K2 Principal Fund L.P. purchased a new stake in Keysight Technologies, Inc. (NYSE:KEYS - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm purchased 7,000 shares of the scientific and technical instruments company's stock, valued at approximately $1,124,000.

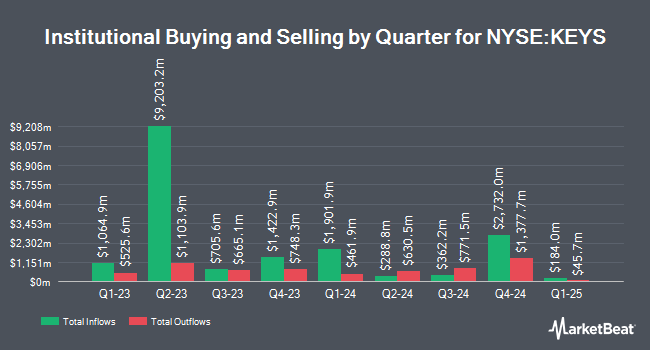

Several other hedge funds and other institutional investors have also made changes to their positions in the stock. Vanguard Group Inc. raised its holdings in Keysight Technologies by 0.3% during the fourth quarter. Vanguard Group Inc. now owns 20,873,635 shares of the scientific and technical instruments company's stock worth $3,352,932,000 after purchasing an additional 55,223 shares in the last quarter. Price T Rowe Associates Inc. MD grew its position in shares of Keysight Technologies by 29.0% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 16,114,952 shares of the scientific and technical instruments company's stock worth $2,588,546,000 after acquiring an additional 3,621,349 shares during the last quarter. Kovitz Investment Group Partners LLC increased its holdings in shares of Keysight Technologies by 364.6% in the 4th quarter. Kovitz Investment Group Partners LLC now owns 4,652,311 shares of the scientific and technical instruments company's stock valued at $747,301,000 after acquiring an additional 3,650,953 shares during the period. Geode Capital Management LLC boosted its stake in Keysight Technologies by 0.4% during the 4th quarter. Geode Capital Management LLC now owns 4,417,248 shares of the scientific and technical instruments company's stock worth $708,349,000 after purchasing an additional 17,213 shares during the period. Finally, Boston Partners grew its position in Keysight Technologies by 21.7% during the 4th quarter. Boston Partners now owns 3,958,274 shares of the scientific and technical instruments company's stock worth $637,125,000 after purchasing an additional 704,920 shares during the last quarter. Hedge funds and other institutional investors own 84.58% of the company's stock.

Keysight Technologies Stock Performance

Shares of KEYS opened at $154.00 on Friday. The company has a quick ratio of 2.27, a current ratio of 2.98 and a debt-to-equity ratio of 0.35. Keysight Technologies, Inc. has a 52-week low of $119.72 and a 52-week high of $186.20. The company has a 50-day simple moving average of $145.42 and a 200-day simple moving average of $159.12. The company has a market capitalization of $26.61 billion, a PE ratio of 44.00, a P/E/G ratio of 2.41 and a beta of 1.10.

Wall Street Analyst Weigh In

KEYS has been the subject of several recent research reports. JPMorgan Chase & Co. decreased their target price on shares of Keysight Technologies from $200.00 to $172.00 and set an "overweight" rating for the company in a research note on Thursday, April 17th. StockNews.com downgraded Keysight Technologies from a "strong-buy" rating to a "buy" rating in a research note on Saturday, March 22nd. Robert W. Baird upped their price target on Keysight Technologies from $180.00 to $190.00 and gave the stock an "outperform" rating in a research note on Thursday, February 27th. Finally, Wells Fargo & Company lifted their price objective on shares of Keysight Technologies from $180.00 to $190.00 and gave the company an "overweight" rating in a research report on Wednesday, February 26th. One investment analyst has rated the stock with a sell rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $181.33.

Check Out Our Latest Analysis on KEYS

Insiders Place Their Bets

In other news, CFO Neil Dougherty sold 3,632 shares of the business's stock in a transaction that occurred on Thursday, March 27th. The stock was sold at an average price of $155.00, for a total transaction of $562,960.00. Following the sale, the chief financial officer now owns 115,063 shares of the company's stock, valued at $17,834,765. The trade was a 3.06 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.61% of the stock is currently owned by company insiders.

Keysight Technologies Company Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Featured Articles

Want to see what other hedge funds are holding KEYS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Keysight Technologies, Inc. (NYSE:KEYS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.