last posted its quarterly earnings data on Wednesday, April 30th. The utilities provider reported $0.31 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.22 by $0.09. OGE Energy had a net margin of 14.79% and a return on equity of 9.71%. The company had revenue of $747.70 million during the quarter, compared to the consensus estimate of $695.59 million. During the same period in the previous year, the firm posted $0.09 EPS. The firm's revenue was up 25.3% compared to the same quarter last year. Research analysts forecast that OGE Energy Corp. will post 2.27 earnings per share for the current fiscal year.

OGE Energy Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, July 25th. Stockholders of record on Monday, July 7th will be issued a dividend of $0.4213 per share. This represents a $1.69 dividend on an annualized basis and a dividend yield of 3.80%. The ex-dividend date of this dividend is Monday, July 7th. OGE Energy's dividend payout ratio is currently 69.42%.

About OGE Energy

(

Free Report)

OGE Energy Corp., together with its subsidiaries, operates as an energy services provider in the United States. The company generates, transmits, distributes, and sells electric energy. In addition, it provides retail electric service to approximately 896,000 customers, which covers a service area of approximately 30,000 square miles in Oklahoma and western Arkansas; and owns and operates coal-fired, natural gas-fired, wind-powered, and solar-powered generating assets.

Further Reading

Before you consider OGE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OGE Energy wasn't on the list.

While OGE Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.