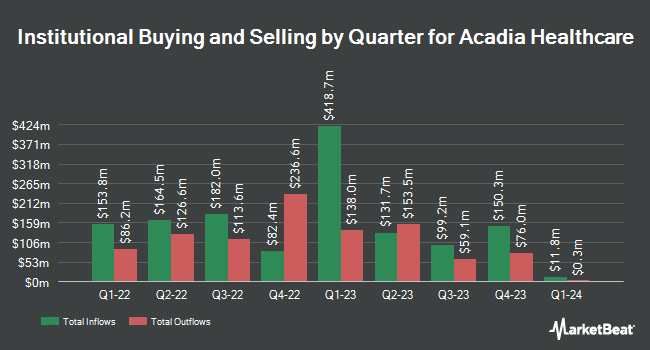

Alliancebernstein L.P. lessened its position in shares of Acadia Healthcare Company, Inc. (NASDAQ:ACHC - Free Report) by 55.3% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 120,561 shares of the company's stock after selling 149,131 shares during the period. Alliancebernstein L.P. owned about 0.13% of Acadia Healthcare worth $4,780,000 as of its most recent SEC filing.

Other institutional investors have also made changes to their positions in the company. JPMorgan Chase & Co. lifted its position in shares of Acadia Healthcare by 17.0% in the 3rd quarter. JPMorgan Chase & Co. now owns 3,126,607 shares of the company's stock worth $198,258,000 after buying an additional 454,044 shares during the last quarter. SG Americas Securities LLC lifted its holdings in shares of Acadia Healthcare by 713.3% in the 4th quarter. SG Americas Securities LLC now owns 110,866 shares of the company's stock worth $4,396,000 after purchasing an additional 97,235 shares during the last quarter. Beach Point Capital Management LP bought a new position in Acadia Healthcare during the 4th quarter worth $14,097,000. Geode Capital Management LLC lifted its stake in Acadia Healthcare by 0.9% in the third quarter. Geode Capital Management LLC now owns 1,613,198 shares of the company's stock valued at $102,320,000 after buying an additional 14,197 shares during the last quarter. Finally, Franklin Resources Inc. grew its position in shares of Acadia Healthcare by 273.1% during the third quarter. Franklin Resources Inc. now owns 105,228 shares of the company's stock worth $6,673,000 after acquiring an additional 77,027 shares during the last quarter.

Acadia Healthcare Trading Up 0.3 %

Shares of ACHC traded up $0.07 during midday trading on Friday, hitting $23.91. The stock had a trading volume of 6,314,242 shares, compared to its average volume of 1,528,556. Acadia Healthcare Company, Inc. has a fifty-two week low of $23.36 and a fifty-two week high of $82.41. The business has a 50-day simple moving average of $31.39 and a two-hundred day simple moving average of $39.92. The company has a current ratio of 1.07, a quick ratio of 1.07 and a debt-to-equity ratio of 0.60. The firm has a market cap of $2.20 billion, a P/E ratio of 7.84, a price-to-earnings-growth ratio of 1.46 and a beta of 1.13.

Analyst Ratings Changes

Several research analysts have commented on the stock. Royal Bank of Canada decreased their target price on shares of Acadia Healthcare from $64.00 to $43.00 and set an "outperform" rating for the company in a research report on Monday, March 3rd. Bank of America decreased their price target on Acadia Healthcare from $50.00 to $44.50 and set a "buy" rating for the company in a research note on Friday, February 28th. KeyCorp reduced their price objective on shares of Acadia Healthcare from $70.00 to $65.00 and set an "overweight" rating for the company in a report on Monday, March 3rd. StockNews.com cut shares of Acadia Healthcare from a "hold" rating to a "sell" rating in a report on Monday, January 6th. Finally, Barclays downgraded Acadia Healthcare from an "overweight" rating to an "equal weight" rating and cut their target price for the stock from $43.00 to $35.00 in a research report on Friday, February 28th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and six have issued a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $50.39.

Get Our Latest Research Report on ACHC

Acadia Healthcare Company Profile

(

Free Report)

Acadia Healthcare Company, Inc provides behavioral healthcare services in the United States and Puerto Rico. The company develops and operates acute inpatient psychiatric facilities, specialty treatment facilities comprising residential recovery facilities and eating disorder facilities, comprehensive treatment centers, and residential treatment centers, as well as facilities offering outpatient behavioral healthcare services for the behavioral healthcare and recovery needs of communities.

Further Reading

Before you consider Acadia Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acadia Healthcare wasn't on the list.

While Acadia Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.