89BIO (NASDAQ:ETNB - Get Free Report)'s stock had its "sell (d-)" rating reissued by equities researchers at Weiss Ratings in a note issued to investors on Friday,Weiss Ratings reports.

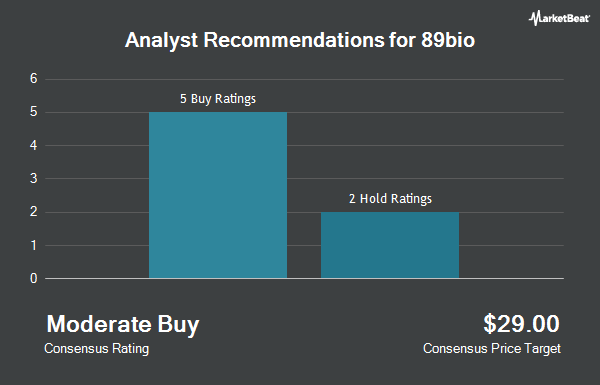

Several other equities analysts have also weighed in on the stock. HC Wainwright reiterated a "buy" rating and set a $21.00 price objective (down previously from $29.00) on shares of 89BIO in a report on Friday, February 28th. Citigroup initiated coverage on shares of 89BIO in a report on Thursday, March 13th. They set a "buy" rating and a $25.00 price objective on the stock. Cantor Fitzgerald upgraded shares of 89BIO to a "strong-buy" rating in a report on Wednesday, April 30th. Finally, The Goldman Sachs Group initiated coverage on shares of 89BIO in a report on Friday, March 14th. They set a "neutral" rating and a $11.00 price objective on the stock. Two analysts have rated the stock with a hold rating, four have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of $26.43.

View Our Latest Report on ETNB

89BIO Stock Performance

Shares of 89BIO stock opened at $9.86 on Friday. The company has a quick ratio of 18.03, a current ratio of 18.03 and a debt-to-equity ratio of 0.06. 89BIO has a twelve month low of $4.16 and a twelve month high of $11.84. The stock has a market cap of $1.44 billion, a price-to-earnings ratio of -2.92 and a beta of 1.30. The company's fifty day moving average is $8.92 and its 200 day moving average is $8.37.

89BIO (NASDAQ:ETNB - Get Free Report) last issued its quarterly earnings results on Thursday, May 1st. The company reported ($0.49) EPS for the quarter, beating analysts' consensus estimates of ($0.50) by $0.01. During the same quarter in the prior year, the firm posted ($0.54) EPS. Sell-side analysts forecast that 89BIO will post -3.19 EPS for the current year.

Insider Buying and Selling

In related news, insider Quoc Le-Nguyen sold 15,329 shares of the company's stock in a transaction dated Tuesday, April 15th. The shares were sold at an average price of $5.95, for a total value of $91,207.55. Following the sale, the insider now owns 328,323 shares in the company, valued at $1,953,521.85. This represents a 4.46% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 2.60% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On 89BIO

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. RA Capital Management L.P. increased its stake in 89BIO by 40.3% in the 1st quarter. RA Capital Management L.P. now owns 19,889,683 shares of the company's stock valued at $144,598,000 after buying an additional 5,714,285 shares during the last quarter. Janus Henderson Group PLC increased its stake in 89BIO by 8.9% in the 4th quarter. Janus Henderson Group PLC now owns 16,514,056 shares of the company's stock valued at $129,177,000 after buying an additional 1,355,838 shares during the last quarter. Suvretta Capital Management LLC increased its stake in 89BIO by 27.7% in the 4th quarter. Suvretta Capital Management LLC now owns 10,202,696 shares of the company's stock valued at $79,785,000 after buying an additional 2,211,052 shares during the last quarter. RTW Investments LP increased its stake in 89BIO by 1.3% in the 4th quarter. RTW Investments LP now owns 7,478,061 shares of the company's stock valued at $58,478,000 after buying an additional 99,513 shares during the last quarter. Finally, Vanguard Group Inc. increased its stake in 89BIO by 25.8% in the 1st quarter. Vanguard Group Inc. now owns 7,163,609 shares of the company's stock valued at $52,079,000 after buying an additional 1,471,278 shares during the last quarter.

About 89BIO

(

Get Free Report)

89bio, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of therapies for the treatment of liver and cardio-metabolic diseases. Its lead product candidate is pegozafermin, a glycoPEGylated analog of fibroblast growth factor 21 for the treatment of nonalcoholic steatohepatitis; and for the treatment of severe hypertriglyceridemia.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider 89BIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 89BIO wasn't on the list.

While 89BIO currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.