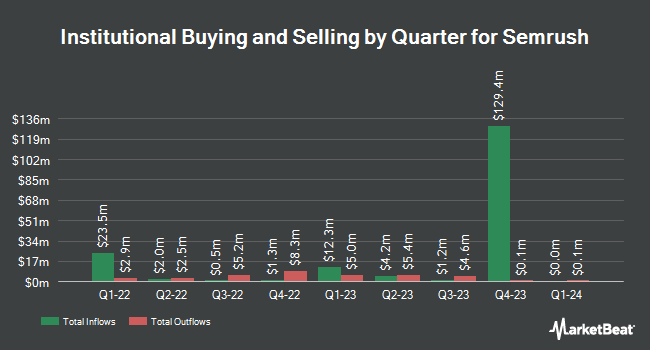

Alliancebernstein L.P. grew its position in Semrush Holdings, Inc. (NASDAQ:SEMR - Free Report) by 356.3% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 149,421 shares of the company's stock after acquiring an additional 116,672 shares during the quarter. Alliancebernstein L.P. owned about 0.10% of Semrush worth $1,775,000 at the end of the most recent reporting period.

Several other hedge funds have also recently modified their holdings of the stock. US Bancorp DE grew its position in Semrush by 2,127.2% during the fourth quarter. US Bancorp DE now owns 3,608 shares of the company's stock worth $43,000 after buying an additional 3,446 shares during the period. KLP Kapitalforvaltning AS acquired a new stake in shares of Semrush in the fourth quarter valued at approximately $71,000. Arizona State Retirement System acquired a new stake in shares of Semrush in the fourth quarter valued at approximately $128,000. Stoneridge Investment Partners LLC acquired a new stake in shares of Semrush in the fourth quarter valued at approximately $135,000. Finally, Virtu Financial LLC acquired a new stake in shares of Semrush in the third quarter valued at approximately $158,000. 32.86% of the stock is owned by institutional investors and hedge funds.

Semrush Stock Up 5.3 %

Shares of SEMR stock traded up $0.49 during mid-day trading on Wednesday, reaching $9.74. The company's stock had a trading volume of 70,391 shares, compared to its average volume of 543,639. The company's 50 day simple moving average is $10.87 and its 200-day simple moving average is $12.94. Semrush Holdings, Inc. has a 12-month low of $7.90 and a 12-month high of $18.74. The firm has a market capitalization of $1.43 billion, a PE ratio of 121.77 and a beta of 1.80.

Insider Activity

In related news, CTO Oleg Shchegolev sold 9,563 shares of the firm's stock in a transaction on Wednesday, April 2nd. The shares were sold at an average price of $9.44, for a total transaction of $90,274.72. Following the completion of the sale, the chief technology officer now directly owns 7,402,719 shares of the company's stock, valued at approximately $69,881,667.36. This trade represents a 0.13 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Brian Mulroy sold 4,207 shares of the company's stock in a transaction dated Friday, April 11th. The shares were sold at an average price of $8.61, for a total transaction of $36,222.27. Following the completion of the sale, the chief financial officer now owns 694,351 shares in the company, valued at approximately $5,978,362.11. This trade represents a 0.60 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 170,374 shares of company stock valued at $1,962,411. Company insiders own 57.83% of the company's stock.

Analysts Set New Price Targets

Several equities analysts recently issued reports on SEMR shares. Northland Capmk raised shares of Semrush to a "strong-buy" rating in a research note on Tuesday, January 14th. Morgan Stanley reduced their price objective on shares of Semrush from $19.00 to $13.00 and set an "overweight" rating on the stock in a research note on Wednesday, April 16th. Needham & Company LLC reissued a "buy" rating and set a $18.00 price objective on shares of Semrush in a research note on Wednesday, January 15th. Northland Securities began coverage on shares of Semrush in a research note on Tuesday, January 14th. They set an "outperform" rating and a $18.00 price target on the stock. Finally, The Goldman Sachs Group cut their price target on shares of Semrush from $14.00 to $12.00 and set a "neutral" rating on the stock in a research note on Friday, March 28th. One investment analyst has rated the stock with a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus price target of $17.14.

Check Out Our Latest Stock Analysis on SEMR

Semrush Company Profile

(

Free Report)

Semrush Holdings, Inc develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally. The company enables companies to identify and reach the right audience for their content through the right channels. Its platform enables the company's customers to understand trends and act upon insights to enhance the online visibility, and drive traffic to their websites and social media pages, as well as online listings, distribute targeted content to their customers, and measure the digital marketing campaigns.

Featured Articles

Before you consider Semrush, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Semrush wasn't on the list.

While Semrush currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.