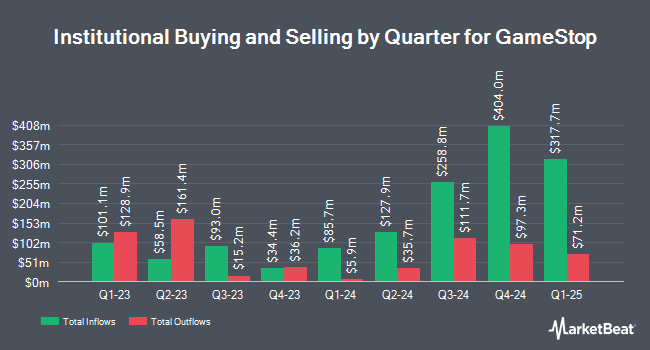

Algert Global LLC raised its position in GameStop Corp. (NYSE:GME - Free Report) by 20.9% during the fourth quarter, according to its most recent 13F filing with the SEC. The fund owned 181,981 shares of the company's stock after buying an additional 31,455 shares during the period. Algert Global LLC's holdings in GameStop were worth $5,703,000 as of its most recent filing with the SEC.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Mitsubishi UFJ Asset Management Co. Ltd. grew its position in shares of GameStop by 223.5% during the 4th quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 990 shares of the company's stock worth $31,000 after buying an additional 684 shares during the period. New Wave Wealth Advisors LLC bought a new stake in shares of GameStop during the 4th quarter valued at $37,000. R Squared Ltd acquired a new position in shares of GameStop in the 4th quarter valued at $51,000. Bessemer Group Inc. boosted its position in shares of GameStop by 67.2% in the 4th quarter. Bessemer Group Inc. now owns 1,720 shares of the company's stock worth $54,000 after purchasing an additional 691 shares during the last quarter. Finally, UMB Bank n.a. grew its stake in shares of GameStop by 59.9% during the fourth quarter. UMB Bank n.a. now owns 1,820 shares of the company's stock worth $57,000 after purchasing an additional 682 shares during the period. 29.21% of the stock is owned by institutional investors and hedge funds.

GameStop Price Performance

NYSE:GME traded up $0.75 during trading hours on Friday, reaching $27.53. 7,749,796 shares of the stock were exchanged, compared to its average volume of 20,021,174. GameStop Corp. has a twelve month low of $17.70 and a twelve month high of $64.83. The firm has a 50 day moving average of $25.05 and a 200 day moving average of $26.65. The stock has a market cap of $12.31 billion, a PE ratio of 152.95 and a beta of -0.76.

GameStop (NYSE:GME - Get Free Report) last announced its quarterly earnings results on Tuesday, March 25th. The company reported $0.30 EPS for the quarter, beating analysts' consensus estimates of $0.09 by $0.21. GameStop had a net margin of 1.45% and a return on equity of 2.11%. The firm had revenue of $1.28 billion during the quarter, compared to analysts' expectations of $1.48 billion. During the same quarter last year, the company posted $0.21 earnings per share. The company's revenue for the quarter was down 28.5% compared to the same quarter last year. Equities research analysts anticipate that GameStop Corp. will post 0.08 earnings per share for the current year.

Insider Activity at GameStop

In other news, CEO Ryan Cohen acquired 500,000 shares of the firm's stock in a transaction that occurred on Thursday, April 3rd. The shares were acquired at an average cost of $21.55 per share, with a total value of $10,775,000.00. Following the completion of the purchase, the chief executive officer now directly owns 37,347,842 shares of the company's stock, valued at $804,845,995.10. The trade was a 1.36 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Daniel William Moore sold 1,608 shares of the business's stock in a transaction on Wednesday, April 2nd. The stock was sold at an average price of $22.53, for a total value of $36,228.24. Following the transaction, the insider now directly owns 29,777 shares of the company's stock, valued at $670,875.81. This trade represents a 5.12 % decrease in their position. The disclosure for this sale can be found here. Insiders bought 515,000 shares of company stock worth $11,140,200 in the last ninety days. 12.28% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

GME has been the subject of a number of recent analyst reports. StockNews.com raised GameStop from a "sell" rating to a "hold" rating in a research note on Thursday, March 27th. Wedbush set a $11.50 target price on shares of GameStop in a research note on Wednesday, March 26th.

Check Out Our Latest Analysis on GameStop

GameStop Profile

(

Free Report)

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

See Also

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.